|

本备忘录是分析交易对两次加息利率互换斯巴达赌场(斯巴达或“公司”)的正确处理,2009年进入了讨论确认,计量和衍生品等相关问题,并根据会计准则汇编(ASC)套815 (衍生品和对冲)。

This memorandum is to analyze the proper treatments of the transactions regarding two interest rate swaps Spartan Casino (Spartan or the “Company”) entered in 2009 by discussing recognition, measurement and other related issues of derivatives and hedging under Accounting Standards Codification (ASC) 815 (Derivatives and Hedging).

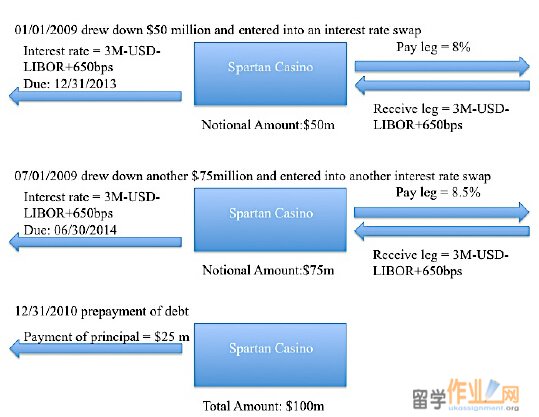

FACTS 事实 在1/1/2009,斯巴达与执行尤伯杯银行股份公司(尤伯杯)一250 $亿美元的循环信贷额度与美元LIBOR + 650个基点(BPS)从1/1/2009到12/31/2010利息率。斯巴达具有1M〜,3M-,并在每次绘制下来的信用额度时6M-美元LIBOR的选择,而利息支付是基于LIBOR的男高音斯巴达选择结算。借来的主要是通常从提款日到期的五年中,从而使每笔提款都有一个特定的到期日。在2009年,斯巴达画倒在信贷额度的两倍。为了对冲与两个先前对冲债务的基础上变化相关的预测利息支出,斯巴达已经订立两份利率掉期到原来的浮动利率支付转换为固定利率支付。在12/31/2010,决定预付2500万$的$ 125个万元欠款而不受处罚。同时,本公司不进行其他更改衍生物其资本结构。在2009年和2010年发生的交易的摘要如下所示:On 1/1/2009, Spartan executed a $250 million revolving credit facility with Uber Bank AG (Uber) with a rate of interest of USD LIBOR + 650 basis points (bps) from 1/1/2009 to 12/31/2010. Spartan has a choice of 1M-, 3M-, and 6M-USD LIBOR each time it draws down on the credit facility, and the interest payments are settled based on the LIBOR tenor that Spartan chose. The principal borrowed is typically due five years from the drawdown date, so that each drawdown has a specific maturity date. During the year 2009, Spartan drew down on the credit facility twice. In order to hedge the forecasted interest payments associated with the changes in the basis of the two previously unhedged debts, Spartan has entered into two interest rate swaps to convert the original variable interest payments to fixed interest payments. On 12/31/2010, decided to prepay $25 million of the $125 million debt without penalty. At the same time, the Company does not make other changes to its capital structure of derivatives. The summary of the transactions happening in 2009 and 2010 is shown below:  ISSUES 问题 Regarding all the transactions happened, issues that need to be addressed are as follows: . Are the two interest rate swaps qualified for being recognized as derivatives? . If the two interest rate swaps are qualified as derivatives, what criteria the Company need to meet and document to ensure the interest rate swaps achieve hedge accounting? . What type of hedge Spartan has to designate in order to meet its demand of hedging the forecasted interest payments associated with the changes in 3M-USD-LIBOR of the two previously unhedged debts? . What are the appropriate accounting treatments for the two hedging relationships, assuming they are perfectly effective? . What are the implications of the Company prepaying $25 million of the $125 million total borrowing? APPLICABLE LITERATURE适用的文学

The applicable literature in this case is ASC 815 (Derivatives and Hedging). This codification gives guidance on the recognition, measurement and all other related issues regarding derivatives and hedging. In order to determine whether the two interest swaps are qualified as derivatives, requirements in ASC 815-10-05 (Derivatives and Hedging-Overview and Background) and ASC 815-10-15 (Derivatives and Hedging -Scope and Scope Exceptions) should be followed. When it comes to the criteria, document requirement and classification of hedge accounting, ASC1. Documentation requirement: 815-20-25 (Derivatives and Hedging-General – Recognition) provides full guidance. The subsequent measurement of cash flow hedges is addressed in ASC 815-20-35 (Derivatives and Hedging-General-Subsequent Measurement) and ASC 815-30-35 (Derivatives and Hedging-Cash Flow Hedges-Subsequent Measurement) are applicable. The implication of prepayment is addressed in ASC 815-20-25 (Derivatives and Hedging-HedgingGeneral-Recognition), ASC 815-20-35 (Derivatives and Hedging-Hedging-General-Subsequent Measurement) and ASC 815-35-40 (Derivatives and Hedging-Cash Flow Hedges-Derecognition).

DISCUSSION & ANALYSIS 讨论与分析 Derivative financial instruments recognition ASC 815-10 (Derivatives and Hedging-Overall) addresses the criteria for a financial instrument to be treated as a derivative instrument: 15-83 A derivative instrument is a financial instrument or other contract with all of the following characteristics: a. Underlying, notional amount, payment provision. The contract has both of the following terms, which determine the amount of the settlement or settlements, and, in some cases, whether or not a settlement is required: 1. One or more underlyings 2. One or more notional amounts or payment provisions or both. Par. 15-83(a) lists “underlying, notional amount, payment provision” as the first characteristic of a derivative. As for the two interest rate swaps that the Company has entered, the underlying is the interest rate index of 3M-USD-LIBOR, and the notional amounts is $50 million of swap 1 and $75 million of swap 2. 15-83: … b. Initial net investment. The contract requires no initial net investment or an initial net investment that is smaller than would be required for other types of contracts that would be expected to have a similar response to changes in market factors… Par. 15-83(b) states that in order to be treated as derivative instruments, “the contract requires no initial net investment or an initial net investment that is smaller than would be required for other types of contracts that would be expected to have a similar response to changes in market factors.” ASC 815-10 (Derivatives and Hedging-Overall) gives an example of the usual net initial investment of a swap: 3

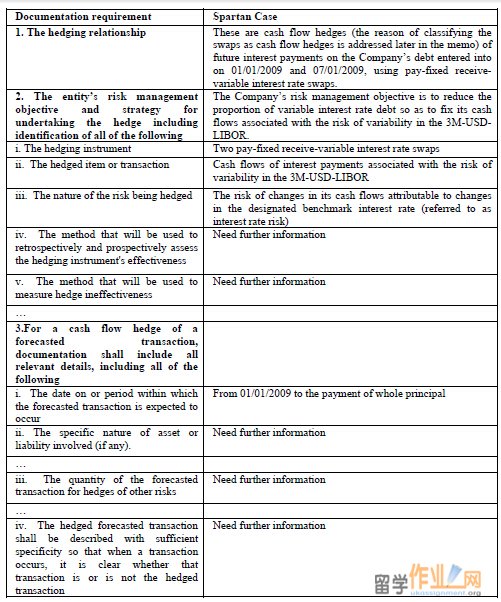

15-95 A derivative instrument does not require an initial net investment in the contract that is equal to the notional amount (or the notional amount plus a premium or minus a discount) or that is determined by applying the notional amount to the underlying. For example:… b. A swap or forward contract generally does not require an initial net investment unless the terms favor one party over the other… Both swap 1 and swap 2 does not require net investments. 15-83: … c. Net settlement. The contract can be settled net by any of the following means: 1. Its terms implicitly or explicitly require or permit net settlement... As for “net settlement” addressed in par. 15-83(c), an interest rate swap permits net settlement as the gain or loss a swap brings to the company. In summary, both swaps that Spartan has entered meet the criteria of derivative instruments so ASC 815 (Derivatives and Hedging) is applicable here. Furthermore, once a financial instrument is qualified for derivative financial instrument, certain accounting treatments are required. ASC 815-10 (Derivatives and Hedging-Overall) gives guidance on the recognition, classification and measurement of derivatives: 05-4 This Topic requires that an entity recognize derivative instruments… as assets or liabilities in the statement of financial position and measure them at fair value. If certain conditions are met, an entity may elect, under this Topic, to designate a derivative instrument in any one of the following ways: a. … a fair value hedge b. … a cash flow hedge c. A hedge of the foreign currency exposure… The two interest rate swaps should be recognized in the statement of financial positions as either an asset or a liability and should be measured at their fair value. Meanwhile, if certain conditions are met, the two swaps could be further classified as a specific type of hedge. The section below would analyze the criteria for a derivative to be treated using hedge accounting. . Hedge accounting criteria and documents ASC 815-20 (Derivatives and Hedging-Hedging-General) addresses the issue of “Formal Designation and Documentation at Hedge Inception” as follows: 25-3: Concurrent designation and documentation of a hedge is critical…To qualify for hedge accounting, there shall be, at inception of the hedge, formal documentation of all of the following… Below is the summary of all the criteria and documentation requirement stated in ASC 815-20-25-3 applicable in the current situation:

1. Documentation requirement: 4

2. Criteria: 1) Hedged item As for hedged items, ASC 815-20 (Derivatives and Hedging-Hedging-General) has further requirements as stated below: 25-6: … The benchmark interest rate being hedged in a hedge of interest rate risk shall be specifically identified as part of the designation and documentation at the inception of the hedging relationship. An entity shall not simply designate prepayment risk as the risk being hedged for a financial asset... In the two interest rate swaps that the Company has entered into, the benchmark interest rate is the 3M-USD-LIBOR and is identified as a part of designation at the inception of the hedging relationship because the receive leg is 3M-USD-LIBOR + 650 bps and the interest rate swaps are used to hedge the cash flows of interest payments associated with the risk of variability in the 3M-USD-LIBOR. Further documentation is needed for making the interest rate swaps qualified as hedges. Specifically in the United States, only certain types of interest rate index can be used as benchmark interest rates, as addressed below by ASC 815-20 (Derivatives and Hedging-Hedging-General): 25-6A: In the United States, currently only the interest rates on direct Treasury obligations of the U.S. government and, for practical reasons, the London Interbank Offered Rate (LIBOR) swap rate and the Fed Funds Effective Swap Rate (also referred to as the Overnight Index Swap Rate) are considered to be benchmark interest rates. In each financial market, generally only the one or two most widely used and quoted rates that meet these criteria may be considered benchmark interest rates. Both swap 1 and swap 2 use LIBOR as a benchmark interest rates, so it meets the requirement set above. 2) Risk being hedged For the Company’s case, the hedges involved the benchmark interest risk, so 815-20-25-15(j) under ASC 815-20 (Derivatives and Hedging-Hedging-General) applies here: 25-15(j): If the hedged transaction is the forecasted purchase or sale of a financial asset or liability (or the interest payments on that financial asset or liability) or the variable cash inflow or outflow of an existing financial asset or liability, the designated risk being hedged is any of the following:… 2. The risk of changes in its cash flows attributable to changes in the designated benchmark interest rate (referred to as interest rate risk)… 4. The risk of changes in its cash flows attributable to all of the following (referred to as credit risk)… The hedged transaction here is the variable cash inflow or outflow of an existing financial asset or liability, and the purpose of entering into the interest rate swaps is to hedge against cash flows of interest payments associated with the risk of variability in the 3M-USD-LIBOR, so the risk being 6 #p#分页标题#e#

hedged in this situation is “the risk of changes in its cash flows attributable to changes in the designated benchmark interest rate (referred to as interest rate risk)”. 3) Hedging instrument The hedging instruments are the two pay-fixed receive-variable interest rate swaps. 4) Hedge effectiveness ASC 815-20 (Derivatives and Hedging-Hedging-General) addresses the requirement for a derivative to be qualified as a hedge is “the hedging relationship, both at inception of the hedge and on an ongoing basis, shall be expected to be highly effective”, as discussed below: 25-75: To qualify for hedge accounting, the hedging relationship, both at inception of the hedge and on an ongoing basis, shall be expected to be highly effective in achieving either of the following: …c. Offsetting cash flows attributable to the hedged risk during the term of the hedge (if a cash flow hedge), except as indicated in paragraph 815-20-25-50 25-50: If a hedging instrument is used to modify the interest receipts or payments associated with a recognized financial asset or liability from one variable rate to another variable rate, the hedging instrument shall meet both of the following criteria… Since the interest rate swaps are modifying the interest payments associated with a recognized liability from one variable rate to fixed rate, they are not qualified for the exception addressed in ASC 815-20-25-50. 25-84: … If the critical terms of the hedging instrument and of the entire hedged asset or liability (as opposed to selected cash flows) or hedged forecasted transaction are the same, the entity could conclude that changes in fair value or cash flows attributable to the risk being hedged are expected to completely offset at inception and on an ongoing basis… The definition of “critical terms” in ASC 815-20-25-84 is as follows: 25-77:...b. Differences in critical terms of the hedging instrument and hedged item or hedged transaction, such as differences in any of the following: 1. Notional amounts 2. Maturities 3. Quantity 4. Location 5. Delivery dates… All of the criteria above are met in the Company’s case, and it is clearly stated that both of the hedging relationships are perfectly effective. In summary, the two interest rate swaps that Spartan entered meet all the criteria of the application of hedge accounting, while some more documentation needs to be prepared by the Company. 7

. The type of hedge As discussed above, ASC 815-10-05-4 requires further classification of derivatives into three types: “a fair value hedge”, “a cash flow hedge” and “a hedge of the foreign currency exposure of any one of the following: a foreign currency fair value hedge, a foreign currency cash flow hedge, a net investment in a foreign operation”. 1. Fair value hedges For instruments to be treated as fair value hedges, the following criteria have to be met under ASC 815-20 (Derivatives and Hedging-Hedging-General): 25-11: An entity may designate a derivative instrument as hedging the exposure to changes in the fair value of an asset or a liability… 25-12: An asset or a liability is eligible for designation as a hedged item in a fair value hedge if all of the following additional criteria are met: …c. The hedged item presents an exposure to changes in fair value attributable to the hedged risk that could affect reported earnings…. The risk being hedged was discussed before as the risk of changes in its cash flows attributable to changes in the designated benchmark interest rate, so no exposure to changes in the fair value of the liability (the debt) is hedged. In summary, the interest rate swaps are not fair value hedges. 2. Cash flow hedges The criteria for instruments being recognized as cash flow hedges under hedge accounting are in ASC 815-20 (Derivatives and Hedging-Hedging-General) and are discussed below: 25-13: An entity may designate a derivative instrument as hedging the exposure to variability in expected future cash flows that is attributable to a particular risk. That exposure may be associated with either of the following: a. An existing recognized asset or liability (such as all or certain future interest payments on variable-rate debt) b. A forecasted transaction (such as a forecasted purchase or sale). The expected future cash flows for the hedge is the forecasted interest payments and they are variable due to the interest rate risk addressed before. The exposure to changes in the interest rate are associated with “an existing recognized asset or liability” instead of “a forecasted transaction” although in the case it describes the interest payment as forecasted interest payment. However, according to ASC 815-20-25-14, “For purposes of this Subtopic [815-20] and Subtopic 815-30, the individual cash flows related to a recognized asset or liability and the cash flows related to a forecasted transaction are both referred to as a forecasted transaction or hedged transaction.” There is no need to differentiate between the individual cash flows related to a recognized asset or liability and the cash flows related to a forecasted transaction. 25-15: A forecasted transaction is eligible for designation as a hedged transaction in a cash flow hedge if all of the following additional criteria are met: 8

a. The forecasted transaction is specifically identified as either of the following: 1. A single transaction 2. A group of individual transactions that share the same risk exposure for which they are designated as being hedged... Par. 25-15(a) states the necessity of identified the forecasted transaction as either “a single transaction” or “a group of individual transactions that share the same risk exposure for which they are designated as being hedged”. The forecasted transaction in this case is the future interest payments of the debt in the credit facility, and all the interest payments share the same risk exposure of the changes in LIBOR while this risk exposure is designated as being hedged. So the forecasted transaction is “a group of individual transactions that share the same risk exposure for which they are designated as being hedged”. 25-15: …b. The occurrence of the forecasted transaction is probable… Par. 25-15(b) addresses that in order for a hedge to be qualified as cash flow hedge, “the occurrence of the forecasted transaction is probable. 25-16: …The following guidance expands on the timing and probability criteria in paragraphs 815-20-25-3 and (b) in the preceding paragraph [ASC 815-20-25-15]: …e. The term probable requires a significantly greater likelihood of occurrence than the phrase more likely than not… The interest payments regarding the credit facility in this case is probable because there is no evidence showing the possibility of Spartan failing to pay interest. 25-15: …c. The forecasted transaction meets both of the following conditions: 1. It is a transaction with a party to the reporting entity. 2. It presents an exposure to variationsin cash flows for the hedged risk that could affect reported earnings… Par. 25-15(c) requires that the forecasted transaction “is a transaction with a party to the reporting entity” and “presents an exposure to variations in cash flows for the hedged risk that could affect reported earnings”. The forecasted interest payments are to Uber, which is an external party for Spartan. Also, the interest payments are exposed to variation due to the changes in LIBOR, and the variation in interest payments will affect the reported earnings through the changes in interest expense. 25-15: …d. The forecasted transaction is not the acquisition of an asset or incurrence of a liability... 25-15: …e. If the forecasted transaction relates to a recognized asset or liability, the asset or liability is not remeasured with changes in fair value… The forecasted transaction does not come from acquisition, and is not remeasured in fair value, so both par. 25-15(d) and par. 25-15(e) are met. 25-15: …f. If the variable cash flows of the forecasted transaction relate to a debt security that is classified as held to maturity under Topic 320… Par. 25-15(f) addresses issues of held to maturity. According to ASC 320 (Investments—Debt and Equity Securities), a held to maturity is an asset, but the credit facility in this case is a liability. So par. 25-15(f) is not applicable here. 9

25-15: …g. The forecasted transaction does not involve a business combination … Par. 25-15(g) states, “The forecasted transaction does not involve a business combination”. The interest payments do not involve a business combination, so par. 25-15(g) is met. 25-15: …h. The forecasted transaction is not a transaction (such as a forecasted purchase, sale, or dividend) involving either of the following: 1. A parent entity's interests in consolidated subsidiaries 2. An entity’s own equity instruments. The interest payments involves neither “a parent entity's interests in consolidated subsidiaries” nor “an entity’s own equity instruments”, so par 25-15(h) is met. 25-15: …i. If the hedged transaction is the forecasted purchase or sale of a nonfinancial asset… The forecasted transaction in this case is not “the forecasted purchase or sale of a nonfinancial asset” so 25-15(i) does not apply. 25-15: …j. If the hedged transaction is … the variable cash inflow or outflow of an existing financial asset or liability, the designated risk being hedged is any of the following: …2. The risk of changes in its cash flows attributable to changes in the designated benchmark interest rate (referred to as interest rate risk)… Par. 25-15(j) has already been discussed before. The risk being hedged is the interest rate risk. 25-15: …k. The item is not otherwise specifically ineligible for designation (see paragraph 81520-25-43). 25-43: Besides those hedged items and transactions that fail to meet the specified eligibility criteria, none of the following shall be designated as a hedged item or transaction in the respective hedges: …b. With respect to both fair value hedges and cash flow hedges: 1. An investment accounted for by the equity method… 2. A noncontrolling interest… 3. Transactions with stockholders… 4. Intra-entity transaction… 5. The price of stock … c. With respect to cash flow hedges only: …2. If variable cash flows of the forecasted transaction relate to a debt security that is classified as held-to-maturity… 3. In a cash flow hedge… on a different index… None of the above transactions is related to the interest payments in this case, so par. 25-15(k) does not apply. Since both swap 1 and swap 2 meet all the requirements above, they should be classified as cash flow hedges. 3. Net investment hedge 10 #p#分页标题#e#

In order for an instrument to be classified as a net investment hedge, certain criteria under ASC 81520 (Derivatives and Hedging-Hedging-General) should be met. 25-66: A derivative instrument or a nonderivative financial instrument that may give rise to a foreign currency transaction gain or loss... Par. 25-66 states “a derivative instrument or a nonderivative financial instrument that may give rise to a foreign currency transaction gain or loss” can be designated as net investment hedge. There is no foreign currency involved in this case because all transactions are conducted in USD. So par. 25-66 does not apply. 25-67: Hedging instruments that are eligible for designation in a net investment hedge include, among others, both of the following: a. A receive-variable-rate, pay-variable-rate cross-currency interest rate swap…. b. A receive-fixed-rate, pay-fixed-rate cross-currency interest rate swap... Par. 25-67 mentions in order for a hedging instrument to be qualified as a net investment, it should include both “a receive-variable-rate, pay-variable-rate cross-currency interest rate swap” and “a receive-fixed-rate, pay-fixed-rate cross-currency interest rate swap”, neither of the two swaps here exist in Spartan’s case. 25-71: Besides those hedging instruments that fail to meet the specified eligibility criteria, none of the following shall be designated as a hedging instrument for the respective hedges: a. With respect to fair value hedges, cash flow hedges, and net investment hedges: 1. A nonderivative instrument… 2. Components of a compound derivative instrument representing different risks… 3. A hybrid financial instrument… 4. A hybrid instrument… 5. Any of the individual components of a compound embedded derivative… c. With respect to cash flow hedges only: 1. A nonderivative financial instrument as a hedging instrument in a foreign currency cash flow hedge. … Par. 25-71 gives examples of hedging instruments that are not qualified as net investment hedges, the two interest rate swaps are not included. In summary, neither interest rate swaps should be classified as net investment hedge. In conclusion, Spartan needs to designate the two interest rate swaps as cash flow swaps in order to hedge the forecasted interest payments associated with changes in 3M-USD-LIBOR. . Appropriate journal entries ASC 815-20 (Derivatives and Hedging-Hedging-General) addresses the subsequent measurement of cash flow hedges as follows: 11

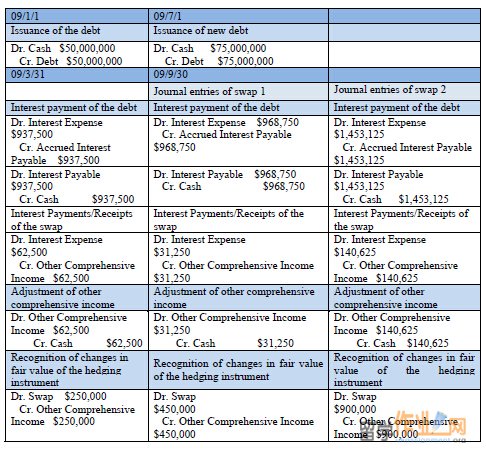

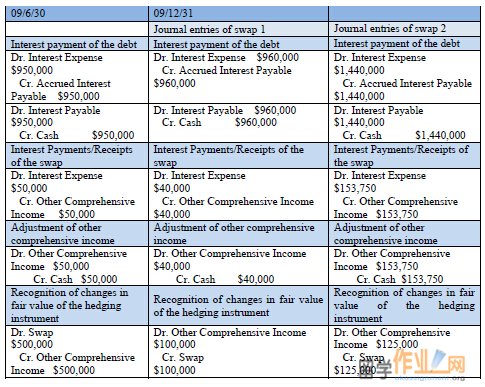

35-1:Paragraph 815-10-35-2 states that the accounting for subsequent changes in the fair value (that is, gains or losses) of a derivative instrument depends on whether it has been designated and qualifies as part of a hedging relationship and, if so, on the reason for holding it. Specifically, subsequent gains and losses on derivative instruments shall be accounted for as follows: …c. Cash flow hedge. The effective portion of the gain or loss on a derivative instrument designated and qualifying as a cash flow hedging instrument shall be reported as a component of other comprehensive income (outside earnings) and reclassified into earnings in the same period or periods during which the hedged forecasted transaction affects earnings…. The remaining gain or loss on the derivative instrument, if any, shall be recognized currently in earnings… According to the above guidance, the appropriate accounting treatments for the year ended December 31, 2009 are as follows:

Implication of prepayment 1. Effect on effectiveness The prepayment of debt might result in ineffectiveness, because it changes the critical terms of the hedging instrument and hedged item, as stated as under ASC 815-20 (Derivatives and Hedging-Hedging-General) as follows: 25-77: Hedge ineffectiveness would result from any of the following circumstances, among others: …b. Differences in critical terms of the hedging instrument and hedged item or hedged transaction, such as differences in any of the following: 1. Notional amounts… The prepayment reduces the principal to $100 million, while the notional amount of the two swaps remain $125 million. This could possibly result in hedge ineffectiveness. If the hedging relationship remains highly effective, under ASC 815-20 (Derivatives and Hedging-Hedging-General), the ineffective portion shall be recorded currently in earnings. 13

35-12: … the entity must measure the amount of ineffectiveness that must be recorded currently in earnings pursuant to the guidance beginning in paragraph 815-30-35-10 if any of the following conditions exist: a. The critical terms of the hedging instrument or the hedged forecasted transaction have changed… After the prepaying the debt principal, the Company should “measure the amount of ineffectiveness that must be recorded currently” and record the corresponding gains or losses. Moreover, as stated in 815-20-25-75: “To qualify for hedge accounting, the hedging relationship, both at inception of the hedge and on an ongoing basis, shall be expected to be highly effective”. Under ASC 815-35 (Derivatives and Hedging-Cash Flow Hedges), the appropriate treatment to the instruments no longer qualified for hedge is addressed as below: 40-1: An entity shall discontinue prospectively the accounting specified in paragraphs 815-25-351 through 35-6 for an existing hedge if any one of the following occurs: a. Any criterion in Section 815-20-25 is no longer met… If the hedging relationship is no longer highly effective, the two interest rate swaps are not qualified for hedge accounting any more. Under this circumstance, the hedge accounting is discontinued prospectively. 2. Effect on financial results Since part of the debt is prepaid, the interest payment is no longer based on the $125 million principal any more. Interest expense on the debt will change accordingly. As mentioned before, if the cash flow hedge is still highly effective, any ineffective part should be recorded in earnings. If the hedging relationship is no longer highly effective, the cash flow hedge is discontinued. Different accounting treatments are applicable here. CONCLUSION Both of the interest rate swaps are derivatives and should be classified as cash flow hedges. The criteria for hedge accounting are hedged item (cash flows of interest payments associated with the risk of variability in the 3M-USD-LIBOR), hedging instruments (two pay-fixed receive-variable interest rate swaps), risk being hedged (interest rate risk) and hedge effectiveness (perfectly effective). The documentation requirements of hedge accounting are as follows: 1. The hedging relationship 2. The entity’s risk management objective and strategy for undertaking the hedge including identification of the hedging instrument, the hedged item or transaction, the nature of the risk being hedged, the method that will be used to retrospectively and prospectively assess the hedging instrument's effectiveness and the method that will be used to measure hedge ineffectiveness. 3.For a cash flow hedge of a forecasted transaction, documentation shall include all relevant details, including the date on or period within which the forecasted transaction is expected to 14

occur, the specific nature of asset or liability involved (if any), the quantity of the forecasted transaction for hedges of other risks and the hedged forecasted transaction shall be described with sufficient specificity so that when a transaction occurs, it is clear whether that transaction is or is not the hedged transaction. The appropriate accounting treatments for the year 2009 are listed in the above discussion. If Spartan prepays $25 million, the hedge effectiveness and the financial results might be affected. 15

|

|

|||

| 网站地图 |