|

Interpret and analyse the annual reports ‘Consolidated Income Statement ’ and ‘Consolidated Bal-ance Sheet’, including:解释和分析年度报告“综合损益表”和“合并财务报表”,包括:

- Calculate and conduct trend analysis for the period from 2012 to 2015, using 2012 as the base year. - 以2012年为基准年,计算并进行2012年至2015年期间的趋势分析。

- Calculate and conduct vertical analysis for the period from 2013 to 2015. - 计算并进行2013年至2015年期间的垂直分析。

- Calculate and conduct the following ratio analysis for the period from 2013 to 2015. - 计算并执行2013年至2015年期间的以下比率分析。

•Current ratio,

•Acid-test ratio,

•Inventory turnover,

•Debt ratio,

•目前的比例,

•酸性测试比率,

•存货周转率,

•资产负债率,

•Debt to equity ratio,

•Time interest earned,

•Gross profit percentage,

•Rate of return on total assets,

•Asset turnover ratio,

•Earnings per share (note: you will find earnings per

share from Consolidated Income Statement, so there is no need to calculate this ratio. Please use ‘Basic earnings per share’ for ‘Earnings per share”).

•债务与权益比率,

•赚取时间利息,

•毛利率,

•总资产回报率,

•资产周转率,

•每股收益(注意:您会发现每股收益)

从合并利润表中分享,因此无需计算此比率。 请使用“每股基本收益”代表“每股收益”)。

Financial analysis on Myer

Introduction

Myer is one of the most popular retailers in Australia, which has more than 60 stores in the domestic market. The company has physical store as well as online store, in order to cater to their customers. Based on the financial statements during the years from 2012 to 2015, the financial results may be slightly disappointing, but it is relief that the company stays in the same position in these years.

Trend analysis

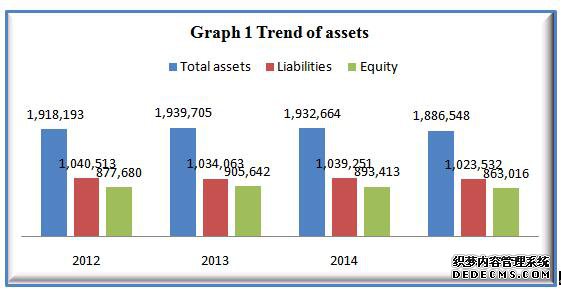

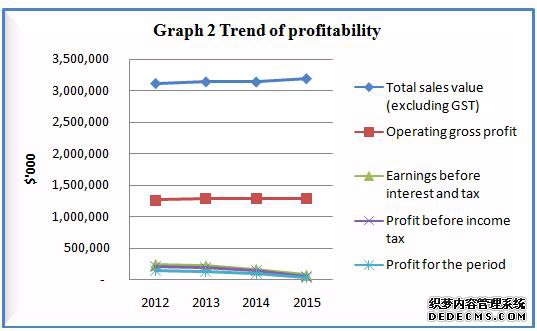

Comparing the financial statements of Myer during the recent four years, it is clear that the company does not change in both the structure of assets and the gross sales. Despite that the management highlights potential change irritated by the new Myer strategy, the graphs of trends analysis below give the message that the company does not change in the recent four years.

On the one hand, the financial position is stable. Considering the profitability in 2015 drops, which will be discussed later, keep balance in the financial position is a preferred choice for the company.

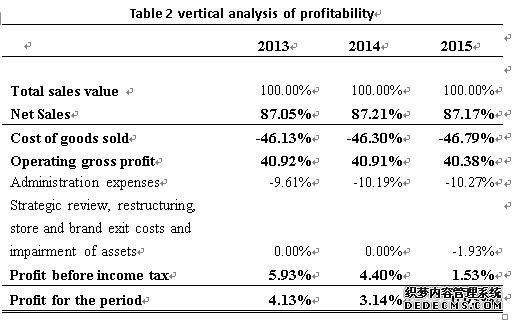

On the other hand, the sales grows sustainably from 2012 to 2015, yet the margin falls at the same time. Obviously, the decrease in profits dues to the upward costs, which is explained by the directors in Myer. The direct reason is the costs associated with refurbishments in four of the top 25 stores as well as two new stores, and costs associated with the growth in the omni-channel business, which is suggested by the director in the annual report of 2015. In fact, in the background of fierce competition between the retailers, the company does take the strategic change into consideration.

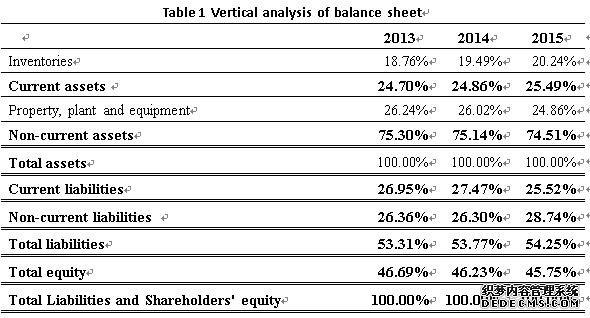

Vertical analysis

In the structure of the assets of Myer, the stable financial position is highly valued according to the data in the following table. The portion of long term assets is large in the total assets, which explains why the company does not change much in accordance to the balance sheet these years.

The profit in 2015 experiences a decline due to the rising costs, especially for the administrative costs and strategy related costs. According to the explanation of management, Myer will be faced up with restructuring the store and strategic changes, which inevitably leads to costs increase in these years.

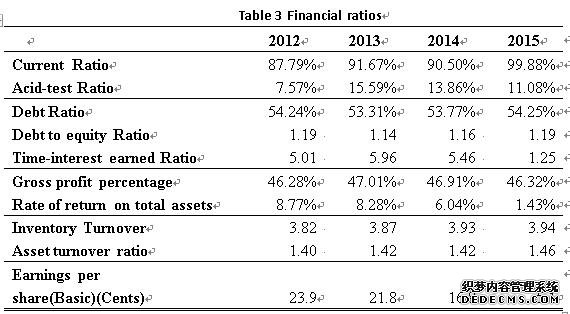

Financial ratios

It is obvious that the company plans to update its competitive strategy by expanding the stores and channels in order to catch more customers. First, the risk of default in short term in the recent years is comparably low due to the large portion of the current assets. However, the acid test ratio reveals that the level of inventory is high. Secondly, in the long run, the financial position is steady, yet the time-interest earned ratio drops in 2015. Third, returns on total assets declines, mostly due to the rising costs related to strategic change. Fourth, the operational capacity is steady in these years. At last, earnings per share shrinks dramatically, because the profits drop in 2015.

Conclusions

Myer experiences a steady development in the recent four years. The financial position is steady, yet the management desires to grow the sales in the future. The company plans to invest in the new stores and channels at the costs of rising expenses. However, the future of the company does require the investments in the current days.

|

|

|||

| 网站地图 |