|

In this lecture

在本次讲座主要内容:

今天,我们将研究的基本原则为投资评估的最简单的技术(我们可以理解为并发症)

Today we will examine the basic principles of investment appraisal’s simplest techniques (we can save complications for later)

We should cover我们怎样做

What investment appraisal means; and alsoWhy is it done?什么样的投资评估手段,也为什么做呢?

Who is ‘interested’?“关注”是谁?

How is it done?它是如何做到的呢?

Value to investment course?价值投资过程?

Investment appraisal techniques which are taught in terms of individual projects apply equally to the purchase or investment in equity and other financial assets教授在个别项目上的投资评估技术同样适用于购买或投资于股票及其他金融资产

These techniques are widely used in bond markets and in company valuation这些技术被广泛应用于债券市场和公司估值

They therefore underpin the ‘fundamentals’ approach to portfolio investment因此,他们的“基本面”的基础投资组合投资方法

What is Investment Appraisal?投资评估是什么?

Appraise = verb ‘to assess the worth, value or quality’ (Collins English Dictionary)

:. Appraisal = assessment

Investment appraisal is the process of evaluation of an organisation’s various investment opportunities

A series of stages exist, namely: A series of stages exist, namely:

Outline the organisation’s need

Outline available projects

Quantify (or assess – where non-financial)

Flow of costs of each project over time

Flow of benefits from each project over time

Consider the impact of risk and uncertainty on the above

Create a list of results, and consider affordability

Why is Investment Appraisal done?

Investment appraisal attempts to create valuations of potential investment projects in order to help in their comparison

These can then be compared in a ‘ranking’ that helps decision makers

Investment appraisal’s valuation may be purely financial, or may include non-financial benefits as well

Principles Principles

Investments should be evaluated with the organisation’s goals in mind, which may be:

Financial – to maximise shareholder and company value (in the short-term)

Strategic – to maximise the shareholder and company value (in the longer-term)

Social (e.g. in social enterprises)

We will focus on financial cases, but should note that when these exist in combination, clear criteria must be found to help rank the projects’ overall value to the firm in an objective manner

Why is it done?

A range of reasons exist for using investment appraisal techniques, e.g.:

Need to maximise returns on capital in order to

maximise the value of the firm to its shareholders;

compete effectively and

avoid takeover;

Need to find some common procedure for comparison of often quite different competing investments;

Need (on part of managers) to demonstrate objective and profitable decisions over use of funds to all stakeholders

Why is it done? (cont.)

Capital Rationing

In an ideal world, firms have unlimited resources

The firm would then pursue all projects that, on balance, produced net benefits (sometimes called a positive Net Present Value project – see later lectures on NPVs!)

– of course in the real world this is not true, as scarcity exists (and resulting necessary choice) and so only a limited number of projects can be financed: investment appraisal helps us to select the ‘best’ projects to undertake by ranking them objectively, and directing limited capital into those projects

This is called ‘capital rationing’

Who is interested?

A surprising range of ‘stakeholders’ exist that may be interested in investment appraisal, directly or indirectly

Shareholders (whose returns depend on it)

Managers

Employees (whose jobs depend on uses)

Potential investors (in stock exchanges etc.)

Government (particularly regarding tax)

Regulators (e.g. LSE listed firms must demonstrate good governance)

How is it done?

A wide variety of techniques exist for investment appraisal

Historically two simple techniques were used, namely

Accounting rate of return (see Collier)

Payback period (see Lumby & Jones)

More recent discounted cash flow techniques - Time value of money and ‘Net Present Value’ calculations

Net Present Value

Internal rate of return

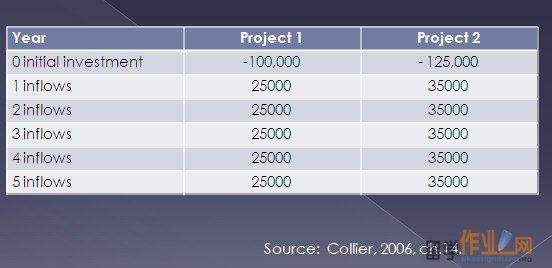

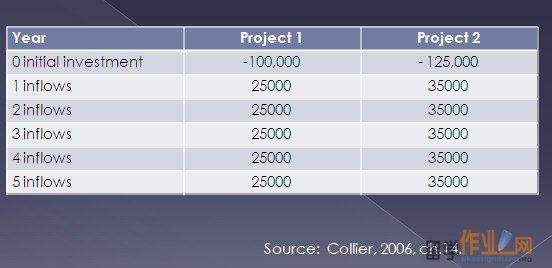

A couple of projects…

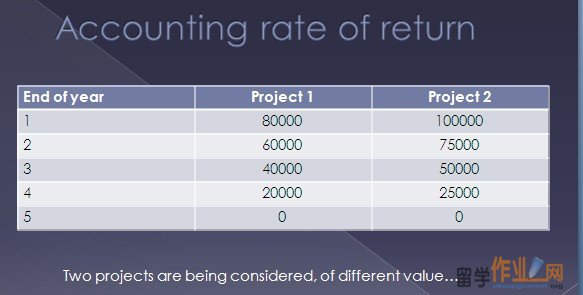

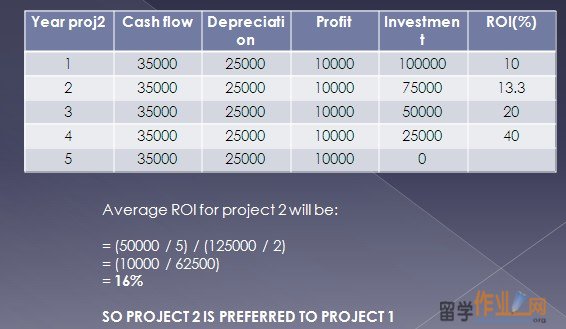

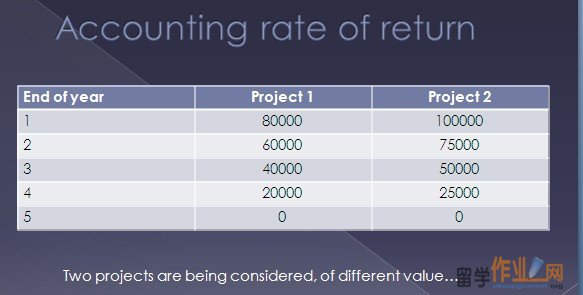

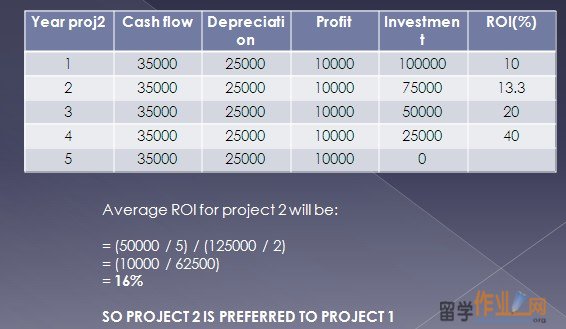

Accounting rate of return

Accounting rate of return is simply the profit generated as a percentage of the investment amount (Collier, p.220) or ‘Return on Investment’ - This is calculated as

Total profits / no. of years

Initial investment / 2

The bottom line assumes ‘straight line depreciation’ occurs over the project, so that the effective annual investment is its average – which is (initial investment / 2).

Accounting rate of return

Problems with this?

It is the highest return, but the assessment fails to take account of the fact that:

It is a larger investment than project 1

It has fairly volatile returns in each particular year

WE may therefore prefer other methods!

Payback Period

Payback period, rather than looking at the rate of return, looks at the speed of return

This may be a good or a bad thing!

可能是可取的风险(如何快速的回报,这样的速度有多快,我们留在债务等。)允许企业在不确定的时代,但

也可以鼓励过多的短期态度

这可能更喜欢至少风险的项目,但忽略回收期日期项目付款后,这可能是相当大的!

May be preferable in firms in uncertain times as allows for risk (how fast is payback, so how fast do we remain in debt, etc..), but

May also encourage too much of a short-term attitude

This may prefer the least-risky project, but ignores project payments after payback date, which may be considerable!!

Payback Period in our example

In examining our projects

Project 1 outlay = £100,000

At payback of 25000 per year, this will be repaid in 4 years (4 x 25000 = 100000)

Project 2 outlay = £125000

At payback of 35000 per year this will be more than repaid in less than 4 years

3 years gives 3 x 35000 = 105000

And then (20000 / 35000) x 1 year = 0.57

So total = 3.57 years

AGAIN WE SELECT PROJECT 2!

Internal rate of return

To tackle the next method, we need a few more ‘building blocks’

Examining returns over time is complicated by the fact that money is worth different amounts according to when it is paid – e.g. would you prefer £1 now or £1 in 1 year’s time?

If we recognise that money has a cost of holding… i.e. there is a specific time value for money, we need to consider a ‘discount rate’… just how much less is the pound worth in 1 year’s time?

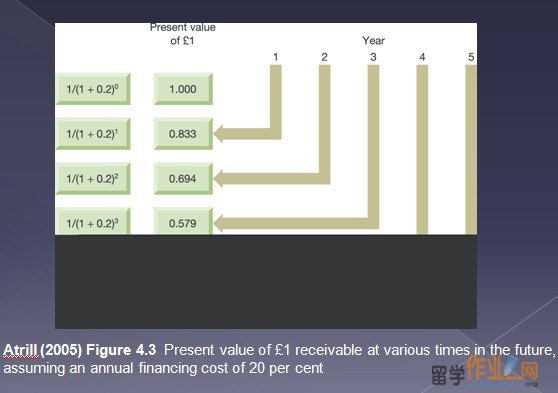

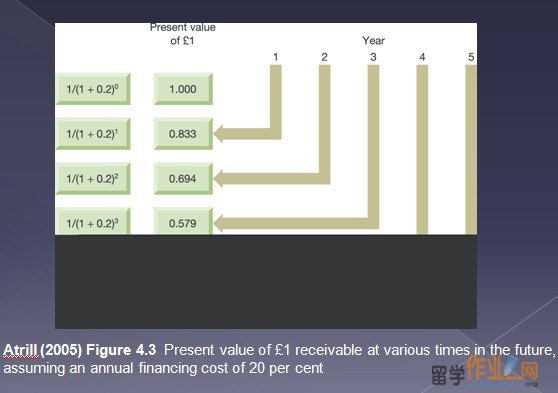

Present Value

The PRESENT VALUE of a FUTURE PAYMENT is equal to its NOMINAL MONETARY VALUE x APPROPRIATE DISCOUNT FACTOR

To start with, think of the implications of being able to get interest on money paid now…

E.g. say our £1 could earn 5% interest in a year –so £1 today could get £1.05 in 1 year.

FV = PV x (1+i)ⁿ or £1.05 = £1 x (1+0.05)¹

What???

Definitions…

FV = Future value at time ‘n’

PV = Present value

i = return (where 5% = 0.05, 10% = 0.1, etc.)

n = number of time periods

And if we need to use it,

DF = Discount factor, which uses i as a ‘discount rate’

So… Present Values

If we know that:

FV = PV x (1+i)ⁿ

Then we can work out that:

PV = FV / (1+i)ⁿ

In this case, where the future value is £1 in 1 year, and we know we could get interest of 5%, then

PV = FV / (1+i)ⁿ = £1 / (1+0.05)¹ = £(1/1.05)

So Present value = £0.952

In this example, we would say that we used 5% as a ‘discount rate’ to calculate the present value

The ‘discount factor’ was:

1 / (1+0.05) or more generally DF = 1 / (1+i)ⁿ

Net Present Value

As projects tend to involve costs and benefits over a series of years, the project is evaluated using a total present value calculation known as the ‘Net Present Value’ or ‘NPV’

NPV = ∑t=1 to n [ Rt / (1+ i)t ]

Where

Rt = NET RETURN (BENEFITS – COSTS) in period t.

Sources

Arnold, Chapter 3

Lumby & Jones, Chapter 3

Collier, P. (2006) Accounting for Managers. (2nd ed., Wiley) Ch.14

|

A series of stages exist, namely:

A series of stages exist, namely:

Principles

Principles