|

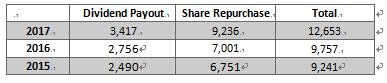

一、按照以下截图要求完成,公司为波音公司,财报我附件里有,除此之外需要用到的数据请到网上查比如Yahoo fanance上查。

Note: The following financial datas are obtained from the Annual Report of Boeing, publicized in the SEC government website.

Investment:

(Source: www.stern.nyu.edu/~adamodar/pc/cfills/BgWACC.xls)

Tax Rate = 34%

Riskless rate to use in CAPM = 9.00%

Current Beta on Stock = 0.95

Risk Premium = 5.50%

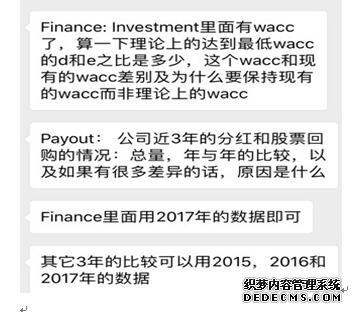

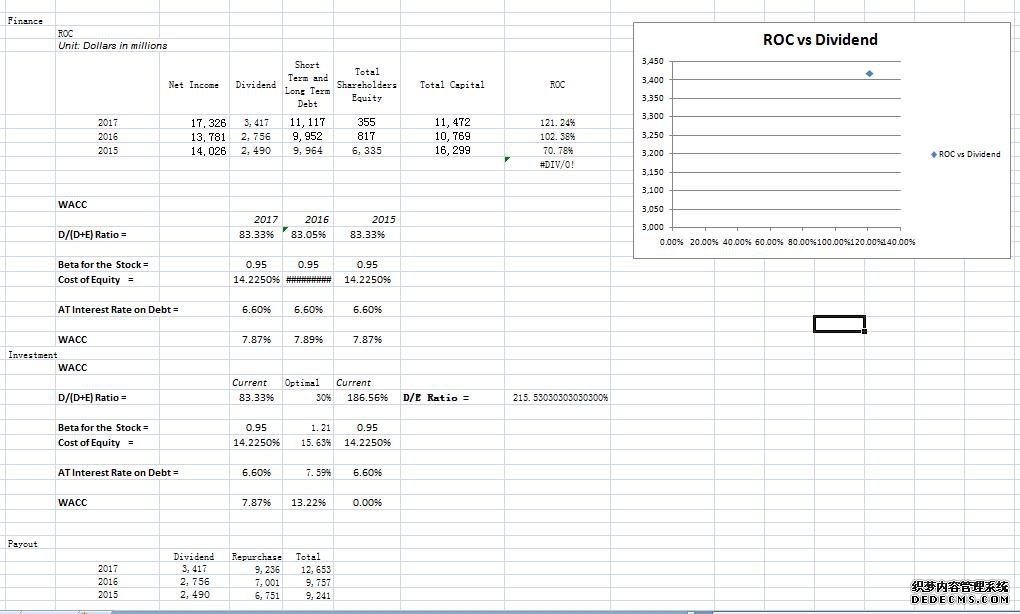

Based on the past year data used in between 2015 to 2017, for Boeing, we can see a general pattern that the ROC is always higher than the WACC.As WACC is a common measurement of the minimum expected weighted average return given the risk level of the future cash flow, a ROC >> WACC is a rule of thumb. We can see that Excess Return = ROC – WACC is always positive and commendable for the year between 2015 to 2017.

(Source: www.stern.nyu.edu/~adamodar/pc/cfills/BgWACC.xls)

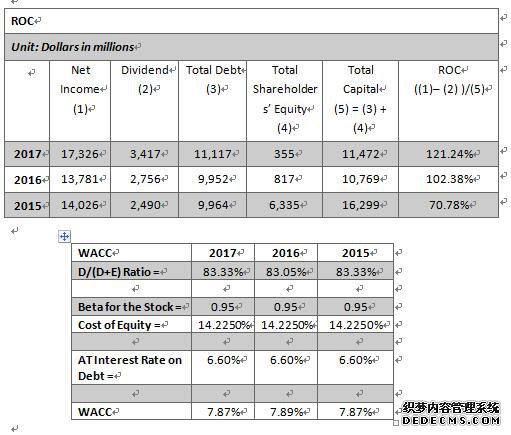

Regression model is performed by AswathDamodaran from the NYU Stern Business School to find the optimal WACC for Boeing. The optimal WACC is obtained through regression model in considering the cost of financing as a function of leverage for Boeing.

We maintain the current WACC instead of the Optimal WACC because the current WACC has a more appropriate capital structure for a capital heavy company like Boeing. Its main capital relies on its Assets which is the plane they are manufacturing and selling.So a higher D/E ratio is acceptable.

Generally speaking, the optimal capital structure is achieved byminimizing the value of the weighted average cost of capital, WACC, and maximizing the value of the firm, D+E. So theoretically speaking, to achieve a minimum WACC value of 0.00%, the optimal D/(D+E) ratio = 186.56%, optimal D/E ratio = 215.53%

Payout

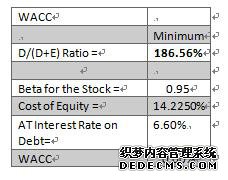

The total cash outflow on financing activities spent on Dividend and Share Repurchase was generally kept in consistent for 2015 and 2016. There is an increase in both the Dividend and Share Repurchase for the year 2017. This is consistent with the increase in Total Income for year 2017 as compared to the past 2 years. A higher Total Income indicates the higher in profitability of Boeing, which is distributed to the shareholders through either the Dividend Payout and Share Repurchase. Ultimately, the decision on the selection of methods between the two depends on the sources of funding, tax statuary requirement, restriction on the issuance of new shares, etc. There are no better off, but more on the suitability and choices by the company.

|

|

|||

| 网站地图 |