|

1.0. TESCO Company Overview公司概览

乐购成立于1919年,TESCO正式在被烧的橡木,在1929年米德尔塞开设了第一家成功的杂货店早。到1990年,TESCO将自身定位为英国领先的零售商,有业务进入市场的其他领域,从一个简单的杂货店的多元化状态,以卖书籍,衣服,互联网服务,金融服务,汽油和跨国零售商即使是在线市场领域(的创新领袖2007)。此外,TESCO是众所周知的创新以及他们痴迷于维持价格低,质量与他们的著名口号“每个小帮助”,在那里他们专注于创新四个重点工程点连贯; “尝试新事物;不自满;正准备改变;并且被确定没有其它业务将实现更多的客户。“(创新领袖2007)

As the 2nd largest retailer in the world, TESCO has built a reputation for itself as an iconic multinational retail business. Founded in 1919, TESCO officially opened its first successful grocery store back in the 1929 at Burnt Oak, Middlesex. By 1990, TESCO has positioned itself as a leading retailer in UK that had a diversified state of operations into other segments of the market, from a simple grocery store to a multinational retailer that sells books, clothes, internet services to financial services, petrol and even an online market segment (Innovative Leaders 2007). Furthermore, TESCO is well known for innovation as well as their obsession to maintaining a low price and quality that works coherently with their well-known slogan ‘Every Little Helps’, where they focus on four focal points on innovation; ‘trying new things; not being complacent; being prepared to change; and being determined that no other business will achieve more for customers.’(Innovation Leaders 2007)

然而,随着全球市场提供了用于生长无限潜力; TESCO的野心是让自己超越的界限,设定其视线与东南亚和东欧市场的出现,国际扩张;在英国的巨大成功,TESCO设法进入全球市场,全球已拥有超过6,784商店在12个国家(乐购2014年)。他们的成功在很大程度上依赖于纳入其业务发展的做法,这TESCO明确列出核心优先事项是嵌入到整个全球范围内他们的商店(乐购2014年),他们所有的业务实践的关键必需品的企业文化,虽然他们一般都是用无数成功世界各地的专卖店,他们也不能幸免于失败。However, as the global market provides limitless potential for growth; TESCO’s ambition was to push beyond the boundaries, setting its sight for international expansion with the emergence of the South-East Asia and Eastern Europe market;with its phenomenal success in the UK, TESCO managed to enter the global market, spanning over 6,784 stores worldwide across 12 countries (TESCO PLC 2014). Their success relies heavily on the corporate culture incorporated into their business development practice, which TESCO clearly outlined core priorities that are key necessities embedded into all their business practices across their stores globally (TESCO PLC 2014), although they are generally successful with a myriad of stores across the world, they are not immune to failure.

In 2011-2012, TESCO was forced to pay £40 million in order toterminate its operations in Japan as they failed to penetrate the market after an eight-year failure from 2003; this is primarily due to the complexity of intercultural differences, in which TESCO stated that it was due to ‘high trade costs and customers’ demands were difficult to meet’ (Wolfestone 2012). Furthermore, during their conquest to build an international empire; TESCO neglected the importance of understanding the targeted market as they failed to compete with local convenience stores with their TESCO Express Format (Telegraph 2012). TESCO was not alone in its fiasco, as there were also other major competitors such as Carrefour from France as well as Walmart from the US; the failure of these multinational retailers has shed some light on the significant cultural differences which drive the difficult economy in Japanbut also as outlines the importance of intercultural exchange that also serves as the driving force to global success.

2.0. The complications of Intercultural Management – Japan vs. UK跨文化管理的并发症:日本与英国

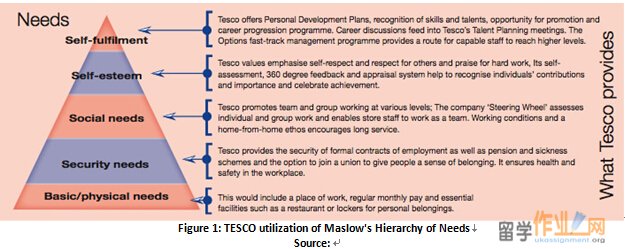

When East and West culture collides, it is inevitable that there would be intercultural conflict among the clash (Morrison 2006). TESCO’s organizational structure is adopted by utilizing Maslow’s hierarchy of needs which analyses individual needs of employees as shown in Figure 1, whereas Japanese organizations stresses the importance of altruism with a mindset towards a more group-orientated and company centered structure where individualism is defined by the social group rather than the individual (Kwintessential 2013). Furthermore, TESCO relies on the innovation of its products and employee growth in a unique way that makes them stand out amongst competitors; although it worked in South Korea, Thailand and other international branches, it was proven to be difficult in the Japanese market given its current difficult economy and vast cultural differences that centers greatly around company growth as a whole rather than individualism.

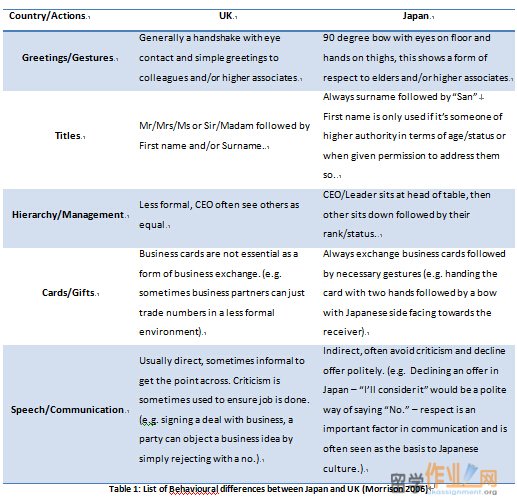

Management styles tend to differ from organizations, particularly in well developed economies; however, the implications of simple gestures, emotions, dressing etc… are part of the many factors that is essential to cultural growth. As depicted in table 1, a list of extensive behavior shows that simple actions can also dictate as a symbol and/or form of ritual from each culture between UK and Japan.

Although these are simple gestures, it can be seen that both cultures have its own unique way to these simple actions that defines their culture. As TESCO retails are generally large with standardized operations, whereas Japanese operates on local businesses that are generally family-owned and/or long-established grocery stores which all offer a unique personal touch (Wolfestone 2012), complications could arise as it would almost impossible to maintain the high standards expected from Japanese customers.

3.0 Competition and Challenges in Japan / Competitive Landscape竞争和挑战日本/竞争格局

Aeon, Ito-Yokado which is also known as 7&I in Japan, Daiei, UNY and FamilyMart are the main retailers that dominating Japanese local grocery retailing industry (IGD, 2013). One thing that is challenging Japanese local grocery retailing market is the increasing pressure from outside investors. Right before Tesco left Japan, Lawson, Walmart and Tesco had huge market share in Japanese grocery industry. Therefore, Japanese local brands are not only facing the competition between domestic brands but also need to face the pressure the incoming investment from internationalized companies.

Another challenge that Japanese grocery retailing industry might meet is the gradually shrinking population. Japan has a mature retailing market so that with the deduction in the number of customers, sales profit will also decrease. Therefore, Japanese entrepreneurs could focus on optimizing their supply chain to reduce the cost and they could also extend their businesses to overseas market like Australia, China and India.

With the booming development in technology, people can easily get information of every products from internet which makes the price of goods become more challenging. Also, shopping through computer and smartphones is getting increasingly popular in young generation. This might impact some traditional Japanese retailers if they could not fit their business with new technologies.

4.0 Management Culture文化管理

The Japanese retailing market is a tough area for not only Tesco but also other retailers including both domestic and globalized brands. One of the biggest challenges for outsiders is the differentiation in management which is deemed to be the essentially reason in result of Tesco’s exit from Japan. The following part will discuss the management in grocery retailing industry regarding with internal and external management in Japan and UK and present a consequence of how Tesco fails their management in Japan.

Management in Japan

Internal Management

Most Japanese local grocery retailers are small stores. This might due to the straining availability of properties and high rent cost in densely inhabited district. Therefore, the management becomes simple but aims to build a strong relationship with customers. One important management issue is the decision making process. In Japanese companies, corporate policy is not clearly defined by the executive leadership. People report the problems they meet in the work to supervisors and receive their response. This process is called “ringisho” and has been adopted by many companies in Japan. Furthermore, in Japanese tradition, the eldest kid in the family always carries on the family business. Therefore, many store within the communities became a family and cultural continuity.

External Management

As claimed by Ahlfeld (2012), customers in Japan prefer high quality products and customer service whereas supermarkets like Tesco are too large in size to provide quality services to Japanese customers which leads to the downstream in competitiveness for Tesco even though their western goods are very popular in Japan.

Furthermore, there are many family owned and long established grocery stores in Japan. Although these stores are small and cannot match supermarkets like Tesco in many areas, but they have a very strong relationship with customers within the community. The foreign business can never build the same relationship with local customers.

Management in UK

To be ranked at the first place in Top 50 UK retailers 2012/13 (Wiggenraad 2014), it is believed that Tesco’s management in UK gained great successful. Tesco’s core operations in UK is concerned with creating products or services which activities are service orientated. One important key for Tesco to achieve competitive advantage in UK is the development of retail high quality with low prices, and experienced customer service which has led the growth in profit growth. With their years of experience and dominance in the market in providing retail products and service, this promotes the corporate image of Tesco to potential customers as one of trustworthiness and quality (UKEssays 2012).

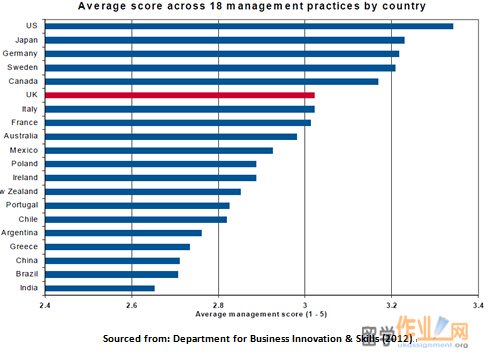

The above figure provided by BIS (2012) shows a comparison in management level and skills between several countries. These scores are stated based on 8,597 management interviews between 2006 and 2010 as a standard of evaluation. It clearly shows that UK is middle ranked and nearly felt 1 point behind Japan in average management level. Therefore, less developed in management skills could also be a cause led Tesco to fail in Japan.

Consequences of Failure

Concluding the findings so far, Tesco’s failure in Japan seems to be destined since they underestimated Japanese grocery retailing market. Firstly, their best - hypermarket operating - was limited in Japan due to issues including land, suppliers and management. Also, underestimating of cultural difference between Japan and UK and lagging behind in management level causes a loss of customers.

5.0 Why Tesco Failed in Japan?为什么在日本失败了

6.0 Benchmark: Other Corporations that Failed in Japan基准:日本其他企业失败

TESCO’s difficulties to survive retail market in Japan were also felt by a number of other western trans-national corporations (TNCs) trying to enter the country’s market, such as Carrefour and Walmart. In the year 2000, the French retailer, Carrefour, became the first major global retailer to open a store in Japan, attracting local communities and media during the first couple of days. Carrefour itself adopts ‘low prices every day’ strategy to promote affordability of its products (Carrefour 2014). The previous experience of the Japanese people toward French brands, however, had been identical to luxurious products, such as Chanel, Louis Vuitton, Hermes, etc, which was on contrary to Carrefour’s low-price strategy (Aoyama 2007). Besides, Aoyama (2007) also mentioned that some products Carrefour tried to offer were overseas items that the Japanese people are not familiar with. These became obstacles for Carrefour to attract the local market and eventually forced the company to incur a huge loss (Nikkei Business 2005).

Similarly, Walmart also tried to enter the Japanese market in 2002 by acquiring 34% share of a Japanese retailer named Seiyu (Aoyama 2007). Seiyu adopts ‘Mainichi Kakaki Yasuku’ strategy which is the Japanese translation of Walmart’s ‘everyday low prices’ motto, similar to Carrefour’s concept (Yamaguchi 2012). Seiyu’s common practice was to put display items in a bulk or in a stack of boxes to increase operational and ordering efficiency. Seiyu’s customers, however, were primarily the elderly or middle-aged people who are not attracted to the display of low-cost bulk items. Japan, as a country where the population is decreasing and growing old, has significant number of customers looking to find experience and entertainment, as well as expecting retailers to add value to their life (Aoyama 2007). Thus, the concept of Seiyu’s low-cost bulk items did not seem to match the expectation of its customers in Japan.

While the idea of Carrefour’s and Seiyu’s low-prices often deemed to be important in retail industry, the characteristics of the Japanese customers tend to be more complex than that. It is true that many customers in Japan regard price as one of the factors that may influence their purchasing decision. However, they tend to regard convenience and after-sales service higher than merely low-price (Aoyama 2007). Moreover, Aoyama (2007) also stated that Japanese customers are more sensitive to product variety, seasonal product changes and new items, as oppose to static types of products normally found on global hypermarkets. Hence, the key for global retailers when entering the Japanese market is to prioritise on localisation rather than standardisation.

7.0 Conclusion总结

References

1. Ahlfeld. C, 2012, ‘Tesco: International Marketing Gone Wrong’, Wolfestone Translation Ltd, viewed 29 September 2014.

2. Aoyama, Y 2007, 'Oligopoly and the structural paradox of retail TNCs: an assessment of Carrefour and Wal-Mart in Japan', Journal of Economic Geography, vol. 7, no. 4, pp. 471-490.

3. Carrefour 2014, 'Major brands and the Carrefour brand at a fair price', Carrefour, viewed 5 October 2014.

4. Department for Business Innovation & Skills 2012, Leadership & management in the uk - the key to sustainable growth, BIS, UK.

5. IGD 2013, Japan – profile, IGD, Australia, viewed 4th October 2014.

6. Kwintessential, ‘Doing Business in Japan’, Kwintessential 2013, viewed 29 September 2014.

7. Morrison. T & Conaway W.A, 2006, ‘Kiss, Bow or Shake Hands’, Masachuettes: Adams Media Corporation

8. Nikkei Business 2005, 'Sekai-ichimuzukashi Nippon no shohisha', Nikkei Business, no. 1287, pp. 129-132.

9. TESCO PLC 2014, ‘Key Facts’, Tesco PLC 2014, viewed 29 September 2014.

10. Tesco PLC 2014, ‘TESCO Company Profile’, Innovation Leaders, viewed 29 September 2014.

11. UKEssays 2013, The operations and competitive advantage of tesco marketing essay, Essays, UK, viewed 5th October 2014.

12. Wallop .H, Wilson. A, 2012, ‘Tesco pays 40 GBP to exit Japan’, The Telegraph UK 2014, viewed 29 September 2014.

13. Wiggenraad, P 2014, Top 50 uk retailers 2012/13, RetailWeek, UK, viewed 5th October 2014.

14. Yamaguchi, Y 2012, 'Japan’s pain is wal-mart’s gain', Bloomberg Businessweek, viewed 5 October 2014.

|

|

|||

| 网站地图 |