|

在国际财务报告准则(IFRS)下,商誉和无形资产必须按照IFRS3在业务组合中单独处理。在IFRS 3之前,公司在业务合并的情况下,可以将无形资产和商誉作为商。

根据国际财务报告准则第3号,收购的无形资产被单独处理为商誉。对于已确认的无形资产,无形资产的价值可以在资产的使用年限上摊销。商誉是指企业在收购过程中支付的价格与资产价值之间的差额。与无形资产不同的是,商誉不能按期摊销,而是需要每年对减值进行重新计量。该损益值可按年度计入损益表中作为费用。这是无形资产与商誉的关键区别。

在获得业务时,兼并公司必须评估相关资产和负债的公允价值,包括一些可辨认的无形资产。这是资产负债表上唯一可以确认的资产。内部创造的无形资产不能在一条直线上摊销,除非资产负债表上的无形资产是有用的预期寿命,否则不能以资产负债表的形式进行摊销。具有无限寿命的无形资产不能以直线为基础摊销,而必须重新计量减值。所有内部创建的无形资产都重新考虑减值,而不管它们是否能够确定资产的有用寿命。

Question 1

Under International Financial Reporting Standards (IFRS), goodwill and intangible assets must be treated separately during a business combination in accordance with IFRS3. Prior to IFRS 3, companies, during a business combination situation, intangible assets and goodwill could be accounted for as goodwill[1].

Under IFRS 3, acquired intangible assets are treated separately to goodwill. With recognised intangible assets, the value of the intangible asset can be amortised over the useful life of the asset. Goodwill is the value difference between the price paid for a business on acquisition and the value of the assets. Unlike intangible assets, goodwill cannot be amortised but needs to be re-measured for impairment, on an annual basis. This impairment value can be included in the income statement as an expense, on an annual basis. This is the critical difference between intangible assets and goodwill[2].

Upon acquiring a business, the acquiring company must assess the fair value of the relevant assets and liabilities including some identifiable intangible assets. This is the only time that these assets can be recognised on the balance sheet. Internally created intangible assets cannot be amortised in a straight line and reduced in this way on the balance sheet unless they are identifiable in terms of a useful life expectancy. Intangible assets that have an indefinite life span cannot be amortised on a straight line basis and must be re-measured for impairment, instead. All internally created intangible assets are re-measured for impairment, regardless of whether or not they are able to ascertain the useful life expectancy of the asset[3].

Goodwill is generally considered as a type of intangible asset; however, for the purposes of IFRS 3, it must be accounted for separately, during a business acquisition, with goodwill never being amortised and intangible assets that can be recognised to have a specific life expectancy can be amortised on a straight line basis. This is not the same for internally created intangible assets which will never be amortised.

Question 2

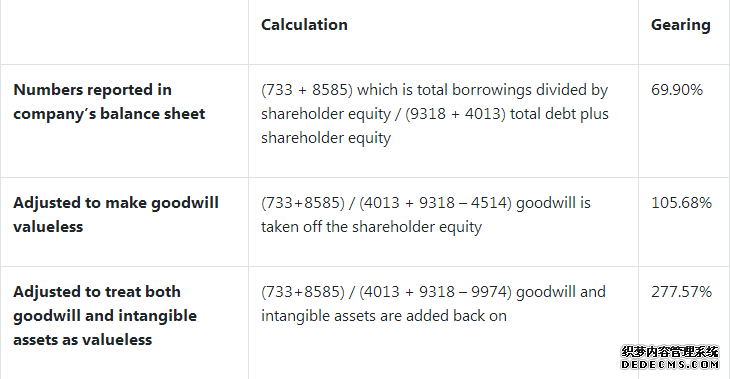

(a) Gearing is calculated by considering the ratio of debt to equity, which is considered as debt divided by capital employed (or debt divided by debt plus shareholder funds). Intangible assets are often added back on to the shareholders’ funds as intangible assets such as goodwill and are a measure of the history of the company and not its current financial strength[4].

The higher the ratio or gearing percentage, the greater the company favours debt over equity. A ratio of 100% would indicate that the company has an equal preference for both the use of equity and debt[5]. Therefore, the higher the percentage the greater the dependence and the greater the perceived financial risk. Shareholders will only obtain a return on their equity once all interest payments have been made. Therefore, the higher the reliance on debt, the more volatile the shareholder earnings are going to be. However, the debt repayment is set and, therefore, the higher the gearing ratio, the greater the risk but also the greater the potential return for the existing shareholders[6].

The figure for Allied Boots, for the purposes of this analysis is 105.68%. Any figure over 100% is considered high, which means that there may be volatility for the shareholders, but the profit growth will also be higher.

In this case, the figure with goodwill ignored, has been used as this takes into account the fact that goodwill is largely a measure of historic value. The reason for this is that goodwill is entirely a reference to historic value generated in the business and should not, therefore, be taken into account as part of the shareholder equity. Intangible assets are continued value generating assets and should, therefore, remain in the calculation. For example, the intangible assets could include intellectual property which continues to add value to the business, whereas goodwill at the point of business acquisition is simply a reflection of the value of the business name at that point; no further value will be generated by virtue of this figure[7].

Question 3

In an entirely efficient market, all analysts will have all relevant information available to them, allowing them to makes suitable adjustments to give them the best possible information in relation to the value of the business. Truly efficient figures imply that all figures within the accounts reflect all known information[8]. However, in reality, markets are not entirely efficient as there is information that is not reflected in the financial data. Financial data, by its very nature, is historic and simply reflects what has happened in the past. Values for intangible assets such as intellectual property and goodwill can vary very quickly and are extremely subjective in nature. Goodwill and intangible assets are often based on information that is not publicly available such as internal know-how and, therefore, cannot be suitably analysed to see how realistic they are; this potentially offers considerable discretion for managers in terms of how these figures are reflected in the accounts[9].

Due to the potential discretion in this area, regulators need to lay down certain treatment rules to ensure that the information being provided by the financial accounts is as close to full, true and fair as is possible. This then allows the analysts to make the most suitable decisions for their chosen position.

|

|

|||

| 网站地图 |