|

Be sure that you know how to save to pdf in advance of your submission. Furthermore, you must submit all your responses in one file – do not submit a separate file for each question. The MyUni printing process only prints one file, so if you submit several files then a number of questions will not be printed and, therefore, not marked. The submission time is 11:00pm on Sunday 2nd June 2013. Late assignments will be penalised at a rate of 20% of the achieved mark per day late (or part thereof). Submit via MyUni well in advance of the due time to ensure that you don’t have any problems with submissions. The submission time will be strictly adhered to.

This Assignment must be your own work. Students are reminded of the Business School’s plagiarism policy (as referred to in the course outline) and any occurrences of plagiarism will be dealt with according to School and University policy. Group Assignments are not permitted. 这种作业必须是你自己的工作。学生提醒商学院的剽窃政策(如在课程大纲简称)和剽窃的任何事件将被处理根据学校和大学的政策。小组作业是不允许的。

There is no need to attach a Cover Sheet as your submission is electronic. However, submitting electronically automatically means that you acknowledge that you have complied with the requirements of the plagiarism policies of the University, Faculty and Business School. 有没有必要附上封面为您提交的是电子。然而,电子自动提交意味着你承认你已遵守大学,学院和商学院的剽窃政策的要求。

This assignment will be marked out of 75 marks and this represents 15% of your overall assessment in the course Accounting for Decision Makers I. 这项任务将被标记出来75占分比例的,这代表你的整体评估的15%的课程

QUESTION 1

20 MARKS

Douglas Brands Ltd (DBL) is an ASX listed company which manufactures and sells pet supplies primarily to the Australian market since 1955. The products include veterinary medicines, pet food, pet supplies and accessories as well as operating a chain of boarding kennels called Hotel Kennels (HK) around Australia. DBL has been a very successful operation and as a result has been able to establish a significant share and property portfolio. 道格拉斯品牌有限公司(DBL)为ASX上市的公司,生产和销售宠物用品主要是自1955年以来澳大利亚市场。该产品包括兽药,宠物食品,宠物用品和配件,以及操作寄宿犬舍的链称为酒店狗舍(香港)澳大利亚各地。 DBL一直是非常成功的操作,因此已经能够建立一个显著份额及物业组合。

You have been provided with the following information on DBL and you are required to prepare a fully classified cash flow statement for the year ended 31st December 2012. Unless otherwise stated the events occurred in 2012. 你已获提供有关DBL以下信息,您需要准备一个完全分类现金流量表截至2012年12月31日。除非另有说明,发生在2012年的事件。

1. One of DBLs competitor’s is PetMart Ltd and this company has been struggling over recent years. As a result DBL made an offer to buy the assets of PetMart during the year. The deal negotiated was that DBL would buy all of PetMart’s assets (essentially plant and equipment) for $2,750,000 and an agreement to that affect was signed on the 31st August 2012. This was a good deal for DBL as the value of the assets in PetMart’s latest financial statements was $6,100,000. At the date of signing of the agreement a deposit of $50,000 was paid by DBL. The balance monies are scheduled to be paid when settlement occurs on the 31st January 2013. DBL will fund the purchase by using $1,500,000 of its own funds and the remainder will come from a loan from the HCSB Bank. The HCSB Bank approved the loan on the 31st October 2012 and the monies will be drawn by DBL at settlement.

2. The global financial crisis, several years ago, made DBL look very carefully at its share portfolio. It now trades in shares more often than in previous years. During the year DBL sold a significant parcel of shares for which it received $565,000. DBL had owned these shares for 10 years and originally paid $239,000 for them. During the year DBL also purchased $876,300 worth of shares.

3. Over recent years DBL has been developing a new line of high priced pet food. In 2012 the final formula was approved and the manufacturing process established. On the 1st February 2012 DBL signed an agreement with an engineering firm to build the manufacturing plant. The total cost of this plant was $1,870,000 and all monies were paid during the year, except that 10% was retained until the warranty period expired which was on the 31st January 2013 – there were no problems and the amount retained was then paid.

4. DBL has a long term loan with the FNZ Investment Bank. This original loan principal was $5,000,000 and this was taken out on the 1st January 2010. DBL is required to repay 12.5% of the original loan principal on the 31st December every year. An annual interest payment is also made on the 31st December of every year. The amount of interest is fixed at 5.55%pa and calculated on the principal owing on the 1st January of that year. Interest and principal payments have been made on time.

5. DBL receives dividends on the share investments it has. DBL prefers to collect these dividends via Dividend Reinvestment Plans (DRPs) but some of the companies in which it invests do not provide this facility. During the year DBL received $128,000 in dividends of which $98,000 was from DRPs and the balance in cash.

6. Apart from the buildings DBL owns it also needs to rent some warehousing properties. The rent expense for the year on these properties is $25,000. No amounts were owing from 2011 and all 2012 amounts were paid when due.

7. In addition, and separate to, the properties rented in Item 6 above, DBL signed a lease for a new kennel based property for its HK operations. The lease was signed on the 30th June 2012 at a monthly rental of $2,000 paid in advance. It was a condition of the lease that there was a rent free period of 3 payments. All payments were made by DBL on time.

8. The Directors of DBL want the company to continue growing and to do this they require further capital from its shareholders. Early in 2012 DBL went to its shareholders for $3,000,000 further capital via a share issue. The offer was fully subscribed by the shareholders and four equal instalments were required on the 30th June 2012, 30th November 2012, 31st March 2013 and the 30th April 2013. All amounts were received as required.

9. As a part of ensuring that it has the latest equipment and as a part of its community spirit DBL undertook a number of activities during the year. First, through its HK operations, it determined that it had plant and equipment which was surplus to its needs. It donated this plant and equipment to an animal shelter.

This plant and equipment originally cost DBL $124,000 but had a written down value of $34,000.

Second, DBL is a major sponsor in the annual Trillions Paws Walk and gives a cash donation of $75,000 to the Animal Protection Society. Third, DBL provides research input into one of Australia’s best veterinary schools. In 2012 it provided in-kind services of $43,000 to a research project dealing with the veterinary school.

10. Wages for the year were $4,700,922 and all amounts were paid.

11. DBL is very proud of the amount of dividends which it pays to its shareholders. DBL also offers a DRP to its shareholders of which 60% of shareholders use and the remaining 40% prefer to receive cash dividends. On the 31st August 2012 DBL paid an interim dividend of $80,000. It can only pay its final 2012 final dividend in early 2013 and after all approvals and profit determination has been made. The final dividend is to be $100,000. For 2011 the interim dividend was $60,000 and the final dividend was $75,000 and these payment were made under similar timing and payment arrangements.

12. Sales for the year were $25,878,940 of which 70% were in cash.

13. One of the development properties which DBL owns is vacant land and DBL has received approval from the local authorities for a resubdivision. This will allow DBL to split the land into 20 housing blocks and it believes that it make approximately $10,000,000 profit when the blocks are sold. The costs of resubdivision are estimated to be $3,000,000 and it has sought finance from the GimmeBank to fund this. The GimmeBank approved the finance on the 30th June 2012 and funds were paid into DBL’s account in the following week. Work on the resubdivison is due to start on the 1st February 2013.

14. Apart from the various loan facilities mentioned above, DBL also has an overdraft with the HCSB Bank. The total interest on this for 2012 was $9,876 and this was debited to the overdraft account immediately it was incurred. #p#分页标题#e#

15. Some of the properties which DBL owns are rented to tenants. Total rental income for 2012 was $76,870.

16. Cost of Goods Sold for the year was $7,658,910

17. At various time throughout the year DBL has excess cash which it invests. It received interest of $213,870 on these deposits throughout the year.

18. DBL paid a total of $1,786,900 in income tax during the year. This amount was the aggregate of the individual sums. These were a) $1,545,500 for income tax levied for the 2011/12 income tax year; b) a further $199,925 was paid in relation to the 2008/09 income tax year where an investigation by the Australian Taxation Office showed revealed an understatement of income by DBL and c) total penalties of $41,475 in relation to the understatement of income referred in b) above.

19. Day-to-day operating expenses (apart from those expenses specifically identified herein) amounted to $8,765,230.

20. The Bank Balance at 31st December 2011 was $65,892.

21. Accounts Receivable’s balance at 31st December 2011 was $132,876.

22. Accounts Receivable’s balance at 31st December 2012 was $116,826.

23. Accounts Payable’s balance at 31st December 2011 was $88,651.

24. Accounts Payable’s balance at 31st December 2012 was $89,555.

25. Rent Received in Advance balance at 31st December 2011 was $18,500

26. Rent Received in Advance balance at 31st December 2012 was $14,700

27. Inventory balance at 31st December 2011 was $265,878.

28. Inventory balance at 31st December 2012 was $298,809.

Required

Prepare a properly classified Cash Flow Statement for Douglas Brands Ltd for the year ended 31st December 2012. Note that the Closing Cash Balance at 31st December 2012 is not provided – proper classification and preparation of the Cash Flow Statement will allow you to determine the closing cash balance. (Notes to Cash Flow Statement are not required).

To assist students in understanding the details on this question, the course Discussion Board on MyUni will be open for the period from Monday 29th April 2013 at 9:00am to Friday 3rd May 2013 at 4:30pm. When the time has expired, the Discussion Board will be deleted but during the time the Discussion Board is open, all students will be able to see all postings. Students are able to ask any questions which assist them in understanding or interpreting

ONLY this particular assignment question. The aim of using the Discussion Board is to provide a process that mimics the communication/advisory relationship between a professional and a client - or an employee and manager – it often occurs that information provided needs clarification (which may include queries regarding the correctness of information) or other queries arise and this is the purpose of opening the Discussion Board. Please note that queries will only be answered if the substance of the question addresses ambiguities or areas of clarification on the information provided – this means that not all queries will necessarily be answered – it depends on what is being asked.

BE CAREFUL with the Discussion Board. It has occurred where information posted on the Discussion Board by students is wrong or misleading, either inadvertently or intentionally. You need to critically examine the information provided and make a decision for yourself as to its veracity. Also note that any inappropriate posts will be deleted and if any post contravenes any law or University policy then further action may be taken.

This question is worth 20 marks. One mark will be deducted for each error until zero is reached.

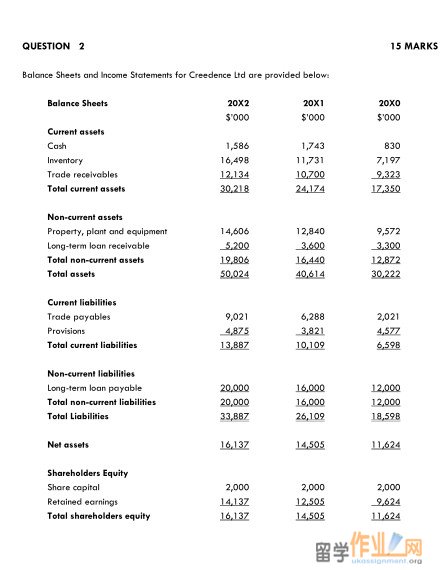

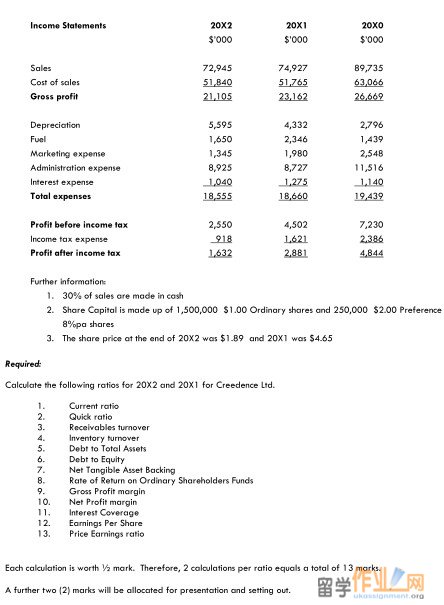

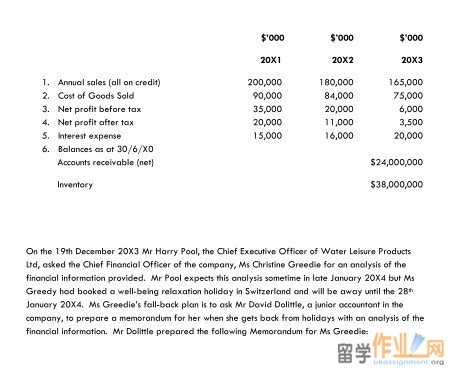

Profitability

The Net Profit margin has been steadily getting worse and is now below the industry average which is of concern. The Gross Profit margin, however, has been reasonably steady and is in excess of the industry average. In analysing the reason for the difference between the Net Profit margin and Gross Profit margin I see that gross sales has slowly been decreasing. This provides an explanation for this difference. In addition we need to make some changes to bring the Gross Profit margin down to the industry average and this will assist in raising the Net Profit margin

The Rate of Return on Shareholders Funds, which indicates the level of dividends paid to shareholders, was very healthy, compared to the industry average, but has slowly decreased. It is now at a very low level and must be of concern to shareholders.

Efficiency

The Debtors Turnover has consistently been above the industry average and this is a good sign. As debtors is related to sales the continued increase in Debtors turnover is a pleasing aspect of the company.

Unfortunately the same cannot be said for the Inventory Turnover. While this ratio was below the industry average it has now moved to be above the industry average and this means that inventory is slowly taking a greater period of time to sell. Of course, the greater the length oftime it takes to sell inventory then this can mean that sales are slower.

Short-term solvency

Similar to the profitability analysis there is some good news here. Both Current and Quick ratios are improving and well above the industry average. Accordingly, we can say that there are no causes whatsoever for concern about Golf Designs ability to pay its short-term debts in the future.

Long-term solvency

Debt to Total Assets indicates the level of our debt (ie what we owe) compared to our assets (ie what our resources are) and the higher that ratio the better. Unfortunately that has been trending lower and is below the industry average.

The Times interest earned is also trending lower and below the industry average. This adds further concerns to the company’s long term financial position.

Summary

Golf Designs Ltd has a mixture of issues. Of most concern is its long term debt position and the company should consider a review of its long term debt. One way of addressing this concern is to shift some of the long term debt to short term debt as the short term debt ratios have the capacity to absorb greater amounts of short term debt.

The main area of concern with the profitability ratios is with sales and as soon as this is addressed then all the profitability ratios will return to normality. Addressing sales will also attend to any issues with the efficiency ratios.

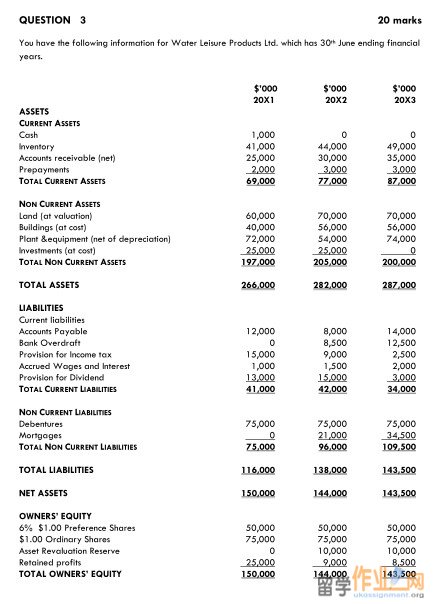

Ms Greedie read Mr Dolittle’s memorandum and she has a few concerns about the contents. She is also now under some pressure to produce the report to Mr Pool. Consequently, Ms Greedie has come to you in your role as the Manager of the Financial Accounting Department in WLP. You have been requested to review Mr Dolittle’s memorandum and provide comments on areas of concern in it. You are, therefore, requested to prepare a further memorandum to Ms Greedie outlining only those areas of Mr Dolittle’s memorandum where you believe clarification or rectification is needed. Time is of the essence for Ms Greedie now so she has asked you to keep your memorandum brief.

Required

Analyse Mr Dolittle’s memorandum provided and write a further memorandum to Ms Greedie addressing only those areas of Mr Dolittle’s memorandum that require clarification or rectification. You have been asked to keep your memorandum brief, so it is limited to 500 words. In preparing your memorandum you should only address the concerns, if any, in the memorandum of Mr Dolittle and not re-write his memorandum.

Allocation of marks

1. Marks will be allocated for the advice you provide in your memorandum. 15 marks

2. Presentation of the memorandum. Marks will be awarded for presentation, professionalism, English and readability.

5 marks

QUESTION 4

20 MARKS

You are the Chief Financial Officer of BigTrans Ltd (BTL) an ASX listed company whose primary activity is operating a fleet of trucks delivering goods around Australia. BTL has been very successful and has earned a high reputation in the industry. The Board of BTL wants to diversify its operations but still maintain a transport focus. As a result the Board has instructed you to investigate the company moving into the aircraft leasing business. The basic premise is: #p#分页标题#e#

BTL wants to buy five planes in three years time

BTL will go to its shareholders now to seek funds, which it will invest for the three years, and which will be used to acquire those planes

On purchase of the planes BTL will enter into lease agreements with airlines for a fixed period of time.

Your basic task is to:

1) calculate the amount which BTL shareholders need to contribute now and

2) to calculate the lease payments payable by an airline on the planes BTL will purchase.

More specific instructions are:

Contribution by shareholders

Funds from shareholders will be sought immediately to acquire the five planes in three years.

These funds will be invested during this three year period. Clearly the funds need to be sufficient so that BTL can wholly purchase the planes at that time. The only cost you have of the planes is in today’s dollars. You estimate that the cost of these planes will increase at the rate of 6%pa during this three year period. The funds to be received from shareholders will be invested in BTL’s bank and interest will be received on those funds. A part of your role is to locate an interest rate typical of that which BTL can expect to receive on such an investment. To do this go to a bank/financial institution website and locate an investment rate for three years (generally you will find this under a title called “Term Deposits”). Assume that interest is payable and reinvested monthly on this investment. It is likely that you won’t find an interest for the size of investment you are looking for – in that event simply take the largest investment amount shown. You need to ensure that the amount of the investment is the same as the purchase price of the aircraft in three years time. You must provide a copy of the website where you located the interest rate.

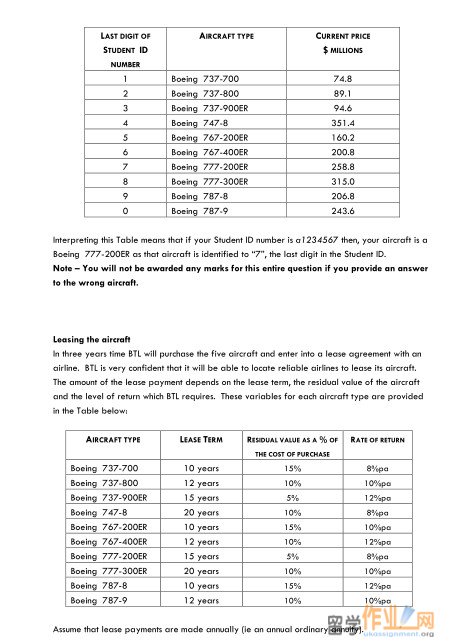

The purchase price of the aircraft depends on the particular model being acquired. BTL wishes to purchase Boeing aircraft and a range of models is provided in the Table below, together with their present cost price. A specific aircraft is allocated to each student and based on a function of the last digit of the student’s ID number.

REQUIRED

Write an informal report using the information above and:

1. Determine the amount of contributions required now by BTL shareholders to fund the purchase of the five aircraft in three years

2. Determine the annual lease payments per aircraft

It is important that you carefully look at the various stages of the question. There are a lot of details and complexities so it is essential that you carefully scrutinise the information, plan the various steps and re-visit your method to ensure that you have captured everything.

Your informal report will need to contain:

A copy of the advertised interest rate for the term deposit you will use

Details that clearly show how you arrived at your various calculations. You can use a financial calculator OR tables of annuities OR a financial mathematical formula OR a website . Do not use any of the calculators provided by financial institutions. Also if you use a financial calculator or an internet site to do calculations then ensure that you know how to use them properly.

Marks will be awarded as follows:

1. You will receive marks for presentation. Your answer should be well written and presented in an easy to understand format. This does not mean that your answer needs to be lengthy – well written answers will be concise while covering the necessary points. Furthermore, you need to include the relevant information requested.

(4 marks)

2. Consideration of the relevant information. The question asks you to research some information and undertake certain tasks. You should state clearly and concisely what you did and how you arrived at your result.

(16 marks)

It is appreciated that there are some parts of this question which may appear unfamiliar. Please keep in mind that you are not been asked to do anything that has not been covered in the course but this question will extend your aptitude. In particular, calculation of the annual lease payment may seem difficult – however carefully examine the nature of the variables and some familiarity with the terms should emerge.

Given the size of the numbers they can remain in millions and you can limit calculations to 2 decimal places.

|

|

|||

| 网站地图 |