|

本文将探讨理性决策过程这一主题。它将解释并定义管理者在组织中实施新项目时将面临的三种决策偏差,进而提出可以实施的策略来克服这些破坏性问题。讨论将以实例加以支持,以帮助以清晰和准确的方式理解这一概念。本文应用Robbins等人提出的“理性决策模型”的定义。“理性决策描述了在特定约束条件下一致且价值最大化的选择。”

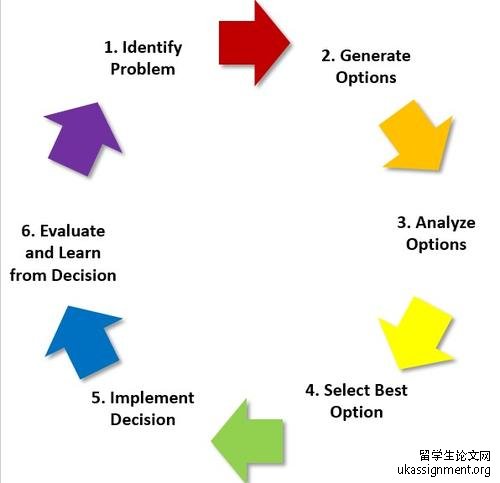

This essay will discuss the topic of the rational decision making process. It will explain and define three decision biases that a manager will face when implementing a new project in an organisation, proceeding to put forward strategies which can be implemented to overcome these undermining issues. The discussion will be supported with examples to aid in the understanding of the concept in a clear and precise manner. This essay applies the definition of the ‘Rational Decision-Making Model’ used by Robbins et al. (2011, p.65) that delineates the rational model of decision making. ‘Rational decision making describes choices that are consistent and value-maximising within specified constraints.’  图:the rational decision making process

理性决策模型的理论解释了“好”决策者做出深思熟虑的决策是向其他人表明决策是明智考虑的结果(Robbins等人,2011年)。理性决策模型的概念是:作为一个管理者,他将是一个完全客观的理性的决策者,他所面临的问题是明确和明确的,决策者的目标是明确和具体的,并且他知道所有可能的选择和后果。还必须假定,在做出管理决策的同时,将组织的最大利益放在首位;所有这些因素都集中在一起,代表了一个理想的情景(Robbins等人,2011年)。

Theory of the rational decision making model explains about ‘good’ decision-makers that make well thought out decisions are showing to others that the decisions are the outcome of intelligent deliberation (Robbins et al, 2011). The concept of the rational decision making model assumes that as a manager one will be a fully objective and a rational decision maker, the problem one is faced with is clear and unambiguous, the decision maker’s goal is clear and specific and that one knows all the possible alternatives and consequences. It also must be assumed that managerial decisions are made while keeping the best interests of the organisation a high priority; all aspects in which come together to represent an ideal scenario (Robbins et al, 2011).

在一个项目的早期阶段,失败的根源就被种下了。正是这种生动性使管理者对项目有信心并相信它会成功。为了使项目看起来对其他人有吸引力,削减了估算成本和时间表,提高了利润估算,直到项目在纸上看起来不错为止(Hodgeson&Drummond 2009)。这往往使企业背负着沉重的债务,因为它们没有足够的储备来资助这一摇摇欲坠的项目。生动性指的是人类倾向于更多地关注丰富多彩的图像(新的令人兴奋的项目),而不是硬的事实。一个人可能会被一股经济上不太理想的热情所吸引,因为它的所有外在吸引力和光芒(Schmidt&Cantanlone 2002)更准确地说,管理者需要简化问题,以便使问题变得有意义。这会导致决策偏差,因为人们会对看似重要的方面付出更多的细节,而忽略了其他潜在的重要信息(Hodgson&Drummond,2009)。

It is early on in the course of a project that the origins of failure are planted. It is vividness that leads a manager to have confidence in the project and believe that it will succeed. In order to make the project look appealing to others, estimated costs and timelines get cut down and profit estimates get scaled up until the project looks good on paper (Hodgson & Drummond 2009). This often leaves businesses burdened with debt as they have not got sufficient reserves to fund the flailing project. Vividness refers to the way in which humans have a tendency to pay more attention to colourful imagery (new exciting projects) than the hard facts. One can become swept along on a wave of enthusiasm that can be economically sub-optimal, for all its exterior appeal and shine (Schmidt & Cantanlone 2002) to be more precise, managers need to simplify problems in order to make sense of them. This leads to decision bias, as one will pay greater detail to the aspects which seemingly look to be of importance; whilst ignoring other potentially significant information (Hodgson & Drummond, 2009).  图:Balancing risk and opportunity According to Bazerman and Moore in their article ‘Emanating from the Confirmation Heuristics’ (2009) ‘Overconfidence is related to conformation heuristics’ (p.37). Overconfidence bias is when a manager believes that they will succeed with a project, because it has been successful in the past. It is also associated with limitations and or biases in information processing (Allen & Evans 2005) Success tends to nurture over-confidence, as it confirms ones capability, as the human mind finds it easier to obtain supportive rather than contradictory evidence (Bazerman & Moore 2009). When one feels competent, it leads them to taking bigger risks as they believe that they are unable to fail. Successful organisations also tend to take bigger risks, according to Allen and Evans (2005) researchers have found that there is propensity for greater overconfidence when decision makers are performing difficult tasks, which is dangerous as research suggest that when doing a risk assessment the ability for one to be fully rational depends on the appetite for risk (Sitkin & Weingart 1995) More specifically, when a manager has a higher propensity for risk taking less risk is perceived than those who have a lower tendency for risk taking. Implying that a manger (with a high propensity for risk taking) will tend to put more emphasis on the positive outcomes of a project rather than the negative aspects. Resulting in a tendency to over-estimate the chance of a gain, relative to the chance of a loss, leaving a distorted perception involving lower risk than is ordinarily suitable (Sitkin & Pablo 1992). Three other factors that trigger overconfidence are: illusion of control, a high commitment for a good outcome, and abstract reference points that make it difficult to compare performance across individual aspects (Malmendier & Tat, 2005).

Once the project is underway, it is feedback that is crucial. Yet feedback is likely to be misleading as information may be limited and variable leading one to the bias Escalation of Commitment. In this circumstance the manager feels one has no choice but to re-invest in the project as there is still a realistic possibility that opportunities will be met. However as time goes on it may become evident through further feedback that the expectations will not be met (Schmidt & Calantone 2002). It is then that the decision maker violates the rational decision making model and rather than search for new alternatives, simply increases one’s commitment to the original decisions leading the project past an economically defendable point (Hodgson & Drummond 2009). It is the sunk costs that many managers forgo, as economics teaches that; sunk costs should not influence one’s future spending in a project as it is an expenditure that cannot influence the outcomes, nor can you get it back.

However decision makers may not see it that way, an emotional attachment can form with the investment and the decision maker does not want to admit that their decisions were flawed. There may also be social pressure which is forcing them to finish the project and not completing the task may be seen as a failure and or a waste. Yet waste is not necessarily a bad thing, a reluctance to gain waste results in sub-optimal decisions being made. It is then that the decision maker becomes trapped because the time it has taken to pursue this project is an investment itself and giving up is no longer a viable option (Hodgson & Drummond 2009).

Janney and Dess (2004) suggest to minimise the effects of vividness one should create categories of potential benefits for the project and continue on to listing all potential benefits in each of the categories. When a benefit is found that does not fit into one of the categories, it must be put aside in a separate category to be deliberated at another point in time in the near future. Intentionally brainstorming to identify previously unconsidered potential benefits that can be gained will increase one’s insight into additional profits and enables managers to think creatively about how to solve specific problems that could arise. Hodgson and Drummond (2009) suggest that constant reality testing should be implemented. This incurs looking at different forms of data and listening to people outside one’s usual persons of reference- in particularly junior staff, as they are more likely to give an honest opinion and a truthful answer about whether a project is destined to fail or succeed rather than their superiors. Hodgson and Drummond (2009) continue on to establish that decision makers whom have been evaluated upon their process rather than the outcome will have less of a tendency to escalate figures to make it more appealing, resulting in a more rational decision.#p#分页标题#e#

Overconfidence as stated previously is the capacity to believe that what succeeded in the past will succeed in the current internal and external environment. One way to minimise overconfidence is to moderate the impact of confirmation heuristics, that is by putting aside the final decision for a while to allow for one’s unconsciousness the chance to select information more empirically for evaluation and to disperse more suitable weights to the relevant characteristics for decision making (Cheng 2010). Angner (2006) suggest two ways in which to overcome overconfidence, the first being providing arguments which contradict the decision maker’s view, specifying reasons as to why they may be wrong. The second involves providing the manager with feedback that is consistent, frequent, prompt and unambiguous so one will not be able to become overconfident in their thinking. It brings them back to reality.

图:管理者理性决策过程的理性决策模型

Hodgson and Drummond (2009) recommend that when feedback suggests that expectations for a new project are unlikely to be met it is when a manager logically needs to promptly reverse any unsatisfactory decision they have made so that escalation to commitment cannot occur. The second remedy Hodgson and Drummond (2009) suggest is that decision makers need to provide an alternative option to mitigate the worst consequences of escalation. For example an immediate exit option may be purchased, where commitments become reversible if specific conditions are not met within a required timeframe. Pan et al. (2006) in their paper ‘Escalation and de-escalation of commitment: a commitment transformation analysis of an e-government project’ suggest four effective ways in which one can turn around a troubled project. Which consist of redefining the project, improved project management, change in the project leadership, and adding and or removing project resources. However, these actions are very effective for project de-escalation, yet it should not be assumed that they can be promptly carried out once negative feedback has been received. Instead it is advised that the project will have to pass through several stages before de-escalation can be successfully carried out. This is because it becomes difficult to suddenly change direction because of the accumulation of commitment within the escalation process.

This essay has discussed the rational decision making model and three biases (Vividness over confidence and escalation of commitment) which can cloud a managers rational decision making process when implementing a new project and what strategies one can apply to optimise the decision making process. The rational decision making model is important so one can make ‘good’ decisions that are well thought out and are the result of intelligent deliberation. Being able to overcome any uncertainties is not a simple process as simply just making decisions under the influence of biases. Bias only exists to prevent decision makers from making fully objective and rational decisions. Managers need to take a step back when making decision and evaluate each uncertainty that arises either by himself or with others. However as much as the rational decision making model tries to eliminate risk one must have risk as it is those decisions that one is most certain about that are of upmost concern.

|

|

|||

| 网站地图 |