|

corporate finance中文称之为 公司金融学又称公司财务管理,公司理财等。公司金融学是金融学的分支学科,用于考察公司如何有效地利用各种融资渠道,获得最低成本的资金来源,并形成合适的资本结构(capital structure);还包括企业投资、利润分配、运营资金管理及财务分析等方面。

公司金融学涉及到现代公司制度中的一些诸如委托-代理结构的金融安排等深层次的问题。一般来说,公司金融学会利用各种分析工具来管理公司的财务,例如使用贴现法(DCF)来为投资计划总值作出评估,使用决策树分析来了解投资及营运的弹性。

It's all corporate finance这是所有企业融资

我公正的世界观My unbiased view of the world

在一个企业做的每一个决定都有财务影响,并涉及货币的使用方面任何决定都是一个企业的财务决策。广义上来说,一个企业做企业融资都和财务决策有关。事实上这是不幸的,我们称之为主体企业融资是因为它表明许多观察家把重点放在如何大企业做出财务决策,似乎排除其职权范围小型和私营企业。对这门学科的一个更合适的头衔是商业融资,因为基本原则仍然是一样的,不管是一个大型的,公开交易的公司或小型,私人经营的企业。如果没有足够的良好投资的所有者,所有企业都必须明智地投资他们的资源,找到合适的种类和组合的融资,以资助这些投资,并返回现金。Every decision made in a business has financial implications, and any decision that involves the use of money is a corporate financial decision. Defined broadly, everything that a business does fits under the rubric of corporate finance. It is, in fact, unfortunate that we even call the subject corporate finance, because it suggests to many observers a focus on how large corporations make financial decisions and seems to exclude small and private businesses from its purview. A more appropriate title for this discipline would be Business Finance, because the basic principles remain the same, whether one looks at large, publicly traded firms or small, privately run businesses. All businesses have to invest their resources wisely, find the right kind and mix of financing to fund these investments, and return cash to the owners if there are not enough good investments.

In this introduction, we will lay the foundation for this discussion by listing the three fundamental principles that underlie corporate finance—the investment, financing, and dividend principles—and the objective of firm value maximization that is at the heart of corporate financial theory.

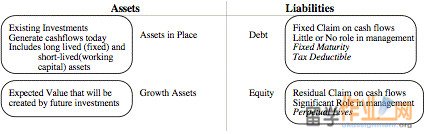

The Firm: Structural Set-Up

In corporate finance, we will use firm generically to refer to any business, large or small, manufacturing or service, private or public. Thus, a corner grocery store and Microsoft are both firms. The firms investments are generically termed assets. Although assets are often categorized by accountants into fixed assets, which are long-lived, and current assets, which are short-term, we prefer a different categorization. The assets that the firm has already invested in are called assets in place, whereas those assets that the firm is expected to invest in the future are called growth assets. Though it may seem strange that a firm can get value from investments it has not made yet, high-growth firms get the bulk of their value from these yet-to-be-made investments. To finance these assets, the firm can raise money from two sources. It can raise funds from investors or financial institutions by promising investors a fixed claim (interest payments) on the cash flows generated by the assets, with a limited or no role in the day-to-day running of the business. We categorize this type of financing to be debt. Alternatively, it can offer a residual claim on the cash flows (i.e., investors can get what is left over after the interest payments have been made) and a much greater role in the operation of the business. We call this equity. Note that these definitions are general enough to cover both private firms, where debt may take the form of bank loans and equity is the owners own money, as well as publicly traded companies, where the firm may issue bonds (to raise debt) and common stock (to raise equity).

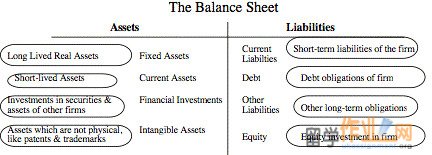

Thus, at this stage, we can lay out the financial balance sheet of a firm as follows:

Note the contrast between this balance sheet and a conventional accounting balance sheet.

An accounting balance sheet is primarily a listing of assets in place, though there are some circumstances where growth assets may find their place in it; in an acquisition, what gets recorded as goodwill is a conglomeration of growth assets in the target firm, synergies and overpayment.

第一原则First Principles

Every discipline has first principles that govern and guide everything that gets done within it. All of corporate finance is built on three principles, which we will call, rather unimaginatively, the investment principle, the financing principle, and the dividend principle. The investment principle determines where businesses invest their resources, the financing principle governs the mix of funding used to fund these investments, and the dividend principle answers the question of how much earnings should be reinvested back into the business and how much returned to the owners of the business. These core corporate finance principles can be stated as follows

The Investment Principle: Invest in assets and projects that yield a return greater than the minimum acceptable hurdle rate. The hurdle rate should be higher for riskier projects and should reflect the financing mix used—owners funds (equity) or borrowed money (debt). Returns on projects should be measured based on cash flows generated and the timing of these cash flows; they should also consider both positive and negative side effects of these projects.

The Financing Principle: Choose a financing mix (debt and equity) that maximizes the value of the investments made and match the financing to nature of the assets being financed.

The Dividend Principle: If there are not enough investments that earn the hurdle rate, return the cash to the owners of the business. In the case of a publicly traded firm, the form of the return—dividends or stock buybacks—will depend on what stockholders prefer.

When making investment, financing and dividend decisions, corporate finance is single-minded about the ultimate objective, which is assumed to be maximizing the value of the business. These first principles provide the basis from which we will extract the numerous models and theories that comprise modern corporate finance, but they are also commonsense principles. It is incredible conceit on our part to assume that until corporate finance was developed as a coherent discipline starting just a few decades ago, people who ran businesses made decisions randomly with no principles to govern their thinking. Good businesspeople through the ages have always recognized the importance of these first principles and adhered to them, albeit in intuitive ways. In fact, one of the ironies of recent times is that many managers at large and presumably sophisticated firms with access to the latest corporate finance technology have lost sight of these basic principles.

公司的目标The Objective of the Firm

No discipline can develop cohesively over time without a unifying objective. The growth of corporate financial theory can be traced to its choice of a single objective and the development of models built around this objective. The objective in conventional corporate financial theory when making decisions is to maximize the value of the business or firm. Consequently, any decision (investment, financial, or dividend) that increases the value of a business is considered a good one, whereas one that reduces firm value is considered a poor one. Although the choice of a singular objective has provided corporate finance with a unifying theme and internal consistency, it comes at a cost. To the degree that one buys into this objective, much of what corporate financial theory suggests makes sense. To the degree that this objective is flawed, however, it can be argued that the theory built on it is flawed as well. Many of the disagreements between corporate financial theorists and others (academics as well as practitioners) can be traced to fundamentally different views about the correct objective for a business. For instance, there are some critics of corporate finance who argue that firms should have multiple objectives where a variety of interests (stockholders, labor, customers) are met, and there are others who would have firms focus on what they view as simpler and more direct objectives, such as market share or profitability.

Given the significance of this objective for both the development and the applicability of corporate financial theory, it is important that we examine it much more carefully and address some of the very real concerns and criticisms it has garnered: It assumes that what stockholders do in their own self-interest is also in the best interests of the firm, it is sometimes dependent on the existence of efficient markets, and it is often blind to the social costs associated with value maximization.

投资原则The Investment Principle

Firms have scarce resources that must be allocated among competing needs. The first and foremost function of corporate financial theory is to provide a framework for firms to make this decision wisely. Accordingly, we define investment decisions to include not only those that create revenues and profits (such as introducing a new product line or expanding into a new market) but also those that save money (such as building a new and more efficient distribution system). Furthermore, we argue that decisions about how much and what inventory to maintain and whether and how much credit to grant to customers that are traditionally categorized as working capital decisions, are ultimately investment decisions as well. At the other end of the spectrum, broad strategic decisions regarding which markets to enter and the acquisitions of other companies can also be considered investment decisions. Corporate finance attempts to measure the return on a proposed investment decision and compare it to a minimum acceptable hurdle rate to decide whether the project is acceptable. The hurdle rate has to be set higher for riskier projects and has to reflect the financing mix used, i.e., the owners funds (equity) or borrowed money (debt). In the discussion of risk and return, we begin this process by defining risk and developing a procedure for measuring risk. In risk and return models, we go about converting this risk measure into a hurdle rate, i.e., a minimum acceptable rate of return, both for entire businesses and for individual investments.#p#分页标题#e#

Having established the hurdle rate, we turn our attention to measuring the returns on an investment. In analyzing projects, we evaluate three alternative ways of measuring returns—conventional accounting earnings, cash flows, and time-weighted cash flows (where we consider both how large the cash flows are and when they are anticipated to come in). In extensions of this analysis, we consider some of the potential side costs that might not be captured in any of these measures, including costs that may be created for existing investments by taking a new investment, and side benefits, such as options to enter new markets and to expand product lines that may be embedded in new investments, and synergies, especially when the new investment is the acquisition of another firm.

融资原则The Financing Principle

Every business, no matter how large and complex, is ultimately funded with a mix of borrowed money (debt) and owners funds (equity). With a publicly trade firm, debt may take the form of bonds and equity is usually common stock. In a private business, debt is more likely to be bank loans and an owners savings represent equity. Though we consider the existing mix of debt and equity and its implications for the minimum acceptable hurdle rate as part of the investment principle, we throw open the question of whether the existing mix is the right one in the financing principle section. There might be regulatory and other real-world constraints on the financing mix that a business can use, but there is ample room for flexibility within these constraints. We begin the discussion of financing methods, by looking at the range of choices that exist for both private businesses and publicly traded firms between debt and equity. We then turn to the question of whether the existing mix of financing used by a business is optimal, given the objective function of maximizing firm value. Although the trade-off between the benefits and costs of borrowing are established in qualitative terms first, we also look at two quantitative approaches to arriving at the optimal mix. In the first approach, we examine the specific conditions under which the optimal financing mix is the one that minimizes the minimum acceptable hurdle rate. In the second approach, we look at the effects on firm value of changing the financing mix.

When the optimal financing mix is different from the existing one, we map out the best ways of getting from where we are (the current mix) to where we would like to be (the optimal), keeping in mind the investment opportunities that the firm has and the need for timely responses, either because the firm is a takeover target or under threat of bankruptcy. Having outlined the optimal financing mix, we turn our attention to the type of financing a business should use, such as whether it should be long-term or short-term, whether the payments on the financing should be fixed or variable, and if variable, what it should be a function of. Using a basic proposition that a firm will minimize its risk from financing and maximize its capacity to use borrowed funds if it can match up the cash flows on the debt to the cash flows on the assets being financed, we design the perfect financing instrument for a firm. We then add additional considerations relating to taxes and external monitors (equity research analysts and ratings agencies) and arrive at strong conclusions about the design of the financing.

The Dividend Principle

Most businesses would undoubtedly like to have unlimited investment opportunities that yield returns exceeding their hurdle rates, but all businesses grow and mature. As a consequence, every business that thrives reaches a stage in its life when the cash flows generated by existing investments is greater than the funds needed to take on good investments. At that point, this business has to figure out ways to return the excess cash to owners. In private businesses, this may just involve the owner withdrawing a portion of his or her funds from the business. In a publicly traded corporation, this will involve either paying dividends or buying back stock. the discussion of dividend policy, we introduce the basic trade-off that determines whether cash should be left in a business or taken out of it. For stockholders in publicly traded firms, we note that this decision is fundamentally one of whether they trust the managers of the firms with their cash, and much of this trust is based on how well these managers have invested funds in the past. Finally, we consider the options available to a firm to return assets to its owners—dividends, stock buybacks and spin-offs—and investigate how to pick between these options.

企业财务决策、公司价值和股权价值Corporate Financial Decisions, Firm Value, and Equity Value

If the objective function in corporate finance is to maximize firm value, it follows that firm value must be linked to the three corporate finance decisions outlined—investment, financing, and dividend decisions. The link between these decisions and firm value can be made by recognizing that the value of a firm is the present value of its expected cash flows, discounted back at a rate that reflects both the riskiness of the projects of the firm and the financing mix used to finance them. Investors form expectations about future cash flows based on observed current cash flows and expected future growth, which in turn depend on the quality of the firms projects (its investment decisions) and the amount reinvested back into the business (its dividend decisions). The financing decisions affect the value of a firm through both the discount rate and potentially through the expected cash flows.

This neat formulation of value is put to the test by the interactions among the investment, financing, and dividend decisions and the conflicts of interest that arise between stockholders and lenders to the firm, on one hand, and stockholders and managers, on the other. We introduce the basic models available to value a firm and its equity, and relate them back to management decisions on investment, financial, and dividend policy. In the process, we examine the determinants of value and how firms can increase their value.

公司财务的若干基本命题Some Fundamental Propositions about Corporate Finance

There are several fundamental arguments we will make repeatedly in this discussion:

Corporate finance has an internal consistency that flows from its choice of maximizing firm value as the only objective function and its dependence on a few bedrock principles: Risk has to be rewarded, cash flows matter more than accounting income, markets are not easily fooled, and every decision a firm makes has an effect on its value.2. Corporate finance must be viewed as an integrated whole, rather than a collection of decisions. Investment decisions generally affect financing decisions and vice versa; financing decisions often influence dividend decisions and vice versa. Although there are circumstances under which these decisions may be independent of each other, this is seldom the case in practice. Accordingly, it is unlikely that firms that deal with their problems on a piecemeal basis will ever resolve these problems. For instance, a firm that takes poor investments may soon find itself with a dividend problem (with insufficient funds to pay dividends) and a financing problem (because the drop in earnings may make it difficult for them to meet interest expenses).

Corporate finance matters to everybody. There is a corporate financial aspect to almost every decision made by a business; though not everyone will find a use for all the components of corporate finance, everyone will find a use for at least some part of it.Marketing managers, corporate strategists, human resource managers, and information technology managers all make corporate finance decisions every day and often dont realize it. An understanding of corporate finance will help them make better decisions.

Corporate finance is fun. This may seem to be the tallest claim of all. After all, most people associate corporate finance with numbers, accounting statements, and hardheaded analyses. Although corporate finance is quantitative in its focus, there is a significant component of creative thinking involved in coming up with solutions to the financial problems businesses do encounter. It is no coincidence that financial markets remain breeding grounds for innovation and change.

The best way to learn corporate finance is by applying its models and theories to real-world problems. Although the theory that has been developed over the past few decades is impressive, the ultimate test of any theory is application. As we will argue, much (if not all) of the theory can be applied to real companies and not just to abstract examples, though we have to compromise and make assumptions in the process.

Conclusion

This introduction establishes the first principles that govern corporate finance. The investment principle specifies that businesses invest only in projects that yield a return that exceeds the hurdle rate. The financing principle suggests that the right financing mix for a firm is one that maximizes the value of the investments made. The dividend principle requires that cash generated in excess of good project needs be returned to the owners. These principles are the core for corporate finance.

|

|

|||

| 网站地图 |