|

(All students must answer THIS question.)(所有学生必须回答这个问题。)

1中央政府部门的新首席执行官(CEO)对账目的编制感兴趣,特别是可以选择的其他会计方法以及国际公共部门会计准则(IPSA)的适用方式。

首席执行官询问了在账户中确认交易的时间安排。举个例子,首席执行官担心购买20台新电脑将计入部门的2011/2012财务报表,而不是下一个财政年度。本署的财政年度为4月1日至3月31日。

1 The new Chief Executive Officer (CEO) of a central government department is taking an interest in the preparation of the accounts, particularly with alternative accounting methods that can be chosen and how the International Public Sector Accounting Standards (IPSAS) apply.

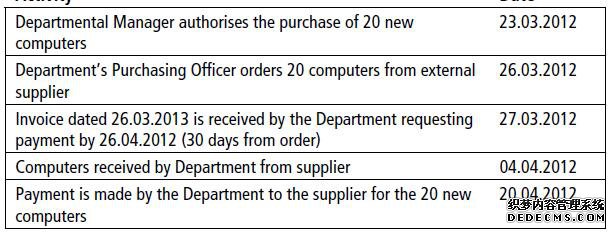

The CEO has queried the timing taken for transactions to be recognised in the accounts. As an example, the CEO is concerned that the purchase of 20 new computers is accounted for in the Department’s 2011/2012 financial statements rather than the following financial year. The Department’s financial year runs from 1st April to 31st March.

Activity Date

该部门的一辆垃圾收集车最近卷入了一场道路交通事故。垃圾收集车的司机承认有责任驾驶家庭汽车,该部门希望他们的保险公司支付汽车的维修费用,估计为4800英镑。该部门车辆保险的一个条件是,所有索赔将少于200英镑。车主已确认所有维修工作将于2013年3月31日前完成,但保险公司尚未正式同意支付。

该部门的中央办公室被归类为非发电资产。以下值可用于此资产:One of the Department’s refuse collection vehicles was recently involved in a road traffic accident. The refuse collection vehicle’s driver has admitted responsibility for driving into a family car and the Department is expecting their insurance company to cover the car’s repair costs which are estimated to be £4,800. One of the conditions of the Department’s vehicle insurance is that all claims will be less the excess of £200. The owner of the car has confirmed that the repairs will all be completed prior to 31 March 2013 but the insurance company has not yet formally agreed to pay.

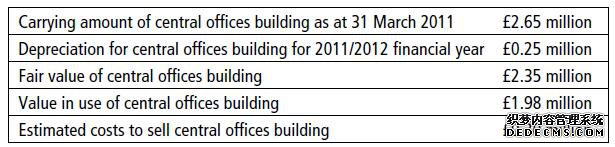

The Department’s central offices are classed as a non-generating asset. The following values are available for this asset:

a) The Department applies accruals accounting but the CEO is only familiar with cash accounting. Contrast the accounting treatment for the purchase of the 20 new computers under cash and Public Financial Management: Financial Reporting (IPSAS) 14 University of London accruals bases, clearly stating when the items that should be recognised in the Department’s accounts. [30% of marks]

b) Determine the accounting treatment in the Department’s accounts for the road traffic accident, referring to relevant IPSAS where appropriate. [25% of marks]

c) Determine the value of the Department’s central offices that should be shown in the 2011/2012 financial statements, referring to relevant IPSAS where appropriate. [45% of marks]

Section A (Answer ONE question from this section)

2 Explain the alternative approaches to budgeting that may be adopted by public sector entities to set their budget, including their various advantages and disadvantages.

3 Evaluate the use of performance budgeting in public sector entities.

4 Critically discuss the use of cash and accruals based financial reporting by public sector entities.

5 Discuss the accounting of heritage assets by public sector entities.

Section B(Answer ONE question from this section)

6 Evaluate the usefulness of consolidated financial reports in the public sector.

7 Critically discuss the use of Public Private Partnerships (PPP).

8 Discuss how the key elements of corporate governance may be applied by public sector entities.

1.1 The Department applies accruals accounting but the CEO is only familiar with cash accounting. Contrast the accounting treatment for the purchase of the 20 new computers under cash and accruals bases, clearly stating when the items that should be recognised in the Department’s accounts.

Accrual accounting is where accounts are prepared recognising transactions at the time they occur, not when cash actually is exchanged. Cash accounting is where accounts are prepared recognising transactions occurring when cash exchanges hands. The key difference between cash accounting and accrual accounting is therefore one of timing.

For example, when the Department applies accruals accounting, the items should be recongnised in the Department’s accounts when the transaction is confirmed, namely, when the Departmental Manager authorises the purchase of 20 new computers on 23.03.2012. However, under the circomstances of cash accounting, the transaction should be registerd when the money is actually paid, namely, when the payment is made by the Department to the supplier for the 20 new computers on 20.04.2012.

Accrual accounting and cash accounting have their advantages and disadvantages. On one hand, accrual accounting is more reasonable when reflecting the business performance. Therefore, it almost completely replaces the cash basis. However, it has limitations when reflecting the financial position of a company or an organization. When a company’s income statement looks good and has high efficiency of business, it may not actually have the liquidity of funds in financial trouble in balance sheet. This is due to the accrual accounting, the accrued income and expenses are all reflected in the income statement, and its balance sheet is in the part reflecting the cash balance and the debts. A cash flow or change in financial position on a cash basis based is recommended to make up for the in sufficiency of accrual system. On the other hand, cash accounting can not fully reflect the financial position, its shortcomings are: 1, it is not conducive to unit costing, enhance efficiency and performance appraisal; 2, can not fully and accurately record liabilities and to reflect the unit is not conducive to guard against financial risks; 3, can not be a true reflection of the balance of payments surplus that year; 4, not a true reflection of foreign investment business; 5, can not reflect the true value and implicit liabilities of fixed assets; 6, is not conducive to dealing with government procurement and year-end carry-over and other accounting matters.

For now, it is sufficient to understand that the cash basis is simpler than accruals and has traditionally been the approach adopted in the public sector. As at September 2009, only the following seven countries had adopted full accrual accounting with financial statements being published on an accrual basis (Khan and Mayes, 2009): New Zealand, Australia, USA, UK, Canada, Colombia and France.

1.2 Determine the accounting treatment in the Department’s accounts for the road traffic accident, referring to relevant IPSAS where appropriate.

According to Public Financial Management: Financial Reporting (IPSAS),

IPSAS 19.18 defines a contingent liability as:

a) A possible obligation that arises from past events and whose existence will be confirmed only by the occurrence or non-occurrence of one or more uncertain future events not wholly within the control of the entity, or

b) A present obligation that arises from past events but is not recognized because:

i) It is not probable that an outflow of resources embodying economic benefits or service potential will be required to settle the obligation, or

ii) The amount of the obligation cannot be measured with

Provisions, contingent liabilities depends on that there is some degree of uncertainty. However, contingent liabilities and obligations itself is uncertain. Therefore, unlike rules, contingent liabilities responsibility does not fully meet the recognition criteria. Therefore, contingent liabilities disclosed in financial statements, but are not recognized.

An example of contingent liabilities will be a legal case, not sure if the hospital will have to pay a patient to Sue for compensation. The contingent liabilities disclosed in the hospital is pointed out that their account but not for approval.

There are three scenarios contingent liabilities, all involve different accounting methods. They are:

High probability. Record a loss may occur when contingent liabilities, and can reasonable estimates of losses. If you can only estimate the number of a range of possible, and record the amount of range seems to be a better estimate than any other amount; If there is no better quantity, and then recorded the lowest number range. "May" means that future events may occur. You should also describe the responsibility with the notes of financial statements.

In probability. The existence of the disclosure of contingent liabilities in the notes accompanying the financial statements may not be possible if responsibility is reasonable, or if it is possible to liability, but you can't estimate. "Reasonable" means that the probability of events than remote but not possible.

Low probability. Do not record or disclosure of contingent liabilities happen if the probability of remote.#p#分页标题#e#

Examples of contingent liabilities are the result of the litigation, government investigations, or the threat of expropriation. Assurance can also be regarded as contingent liabilities, because of the uncertainty of the specific number of units, will return to the customer repair or replacement.

Contingent liabilities of the accounting treatment is very free, there is no need to record, unless the risk of loss is very high. Therefore, you should check with the disclosure of the company's financial statements for additional risks, or has not been approved. After the disclosure should consider the number of warning appear as formal liabilities in the financial statements.

In the case of the road traffic accidence, it is the category of the contingency liabilities, so that it should record the expenses under the accrual accounting principle under the relevant accounting standard, which should record the non-operation expenses in the statement; and also the insurance is claimed back, it is treated as non-operation revenue from the insurance. There are no considered to the tax consequence.

1.3 Determine the value of the Department’s central offices that should be shown in the 2011/2012 financial statements, referring to relevant IPSAS where appropriate.

Tangible non-current (fixed) assets are assets that have physical substance and are held for use in the production or supply of goods or services, for rental to others, or for administrative purposes on a continuing basis in the reporting entity’s activities. Examples of tangible non-current assets that a public sector entity may hold include buildings, machinery and motor vehicles. Such assets fall in the main category of tangible non-current assets that will be the focus of this section namely property, plant and equipment (PPE), which is covered by IPSAS 17.

In the financial position statement,

Carrying amount of central offices building as at 31 March 2011 £2.65 million

Depreciation for central offices building for 2011/2012 financial year £0.25 million

Net value £2.4 Million

In the comprehensive income statement, there are no statements to sell the building, so that there are no disclosures on the comprehensive income statement.

2 Explain the alternative approaches to budgeting that may be adopted by public sector entities to set their budget, including their various advantages and disadvantages.

There are several budget approaches, including incremental budgeting, zero-based budgeting, programme budgeting and output/outcome budgeting.

The advantage of the incremental budget: a budget is stability and change is gradual. Manager can operate department on a consistent basis. System operation is relatively simple and easy to understand. Conflict should be avoided if the department can see the same treatment. It is easier to implement coordination between budget. Can see the impact of change quickly. Disadvantages: incremental budget assumes activities and methods, will continue to work in the same way. Have no incentive to develop new ideas. No incentive to reduce costs. Encourage spending budget for next year's budget maintenance. Budget may become out of date, and the level of activity or is no longer for the type of work. For resources priority may change since the initial set of budget. May have a built-in budget slack budget, this is never reviewed - managers may have overestimated their needs in the past in order to get the budget work more easily, which makes them get good results.

Advantages of zero-based budget: to ensure efficient allocation of funds because it is based on the needs and interests, so to avoid the unnecessary cost. To improve the service by using the method of cost-effective. Impose restrictions on the allocation of funds; contain any inflation. Control rights point of view, require allocation of reason. Budget allocation and discussion is meaningful and purposeful. Weeds expired, invalid and counterproductive. Zero-based budget drawback: preparing time and cost budget. Zero-based budget sometimes sounds too radical, so it is difficult to get a consensus. Too many decision package may require a very large organization. Need commitment and professional attitude, in order to ensure appropriate implementation. Prove that each cost may not be feasible or practical. As r&d department can find cash shortage. All managers and employees should be the concept of education and training of zero-based budget application.

Advantages include project budget, rational, focus on results, enterprise or across, admitted that the long-term goal. The project budget on the downside, it is a complicated and difficult to use.

Advantage the output/results of budget, the budget is also known as guide, organize the implementation of the budget and measurement system mentioned they can generate two advantages: improve the service efficiency and the value of the exchange program.

However, on the basis of the results of budgeting, not for all. Although there are some obvious benefits to gain, it's important to remember that what you can do and cannot expect from extrinsic base resistance. To managers and employees know how and when to use the extrinsic base resistance, may need other ways to complement it.

3 Evaluate the use of performance budgeting in public sector entities.

The main reason for the oecd countries have already started performance budget includes: the financial crisis, more and more pressure to reduce spending and change management. Three types of performance budgeting: first of all, the appearance of performance budgeting performance information supplied in the budget document or other government documents, the second performance - informed budget resources indirectly related proposal of performance in the future or past performance, third, budget performance directly, including the allocation of resources based on the results. Instead of implementing performance budgeting method includes six aspects. First, the top-down approach, the central government plays an important role in the development, implementation and monitoring of the reform. Second, the bottom-up approach in various agencies plays the key role in the development, implementation and monitoring of reform, rather than the central government. Third, implement in an all-round way. Fourth, the part of the implementation.Fifth, can realize incremental approach, the reform gradually for many years, such as in Australia.Sixth, the big bang approach, change very fast, such as in South Korea.

Performance budgeting is the government's first make business plan and project, and then make a plan implementation procedures in accordance with the functions of the government and management plan, to determine the application requirements, make the cost benefit analysis method on the basis of preparing the budget. From the public sector entities implementation of performance budgeting reform practice, performance budgeting to improve the efficiency of the use of public funds, government performance improvement, important achievements have been obtained. Performance characteristics of the budget plan decision budget, calculated according to the estimated cost, cost benefit analysis, and then to measure the effectiveness of their performance. Visible, performance budgeting is a cost-benefit analysis is determined based on the standard form of expenditure budget organization, supervision and control of budget expenditure, improve the efficiency of expenditure, avoid waste has a positive effect. Performance budget and the difference between the traditional budget method is that it is the basic concept of the market economy to public management, so as to effectively reduce the cost of the provision of public goods, improve the efficiency of fiscal expenditure. Performance budgeting management is a complete control and process control system, the budget in the performance of the network, all resources should be included in the budget management monitoring, allocate limited resources allocation, the boundary of the internal function is gradually weakened, can be integrated with each other, to make it through the performance budget in order to better overall coordination, reduce the resources available.

4 Critically discuss the use of cash and accruals based financial reporting by public sector entities.

The cash basis of accounting, income of cash received from the customer in reporting the profit and loss account; Expense report profit and loss statement, the cash payment. In addition, under accrual accounting, revenue report income earned - which often appear before the cash received from the customer. Expense report of the income statement period occurred, or when they expire - which is often different in a period of time the time of payment. Accrual basis accounting provides a better understanding of a company during an accounting profit. Reason was prepared under the accrual of income statement will report all during the actual revenue and all costs, in order to obtain income. Accrual basis accounting also provides a better understanding of the company's financial position at a moment or point in time. The reason is that all assets income report and all liabilities. Accrual basis accounting is necessary, because the matching principle.

The seriousness of the sovereign debt crisis continue to affect the stress results bad financial management and financial reporting in the public sector. Increased focus on public sector financial management created more and more high quality standards and requirements, how to adopt and implement these standards. The international public sector accounting standards board (IPSASB) is an international organization committed to the development of the public sector accounting entity (IPSASs). High quality, robust and effective accrual - -based financial reporting system, such as based on the IPSASs, integral to strengthen accountability and the transparency of the government financial report. Citizens under the influence of the government's financial management decision. Strong and transparent financial reporting has the potential to improve public sector decisions, make the government more accountable to their voters. Failure of the government to manage their finances in the past, and in the future, with dramatic consequences, such as the loss of democratic control, social unrest, the government's failure to fulfill its promise of today and the future. The failure of the financial management in the public sector is widespread and has a loss, the influence of the economic effect than corporate bankruptcies in the first decade of this century. Sovereign debt crisis shows that the choice of policy response to the global financial crisis may have inadvertently changed the nature of the problem, it transferred from the enterprise to government departments. In a recent insights into the global risk report, the world economy BBS published the results of an investigation of 469 experts industry, government, academia, and civil society, the 50 global risk class five. It points out that the current is the most important global economic risks "long-term fiscal imbalance"#p#分页标题#e#

Public sector financial reporting is a critical problem, many governments still insist on cash basis of accounting, thus to provide the minimum disclosures relative to the public, Banks, investors and credit providers usually expect of the private sector. Given that government debt held by the bank and the private sector investors, it is no wonder that more and more of the same level of financial demand is expected from the transparency and accountability of public sector, from the private sector. Current (cash accounting system, in many countries, may not be able to provide appropriate incentives. For example, (cash reporting system would promote a clear decision on whether to offer higher wages to the government workers today, or to provide increased pensions, they can visit in the coming days. (the cash system, does not require pension debt records and reports, will provide incentives to encourage politicians to choose the latter. No cash exchange, the growth rate is not reported spending increases, so there is no pressure to raise the debt decided to provide increased pensions. However, accrual - -based accounting system for pension debt report will promote more careful analysis, and could lead to another is up to the government's financial situation factors, net assets, long-term sustainability can be considered. Accrual - -based accounting standards to ensure greater transparency and accountability of public sector finances, as well as better supervision of the government's debts and liabilities.

High quality and timely accrual - -based financial report can be in the public sector through the adoption of global acceptable, high quality of reporting standards developed specifically for the public sector, namely. The IPSASs. Using IPSASs to governments around the world will improve the quality of financial information report public entities, it is crucial for investors, taxpayers and the public to understand the full impact of the government decisions about their financial situation, financial position and cash flow. Global adoption of these standards will promote on a global scale comparable to the information and assist in the internal management decision-making in resource allocation plan and budget, monitor, and accountability. In addition, a common set of public sector accounting standards, IPSASs also provide better information about systemic risk associated with government debt. In addition, the financial report using IPSASs support the government's ability of high quality auditing financial statements, because they provide a solid foundation and appropriate standards for auditors (in most cases, the public sector auditors and supreme audit institutions) to their work. The IPSASs will be an important step forward to achieve fiscal transparency of governments around the world. Although IPSASs individual applications will not solve the problem of reflected by the sovereign debt crisis, financial information to present the appropriate use of these standards will assist in evaluating the meaning of public officials and other groups or by government finance decisions are put forward. In fact, it can be said that, there is no better reporting and enhance transparency and accountability, the prominent problems of the current sovereign debt crisis will never truly and fully solved.

5 Discuss the accounting of heritage assets by public sector entities.

National treasure legacy assets may be considered to be held indefinitely, government or public sector organizations. This after reading the introduction of the concept of traditional assets. 17 points and international public sector accounting standards authority and heritage assets include, first of all, the international public sector accounting standards in 17 neither need nor forbidden legacy assets recognition. Second, if heritage assets are acknowledged in the financial statements of an organization, the international public sector accounting standards and disclosure requirements must comply with these legacy assets. Subcommittee on international federation of accountants (IFAC) was established in 2006, the special consideration of legacy assets accounting and disclosure requirements, develop a new standard or modify the international public sector accounting standards authority (asa) 17. Consultation paper was published in 2005, after the reaction, the consultation document in 2006, it's that need to be further inspection and analysis. However, due to other priorities for the project in 2007 to be extended at the time of this writing has not been activated. Australia for legacy assets in the financial statements and recognition, and international public sector accounting standards authority (asa) 17. This suggests that some countries and the government can't accept the international public sector accounting standards as the most appropriate accounting treatment for their individual circumstances will clearly affect the global adoption ipsa purpose.

Legacy assets accounting in the public sector still has many problems. For example, according to the FRS 30 of legacy assets, there are still many problems. First of all, current accounting rules legacy assets is not satisfactory. Secondly, put forward the financial reporting standards provide valuations are based on collecting collection. Third, FRS valuation on the basis of practical, rather than on the basis of the concept of consideration. In most cases the legacy assets is not normal in the sense of economic assets, especially any value on them will be enough to offset the cost to meet its obligations or entity trust legislation to safeguard assets. In fact, heritage assets often doesn't even reflect mountable in office services, in the form of potential measurement. Some entities holding these assets simply because they have a duty to the provisions of the trust or legislation. We repeat: there is a problem in money, including legacy assets on the balance sheet does not constitute a proper measures. Fourth, who are the key users of published financial statements of real estate assets, and they want information should be considered. Fifth, it is the costs and benefits, further aroused people's concern. Value will be very expensive, even if it's not, it can be for charity believes that any resources spent on valuation may not be useful, most readers accounts, is a waste of the resources. Related, and increase the audit costs could be enormous.

6 Evaluate the usefulness of consolidated financial reports in the public sector.

As Walker (2009) highlights, it is important to know who the users of consolidated financial statements are in order to enable the information disclosed to be as optimal as possible. The consolidated financial statements produced in the public sector should meet the needs of users in order to be useful for assessing governmental financial performance.

7 Critically discuss the use of Public Private Partnerships (PPP).

Purchasing power parity (PPP) is public and private sector cooperation organizations provide public sector projects, assets, or services. More specifically, one effective purchasing power parity (PPP) is defined as "a long-term arrangement, the private sector organizations to take risks and responsibilities of public works projects, usually involves creating or improving fixed assets". The arrangement of the relationship between the public and private sector organizations in purchasing power parity (PPP) can significantly change. For example, the private sector entities may design and build a new prison from public sector organizations run and maintain it. In addition, the private sector entities can operate on the prison prison service and maintenance. The size of the private sector to participate in the summary below.

A key reason for public sector organizations has entered the PPP is high so that the initial cost of the private sector financial asset. In fact, the purchasing power parity (PPP) in response to the concerns of the public debt levels (connolly and wall, 2010) - think back to your research unit 5 debt and public debt. Now, conversion become the preferred method for the government in many countries all over the world to provide public services, although the actual nature of the PPP protocol is very big difference (brow laughlin, 2004). With any major contract or project, it is crucial, management of purchasing power parity (PPP) is appropriate. Effective management is not always obvious, however, lead to the failure of the potential projects. Some of the major weaknesses in the management of the PPP has been identified as the following (rial, 2012). First of all, the weak at the gate of the role of the ministry of finance or budget authority, keeper of the public finances. Second, the lack of the PPP project in the budget process integration. Third, the contradiction between the budget, accounting and reporting standards.Fourth, the purchasing power parity (PPP) operation gradually extrapolation of the government's report. Fifth, in the public sector monitoring ability is weak. The weaknesses and concern is the problem of purchasing power parity (PPP), can be very expensive. High conversion cost including these two examples. Brampton, Ontario, Canada, first of all, the public hospital public spending more than $200 million, if publicly funded by the Canadian government, rather than directly by purchasing power parity (PPP). College second, purchasing power parity (PPP) in the university of Montreal, Quebec, Canada, and failed, turn to the public cost from $200 million to $200 million. college

Public sector organizations tend to enter the purchasing power parity (PPP), the private sector can be a high initial cost of financial assets. Assets accounting, it is usually displayed in the private sector's balance sheet (or financial status) college and public sector procurement organization only shows the annual income of rental costs, as shown in figure 7.2. This means that the public sector from the report also important total liabilities over the asset's life. Conversion of the private sector to provide infrastructure and services from infrastructure assets have been provided by the public sector. Purchasing power parity (PPP) is spread around the world. It may be some truth, such arrangement initial advertisements try to avoid spending and hidden public budget deficits. But if they have reasonable design and transparently reports, conversion can improve the efficiency of providing services, previously only provided by the public sector.#p#分页标题#e#

8 Discuss how the key elements of corporate governance may be applied by public sector entities.

Corporate governance is the manner in which an organization, are willing to guide and lead (the British Treasury and the cabinet office, 2011). In a typical private company, directors appoint running business on behalf of the owner or shareholder. The term in the public sector and the relationship is slightly change the director or manager appointed by local government or hospital operation, for example, on behalf of the public or the taxpayer. How, the taxpayer can believe that the public sector entities operating managers in their best interests? What prevent managers to take some of the money for themselves or report public sector organizations, executive than it actually is? The answer is good corporate governance practice, you will explore in this unit. The audit committee (UK) definition of corporate governance in the public sector as a "user responsibility under the framework of stakeholders and the wider community, in the organization to take decisions, and leadership and control functions, achieve their goals."

Key elements of organizational governance, including the college board of directors, audit committee and compensation process. The three principles of corporate governance and transparency is the key to the independence, separation of function. Cadbury's report put forward the principles of corporate governance is openness, honesty and responsibility. ANAO suggested the principles of corporate governance is the leadership, management environment, risk management, monitoring and accountability.

The following corporate governance best practice recommendations should be in place (financial reporting council, 2012). First of all, an effective board, is responsible for the long-term success of the organization. Second, the chairman of the board, is responsible for the operation. Secondly, a clear distinction between administrative running operation business and the board of directors. Fourth, NED to constructively challenge and help suggested strategies for development in the role of the board of directors. Fifth, the board of directors and the right balance of skills, knowledge and experience. Sixth, formal, rigorous and transparent procedure to appoint new board members. Seventh, an induction process new board members and regularly update the skills and knowledge. Eighth, quality information in a timely manner to provide members of the board of directors. Ninth, change on a regular basis.

The four key elements of corporate governance, namely, board independence, separation of chairman and chief executive officer (CEO), the role of the audit committee independence and compensation disclosure. Global governance is different, because this is such a huge topic, it is impossible to provide detailed reports.

First of all, board independence, public sector director is responsible for the day-to-day running of the business of the organization. However, more specifically, the director every day running organization known as executive director. In fact, there are two main types of directors and the differences between them and their role in corporate governance is very important. The following corporate governance best practice recommendations should be in place (financial reporting council, 2012) : an effective board of directors, shall be responsible for long term success, President, responsible for the board of directors; A clear distinction between operation business executives and board college running; NED constructively challenge, help develop part of the suggested strategies, their role in the board of directors, board of directors and the right balance of skills, knowledge and experience, formal, rigorous and transparent procedure to appoint new members of the board of directors college; An induction process new board members and regularly update the skills and knowledge, good quality information in a timely manner to provide members of the board of directors; Boardroom changes on a regular basis. college

Second, this is the separation of chairman and chief executive. The top two job board chairman and chief executive. Now, the two jobs can't corporate governance best practice recommendations by the same person. This part is to avoid a person control over an organization, in fact, there has been a scandal in the past when the same person is chairman and chief executive.

Third, it is the independence of the audit committee. Corporate governance recommended best practice is for the organization to establish an independent audit committee, supervision and internal control system and the organization's relationship with external audit. Although this relationship and the suggestion was established in the private sector of the public sector organizations still have relevance. In fact, many public sector organizations have an audit committee.

|

|

|||

| 网站地图 |