|

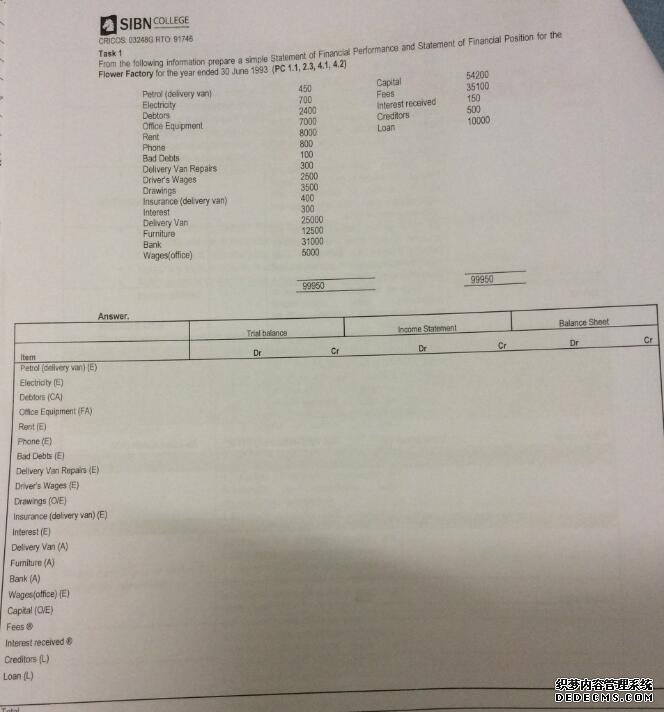

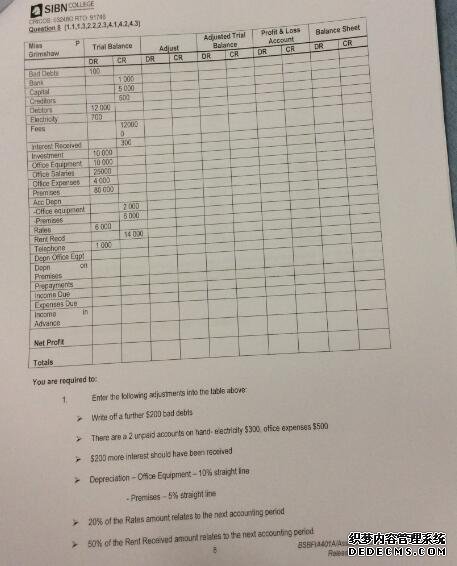

Task 1

Trial balance

Cr: office equipment, petrol, electricity, bad debts, drawings, interest, capital, interest received, creditors, loan.

Dr: rent, phone, delivery van repairs, driver’s wages, insurance, delivery van, furniture, bank, wages, fees,

Income statement:

Dr:creditors,

Cr:petrol, electricity, bad debts,interest,driver’s wages, insurance,bank, wages, fees

Balance sheet:

Dr:capital

Cr:creditors, loan,wages, fees

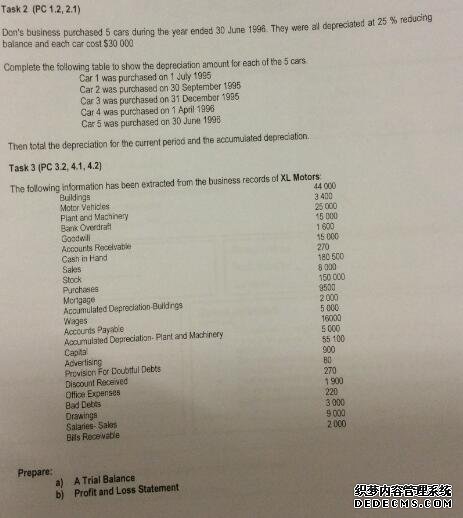

Task 2

Car 1:

Current period: 30000*0.25=7500

Accumulated depreciation 30000

Car 2:

Current period: 30000*0.25*9/12=5625

Accumulated depreciation 30000

Car 3:

Current period: 30000*0.25*6/12=3750

Accumulated depreciation 30000

Car 4:

Current period: 30000*0.25*3/12=1875

Accumulated depreciation 30000

Car 5:

Current period: 0

Accumulated depreciation 30000

Task 3

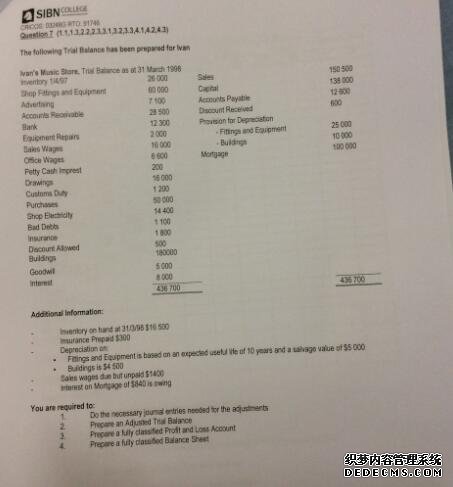

a) A trial balance

Dr buildings 44000

Motor vehicles 3400

Plant and machinery 25000

Goodwill 1600

Accounts receivable 15000

Cash in hand 270

Stock 8000

Purchase 150000

Discount received 270

Advertising 900

Office expenses 1900

Bad debts 220

Salaries 9000

Cr bank overdraft 15000

Sales 180500

Mortgage 9500

Accumulated depreciation-buildings 2000

Wages 5000

Accounts payable 16000

Accumulated depreciation-plant and machinery 5000

Capital 55100

Provision for doubtful debts 80

Drawings 3000

Bills receivable 2000

b) Profit and loss statement

Sales 180500

Purchase 150000

profit 30500

accumulated depreciation 7000

advertising 900

bad debts 220

office expense 1900

20480

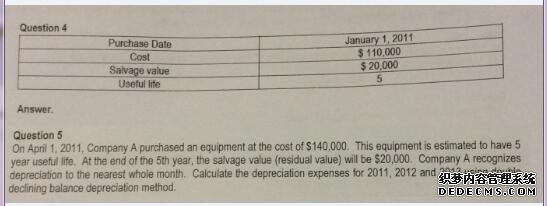

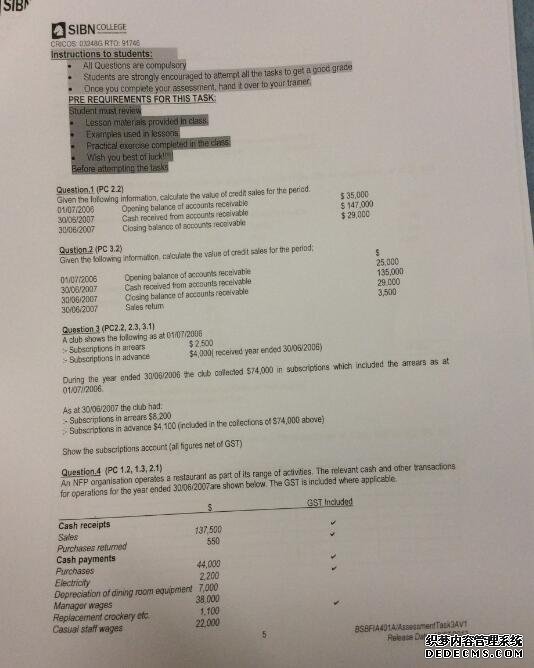

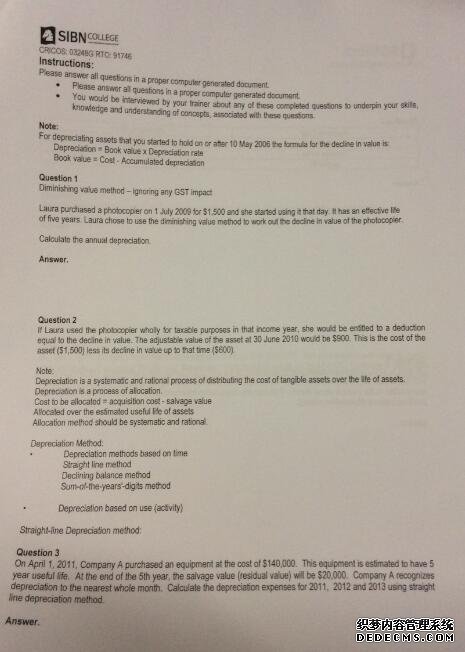

Question 1

1500/5=300

Question 2

First year 600

Four years: (1500-600)/4=225

Question 3

2011: (140000-20000)/5*9/12=18000

2012 and 2013:(140000-20000)/5=24000

Question 5

2011: 140000*20%=28000

2012: (140000-28000)*20%=22400

2013: (140000-28000-22400)*20%=17920

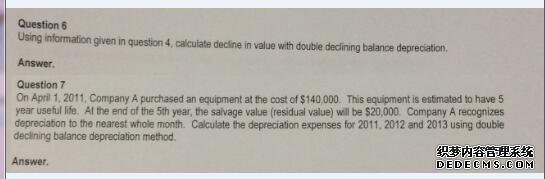

Question 6

2011: 140000-28000=112000

2012: 140000-28000-22400=89600

2013: 140000-28000-22400-17920=71680

Question 7

Same as question 5.

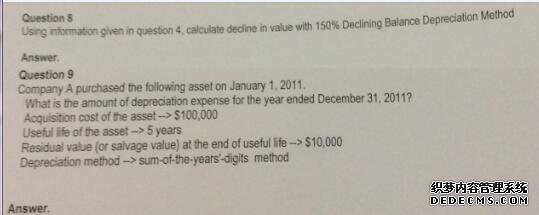

Question 8

2011: 140000*50%=70000

2012: (140000-70000)*50%=35000

2013: (140000-70000-35000)*50%=17500

Question 9

(100000-10000)*1/15=6000

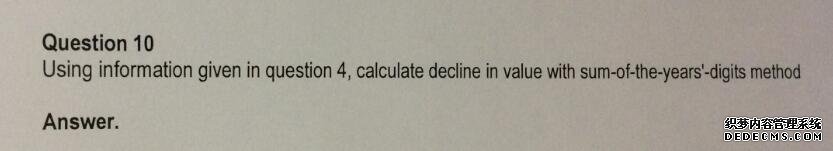

Question 10

100000-6000=94000

Question 1

Closing balance of accounts receivable = opening balance of accounts receivable + value of credit sales– cash received from accounts receivable

Therefore, value of credit sales = $141,000

Question 2

Closing balance of accounts receivable = opening balance of accounts receivable + value of credit sales– cash received from accounts receivable – sales return

Therefore, value of credit sales = $142,500

Question 3

Dr Cr

4100 8200

74000 (4200)

(75600) 4000

2500

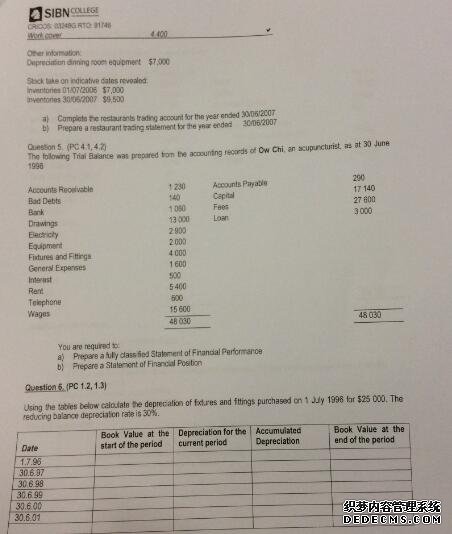

Question 4

a) Trading accounts

Opening inventory 7000

Purchases 44000

Sales 41500

Closing inventory 9500

b) Trading statement

Sales 137500

Purchases 43450 (44000-550)

94050

Electricity 2200

Depreciation 7000

Manager wages 38000

Replacement crockery etc 1100

Casual staff wages 22000

23750

Question 5

Statement of financial position

Assets

Equipment 2000

Fixtures and fittings 4000

Accounts receivable 1230

7230

Bank 1060

8290

Liabilities and equity

Drawings 13000

Accounts payable 290

Capital 17140

Loan 3000

33430

Question 6

25000 7500 7500 17500

17500 5250 12750 12250

12250 3675 16425 8575

8575 2572.5 18997.5 6002.5

6002.5 1800.75 20798.25 4201.75

4201.75 1260.53 22058.78 2941.22

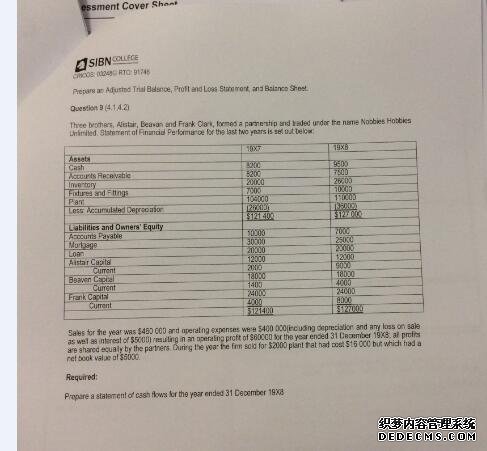

Question 9

Accounts receivable (9500-8200) 1300

Inventory (7500-8200) (700)

Depreciation (36000-26000) 10000

Accounts payable (7000-10000) 3000

Cash generated from operating activities: 13600

Loan (20000-20000) #p#分页标题#e#

Cash generated from investing activities: 0

Cash generated from financial activities:

Sales of plant (2000-5000) (3000)

Opening cash 8200

Closing cash 9500

|

|

|||

| 网站地图 |