|

尽管对小额信贷的研究很多,但仍有出乎意料的小额信贷数据对小额信贷的影响。这一分析集中于小额信贷对家庭消费的影响,并回顾了有关家庭消费和小额信贷可用性之间关系的相关文献。

传统上,小额信贷已被视为通过增加消费来减少贫困的工具。最近的一个思维转变是将小额信贷视为促进消费平滑和建立资产以防范风险的手段,并应对冲击,导致广泛的减贫,而不是普遍的减贫。

1. Introduction 简介

Despite the multitude of studies on microfinance, there still exits surprisingly little hard data on the effects of microcredit. This analysis focuses on the effect of microcredit specifically on household consumption, and reviews relevant literature which addresses the relation between household consumption and availability of microcredit.

Traditionally Microcredit has been studied as a tool of poverty reduction through increase of consumption. A relatively recent shift in thinking has been to consider microcredit as a means to facilitate consumption smoothing and build assets to protect against risks ahead of time and cope with shocks, leading to widespread poverty alleviation but not widespread poverty reduction.

The review is divided into three sections based on the approach used to study the effect of microcredit. The first section examines the works of Pitt & Khandeker and Morduch which use non-experimental methods to make claims of causal identification. This is followed by a look at random evaluation studies performed and discusses their conclusions. The final section introduces “Portfolios of the Poor” by Daryl Collins et al (2009), a descriptive study of the financial activities of the poor.

2. Literature Review 文献综述

2.1 Non-Randomised Approach

The studies by Pitt & Khandeker and Morduch are all based on the 1991-92 cross-sectional survey of nearly 1800 households in Bangladesh served by microfinance programs of the Grameen Bank, the Bangladesh Rural Advancement Committee (BRAC), and the Bangladesh Rural Development Board (BRDB). The sample also includes a control group of households in areas not served by any microfinance programs.

Pitt and Khandeker (1998 A) apply a quasi-experimental design to this data and use a regression-discontinuity design to estimate the marginal impacts of microcredit while distinguishing borrowing by gender. The study obtains the result that “annual household consumption expenditure increases 18 taka for every 100 additional taka borrowed by women as compared with 11 taka for men” and hence concludes that microcredit increases household consumption.

A key to the identification strategy used in this study is the fact that the factors driving credit choice be exogenous. One of these factors is the eligibility of households for credit (eligible if they own less than 0.5 acre). However this factor as noted by Morduch (1998) suffers from considerable mistargeting: overall 20-30% of borrowers own more than the mandated threshold and are actually ineligible. Consequently a criticism of this paper would be that the lax implementation of program rules undermines the application of the regression-discontinuity design.

Morduch (1998) uses simpler estimators as compared to Pitt and Khandeker (1998 A). The study regresses directly on the primary instruments for credit, dummies for credit choice. Morduch measures the average impact of microcredit by first performing simple difference-in-difference estimates and then adding controls.

Contrary to Pitt and Khandeker (1998 A), Morduch (1998) finds no significant effect of microcredit on the level of consumption. He however finds evidence that microcredit causes a decrease in the volatility of consumption (coefficient significant at 95% confidence) and also results in a smoothing of household labour supply (coefficient significant at 90% confidence). He asserts that consumption smoothing by households is driven by income smoothing but does not substantiate this with direct evidence.

The possibility of seasonal consumption smoothing by landless households (primarily engaged in agriculture) through credit is explored by another study by Pitt and Khandeker (1998 B) and is based on data from the same survey as the two papers discussed above. The premise for this investigation is that, microcredit can help smooth seasonal consumption for credit constrained households by financing a new productive activity whose income flows that do not highly covary seasonally with income from agricultural pursuits. The econometric results generated are consistent with Morduch’s assertion of consumption smoothing through income smoothing. The results strongly suggest that an important motivation for credit program participation is the need to smooth the seasonal pattern of consumption and male labour supply. For male labour supply, as with household consumption, it seems that these group-based credit programs i) have a pattern of seasonal effects that act to smooth flows over the seasons, and ii) have a pattern of self-selection in which those households with the experiencing great than average seasonal variation in flows are most likely to join the programs and borrow.

A paper by Morduch and Roodman (2009) revisits the studies by Morduch (1998) and Pitt & Khandekar (1998 B). A replication exercise followed by Two-Stage Least-Squares (2SLS) regression is performed for the two, the result of which casts doubt on the positive results of both. In case of the Pitt and Kandeker finding, the replication generates results with opposite sign. However rather than microcredit being harmful, specification test suggests that the instrumentation strategy fails and that omitted variable causation is driving the result.

As for Morduch rebuilding the data set revealed errors regarding the labour supply variables of the original set. The changes weaken the result on consumption volatility causing the statistic to no longer be significant.

The non-experimental studies discussed above face challenges in establishing causality. A chief problem is that since microfinance clients are self-selected, they are not comparable to non-clients. Also MFIs purposefully choose some villages (non- random program placement) and participants (client selection) and not others. While Difference in Difference estimates can control for fixed differences between clients and non-clients, it is likely that participants in MFIs are on different trajectories even in the absence of Microcredit, invalidating comparisons between clients and non-clients.

2.2 Randomised Evaluation

Given the complexity of the identification problem, randomised evaluations are a viable approach to study the effects of microcredit since it ensures that the difference between residents in the control areas vis-a-vis the treatment areas is the greater ease of access to microcredit.

Banerjee (2010) conducts randomized evaluation of the impact of introducing microcredit in a new market. Half of 104 slums in Hyderabad, India were randomly selected for opening of an MFI branch while the remainder were not. The outcomes in both sets of areas were compared using intent to treat (ITT) estimates; that is, simple comparisons of averages in treatment and comparison areas, averaged over borrowers and non-borrowers.

The results show no impact on average consumption, however the effects observed are heterogeneous and vary between households. Households who have a pre-existing business used microcredit to expand their existing ventures and show a significant increase in durable expenditure in treatment vs control areas. Households without a business but with a high propensity to start a business displayed a significant positive treatment effect on durable spending along with a decrease in non-durable spending. This reduction in nondurables spending could possibly be to facilitate a larger investment than received credit. Finally, household which didn’t have a business and are less likely to start a business showed a significantly large increase in nondurable expenses.

These results are echoed in a study by Crepon et al (2011) who conducted a similar evaluation at the extensive margin to check if the effects of the programs but changed the context to a rural setting in Morocco where both credit and business opportunities are thinner in order to check if the effects of the programs would be different.

As a possible explanation to no evidence of a positive impact of microcredit on consumption being found, the two studies suggest that, the households which increased durable spending may benefit from increased income and hence increased consumption in the future. In other words, the evaluation period may have been too short to capture the gains from investing in enterprise. Furthermore it would also be pertinent to observe whether households which increase non-durable spending and hence consumption continue to do so, given continued access to credit.

2.3 Financial diaries

While looking at the relationship between Microcredit and consumption, a longitudinal survey on how poor households manage money and use financial services would be insightful. The book “Portfolios of the Poor” by Daryl Collins et al (2009) does this by constructing financial diaries for over 250 households, in Bangladesh, India and South Africa. To create a financial diary, a researcher visits a poor household repeatedly, say, every fortnight for a year, and gathers detailed information on transactions conducted by its members since the last visit. Through the data collection and the associated conversations the researcher has with the household, an intimate portrait of the household's financial life is compiled.#p#分页标题#e#

The book emphasises and shows evidence for the assertion that poor households faced with low and variable income look at all financial services to turn small, frequent pay-ins into occasional, large pay-outs and to smooth the mismatch between fluctuating income and steady outflows. Towards this end, MFIs by providing a reliable source of credit is of great help to the poor. However the canonical form of microcredit bears the disadvantage of being too rigid so as to address all credit needs of the poor (expenditure shocks like unexpected health expenses) and hence the household portfolios feature a diverse range of credit sources both formal and informal.

Since they present an intricate picture of the transactions undertaken by the household, financial diaries, and for the purpose of this review the Grameen II financial diaries present a great opportunity to study how microcredit is actually used by the poor. The rest of this section presents a short review presented in the book, in order to give a flavour of the type of inferences which can be drawn from these types of studies.

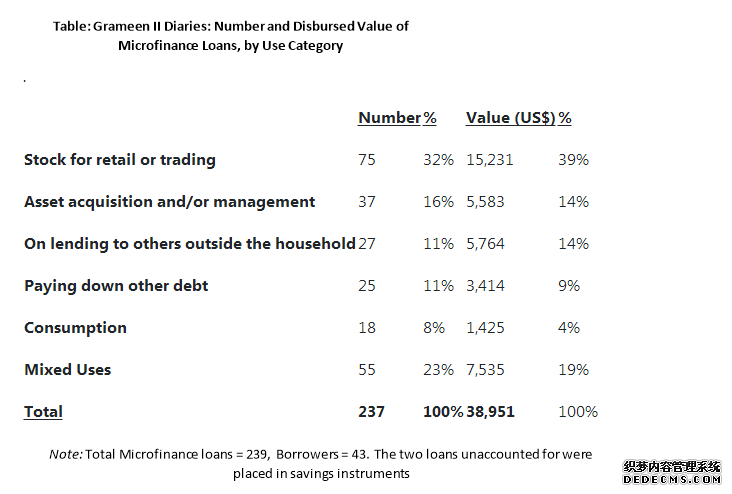

In the following table, 237 loans made by 43 households who were a part of the Grameen II financial diaries are classified into 6 main uses

Taking the first two categories to be productive use of loan, it is observed that roughly half the loans made fell into this category (48% of all loans and 53% of the loan value). This however does not mean that half of the client’s use the credit provided for productive expenses. Of the 43 households in the sample, just 6 were responsible for three quarters of the loan value in the biggest category business and also were recipients of two thirds of the loans issued in this category. These 6 households all have established businesses and borrow to buy stock as often as they are permitted.

From this brief and simple look at the financial diaries we observe that, there is a great diversity to the activities the poor use microfinance for, also there is concentration of some uses among distinct types of users. Further, while investment uses account for more than half the value of loans disbursed, it is concentrated among the relatively well placed borrowers. Finally, the claim can presumably be made that the unproductive uses of loans made by the households are being used for consumption smoothing.

Conclusion 结论

Based on the literature discussed by this review, while the shift to randomised evaluations from non-randomised studies in studying the effect of microcredit is good (considering the relative advantages provided by the former). The effect of microcredit on the consumption levels of households continues to remain ambiguous based on the present academic literature available. Whereas in the case of microcredit inducing consumption smoothing, there simply has not been enough study done exploring this perspective. In order to measure both the effect on both consumption level and consumption smoothing information on money management by poor households is required for many months if not years. The needed time series data can be obtained using the time intensive financial diaries method. Moreover an optimal research portfolio should probably blend the randomised approach with the financial diaries approach.

|

|

|||

| 网站地图 |