|

法国assignment指导-法国核电事业-Nuclear Power in France由指导assignment事业部提供文本资料(Updated December 2010)

l France derives over 75% of its electricity from nuclear energy. This is due to a longstanding

policy based on energy security.

l France is the world's largest net exporter of electricity due to its very low cost of

generation, and gains over EUR 3 billion per year from this.

l France has been very active in developing nuclear technology. Reactors and fuel

products and services are a major export.

l It is building its first Generation III reactor and planning a second.

l About 17% of France's electricity is from recycled nuclear fuel.

In 2007 French electricity generation was 570 billion kWh gross, and consumption was about 447

billion kWh - 6800 kWh per person. Over the last decade France has exported 60-80 billion kWh

net each year and EdF expects exports to continue at 65-70 TWh/yr, to Belgium, Germany, Italy,

Spain, Switzerland and UK. Imports are relatively trivial.

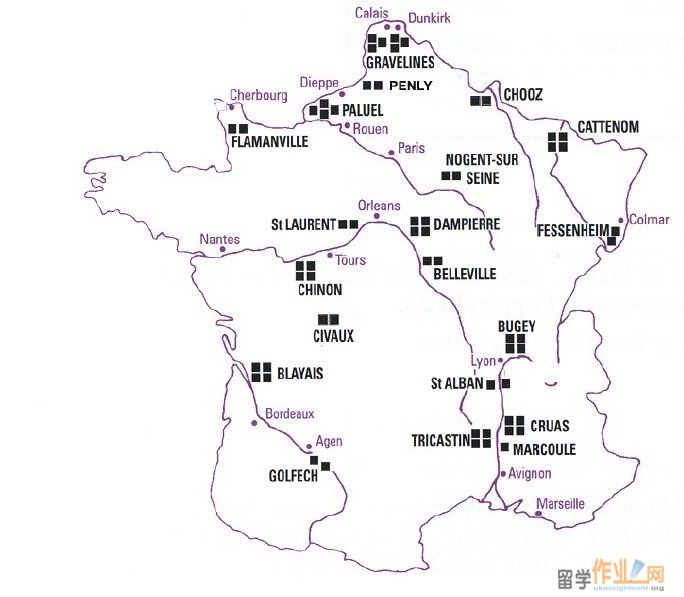

France has 59 nuclear reactors operated by Electricite de France (EdF), with total capacity of over

63 GWe, supplying over 430 billion kWh per year of electricity (net), 78% of the total generated

there. Total generating capacity is 116 GWe, including 25 GWe hydro and 26 GWe fossil fuel.

The present situation is due to the French government deciding in 1974, just after the first oil shock,

to expand rapidly the country's nuclear power capacity. This decision was taken in the context of

In 2007 French electricity generation was 570 billion kWh gross, and consumption was about 447

billion kWh - 6800 kWh per person. Over the last decade France has exported 60-80 billion kWh

net each year and EdF expects exports to continue at 65-70 TWh/yr, to Belgium, Germany, Italy,

Spain, Switzerland and UK. Imports are relatively trivial.

France has 59 nuclear reactors operated by Electricite de France (EdF), with total capacity of over

63 GWe, supplying over 430 billion kWh per year of electricity (net), 78% of the total generated

there. Total generating capacity is 116 GWe, including 25 GWe hydro and 26 GWe fossil fuel.

The present situation is due to the French government deciding in 1974, just after the first oil shock,

to expand rapidly the country's nuclear power capacity. This decision was taken in the context of

France having substantial heavy engineering expertise but few indigenous energy resources.

Nuclear energy, with the fuel cost being a relatively small part of the overall cost, made good sense

in minimising imports and achieving greater energy security.

As a result of the 1974 decision, France now claims a substantial level of energy independence

and almost the lowest cost electricity in Europe. It also has an extremely low level of CO2 emissions

per capita from electricity generation, since over 90% of its electricity is nuclear or hydro.

In mid 2010 a regular energy review of France by the International Energy Agency urged the country

increasingly to take a strategic role as provider of low-cost, low-carbon base-load power for the

whole of Europe rather than to concentrate on the energy independence which had driven policy

since 1973.

Recent energy policy

In 1999 a parliamentary debate reaffirmed three main planks of French energy policy: security of

supply (France imports more than half its energy), respect for the environment (especially re

greenhouse gases) and proper attention to radioactive waste management. It was noted that

natural gas had no economic advantage over nuclear for base-load power, and its prices were very

volatile. Despite "intense efforts" there was no way renewables and energy conservation measures

could replace nuclear energy in the foreseeable future.

Early in 2003 France's first national energy debate was announced, in response to a "strong

demand from the French people", 70% of whom had identified themselves as being poorly

informed on energy questions. A poll had shown that 67% of people thought that environmental

protection was the single most important energy policy goal. However, 58% thought that nuclear

power caused climate change while only 46% thought that coal burning did so. The debate was to

prepare the way for defining the energy mix for the next 30 years in the context of sustainable

development at a European and at a global level.

In 2005 a law established guidelines for energy policy and security. The role of nuclear power is

central to this, along with specific decisions concerning the European Pressurised Water Reactor

(EPR), notably to build an initial unit so as to be able to decide by 2015 on building a series of

about 40 of them. It also set out research policy for developing innovative energy technologies

consistent with reducing carbon dioxide emissions and it defined the role of renewable energies in

the production of electricity, in thermal uses and transport.

In 2008 a Presidential decree established a top-level council on nuclear energy, underlining the

importance of nuclear technologies to France in terms of economic strength, notably power supply.

It will be chaired by the President and include prime minister as well as cabinet secretaries in

charge of energy, foreign affairs, economy, industry, foreign trade, research and finance. The head

of the Atomic Energy Commission (CEA), the secretary general of national defence and the military

chief of staff will also sit on the council.

In May 2006 the EdF board approved construction of a new 1650 MWe EPR unit at Flamanville,

Normandy, alongside two existing 1300 MWe units. The decision was seen as "an essential step

in renewing EDF's nuclear generation mix". After considerable preparatory work first concrete was

poured on schedule in December 2007 and construction was expected to take 54 months.

However, completion is now expected late in 2012.

Under a 2005 agreement with EdF the Italian utility ENEL was to have a 12.5% share in the

Flamanville-3 plant, taking rights to 200 MWe of its capacity and being involved in design,

Nuclear_Power_in_France

importance of nuclear technologies to France in terms of economic strength, notably power supply.

It will be chaired by the President and include prime minister as well as cabinet secretaries in

charge of energy, foreign affairs, economy, industry, foreign trade, research and finance. The head

of the Atomic Energy Commission (CEA), the secretary general of national defence and the military

chief of staff will also sit on the council.

In May 2006 the EdF board approved construction of a new 1650 MWe EPR unit at Flamanville,

Normandy, alongside two existing 1300 MWe units. The decision was seen as "an essential step

in renewing EDF's nuclear generation mix". After considerable preparatory work first concrete was

poured on schedule in December 2007 and construction was expected to take 54 months.

However, completion is now expected late in 2012.

Under a 2005 agreement with EdF the Italian utility ENEL was to have a 12.5% share in the

Flamanville-3 plant, taking rights to 200 MWe of its capacity and being involved in design,

construction and operation of it. However, early in 2007 EdF backed away from this and said it

would build the plant on its own and take all of the output. Nevertheless, in November 2007 an

agreement was signed confirming the 12.5% ENEL investment in Flamanville - expected to cost

EUR 450 million - plus the same share of another five such plants. The agreement also gives EdF

an option to participate in construction and operation of future ENEL nuclear power plants in Italy or

elsewhere in Europe and the Mediterranean.

In January 2006 the President announced that the Atomic Energy Commission (CEA)* was to

embark upon designing a prototype Generation IV reactor to be operating in 2020, bringing forward

the timeline for this by some five years. France has been pursuing three Gen IV technologies: gascooled

fast reactor, sodium-cooled fast reactor, and very high temperature reactor (gas-cooled).

While Areva has been working on the last two types, the main interest in the very high temperature

reactors has been in the USA, as well as South Africa and China. CEA interest in the fast reactors

is on the basis that they will produce less waste and will better exploit uranium resources, including

the 220,000 tonnes of depleted uranium and some reprocessed uranium stockpiled in France.

* Now the Commission of Atomic and Alternative Energy

If the CEA embarks on the sodium-cooled design, there is plenty of experience to draw on - Phenix

and Superphenix - and they could go straight to a demonstration plant - the main innovations would

be dispensing with the breeding blanket around the core and substituting gas for water as the

intermediate coolant. A gas-cooled fast reactor would be entirely new and would require a small

prototype as first step - the form of its fuel would need to be unique. Neither would operate at a high

enough temperature for hydrogen production, but still CEA would participate in very high

temperature R&D with the USA and east Asia.

In December 2006 the government's Atomic Energy Committee decided to proceed with a

Generation IV sodium-cooled fast reactor prototype whose design features are to be decided by

2012 and the start up aimed for 2020. A new generation of sodium-cooled fast reactor with#p#分页标题#e#

innovations intended to improve the competitiveness and the safety of this reactor type is the

reference approach for this prototype. A gas-cooled fast reactor design is to be developed in

parallel as an alternative option. The prototype will also have the mission of demonstrating

advanced recycling modes intended to improve the ultimate high-level and long-lived waste to be

disposed of. The objective is to have one type of competitive fast reactor technology ready for

industrial deployment in France and for export after 2035-2040. The prototype, possibly built near

Phenix at Marcoule, will be 250 to 800 MWe and is expected to cost about EUR 1.5 to 2 billion and

come on line in 2020. The project will be led by the CEA.

Economic factors

France's nuclear power program has cost some FF 400 billion in 1993 currency, excluding interest

during construction. Half of this was self-financed by Electricité de France, 8% (FF 32 billion) was

invested by the state but discounted in 1981, and 42% (FF 168 billion) was financed by commercial

loans. In 1988 medium and long-term debt amounted to FF 233 billion, or 1.8 times EdF's sales

revenue. However, by the end of 1998 EdF had reduced this to FF 122 billion, about two thirds of

sales revenue (FF 185 billion) and less than three times annual cash flow. Net interest charges had

dropped to FF 7.7 billion (4.16% of sales) by 1998.

In 2006 EdF sales revenue was EUR 58.9 billion and debt had fallen to EUR 14.9 billion - 25% of

this.

Nuclear_Power_in_France

come on line in 2020. The project will be led by the CEA.

Economic factors

France's nuclear power program has cost some FF 400 billion in 1993 currency, excluding interest

during construction. Half of this was self-financed by Electricité de France, 8% (FF 32 billion) was

invested by the state but discounted in 1981, and 42% (FF 168 billion) was financed by commercial

loans. In 1988 medium and long-term debt amounted to FF 233 billion, or 1.8 times EdF's sales

revenue. However, by the end of 1998 EdF had reduced this to FF 122 billion, about two thirds of

sales revenue (FF 185 billion) and less than three times annual cash flow. Net interest charges had

dropped to FF 7.7 billion (4.16% of sales) by 1998.

In 2006 EdF sales revenue was EUR 58.9 billion and debt had fallen to EUR 14.9 billion - 25% of

this.

The cost of nuclear-generated electricity fell by 7% from 1998 to 2001 to about EUR 3 cents/kWh,

which is very competitive in Europe. The back-end costs (reprocessing, wastes disposal, etc) are

fairly small when compared to the total kWh cost, typically about 5%.

EdF early in 2009 estimated that its reactors provide power at EUR 4.6 cents/kWh and the energy

regulator CRE puts the figure at 4.1 c/kWh. The weighted average of regulated tariffs is EUR 4.3

c/kWh. Power from the new EPR units is expected to cost about EUR 5.5 to 6.0 c/kWh.

From being a net electricity importer through most of the 1970s, France now has steadily growing

net exports of electricity, and is the world's largest net electricity exporter, with electricity being

France's fourth largest export. (Next door is Italy, without any operating nuclear power plants. It is

Europe's largest importer of electricity, most coming ultimately from France.) The UK has also

become a major customer for French electricity.

France's nuclear reactors comprise 90% of EdF's capacity and hence are used in load-following

mode and are even sometimes closed over weekends, so their capacity factor is low by world

standards, at 77.3%. However, availability is almost 84% and increasing.

Reactor engineering and new build

The first eight power reactors were gas-cooled, as championed by the Atomic Energy Authority

(CEA), but EdF then chose pressurised water reactor (PWR) types, supported by new enrichment

capacity.指导assignment事业部提供文本资料

All French units are now PWRs of three standard types designed by Framatome - now Areva NP

(the first two derived from US Westinghouse types): 900 MWe (34), 1300 MWe (20) and 1450

MWe N4 type (4). This is a higher degree of standardisation than anywhere else in the world.

(There have been two fast reactor - Phenix which ran for over 30 years, and Super Phenix, which

was commissioned but then closed for political reasons.)

Licence renewal: The 900 MWe reactors all had their lifetimes extended by ten years in 2002,

after their second 10-yearly review. Most started up late 1970s to early 1980s, and they are

reviewed together in a process that takes four months at each unit. A review of the 1300 MWe class

followed and in October 2006 the regulatory authority cleared all 20 units for an extra ten years'

operation conditional upon minor modifications at their 20-year outages over 2005-14. The 3rd

ten-year inspections of the 900 MWe series began in 2009 and run to 2020. The 3rd ten-year

inspections of the 1300 MWe series run from 2015 to 2024.

In July 2009 the Nuclear Safety Authority (ASN) approved EdF's safety case for 40-year operation

of the 900 MWe units, based on generic assessment of the 34 reactors. Each individual unit will

now be subject to inspection during their 30-year outage, starting with Tricastin-1. In December

2010 ASN extended its licence by ten years, to 2020.

In July 2010 EdF said that it was assessing the prospect of 60-year lifetimes for all its existing

reactors. This would involve replacement of all steam generators (3 in each 900 MWe reactor, 4 in

each 1300 MWe unit) and other refurbishment, costing EUR 400-600 million per unit to take them

beyond 40 years. EdF is currently replacing steam generators at two units per year, and plans to

increase this to three units in 2016.

Uprates: In the light of operating experience, EdF uprated its four Chooz and Civaux N4 reactors

Nuclear_Power_in_France

In July 2009 the Nuclear Safety Authority (ASN) approved EdF's safety case for 40-year operation

of the 900 MWe units, based on generic assessment of the 34 reactors. Each individual unit will

now be subject to inspection during their 30-year outage, starting with Tricastin-1. In December

2010 ASN extended its licence by ten years, to 2020.

In July 2010 EdF said that it was assessing the prospect of 60-year lifetimes for all its existing

reactors. This would involve replacement of all steam generators (3 in each 900 MWe reactor, 4 in

each 1300 MWe unit) and other refurbishment, costing EUR 400-600 million per unit to take them

beyond 40 years. EdF is currently replacing steam generators at two units per year, and plans to

increase this to three units in 2016.

Uprates: In the light of operating experience, EdF uprated its four Chooz and Civaux N4 reactors

from 1455 to 1500 MWe each in 2003. Over 2008-10 EdF plans to uprate five of its 900 MWe

reactors by 3%. Then in 2007 EdF announced that the twenty 1300 MWe reactors would be

uprated some 7% from 2015, within existing licence limits, and adding about 15 TWh/yr to output.

France has exported its PWR reactor technology to Belgium, South Africa, South Korea and China.

There are two 900 MWe French reactors operating at Koeberg, near Capetown in South Africa,

two at Ulchin in South Korea and four at Daya Bay and Lingao in China, near Hong Kong.

French nuclear power reactors

Differences in net power among almost identical reactors is usually due to differences in cold

sources for cooling

Framatome in conjunction with Siemens in Germany then developed the European Pressurised

Water Reactor (EPR), based on the French N4 and the German Konvoi types, to meet the

European Utility Requirements and also the US EPRI Utility Requirements. This was confirmed in

1995 as the new standard design for France and it received French design approval in 2004.

In mid 2004 the board of EdF decided in principle to build the first demonstration unit of an

expected series of 1650 MWe Areva NP EPRs, and this decision was confirmed in May 2006,

after public debate. The overnight capital cost or construction cost was expected to be €3.3 billion

in 2005 Euros (€3.55 billion in 2008 Euros), and power from it EUR 4.6 c/kWh - about the same as

from new combined cycle gas turbine at 2005 gas prices and with no carbon emission charge.

Series production costs are projected at about 20% less. EDF then submitted a construction

licence application. The Flamanville 3 unit is to be 4500 MWt, 1750 MWe gross (at sea

temperature 14.7°C) and 1630 MWe net.

Class Reactor MWe net, each Commercial operation

900 MWe Blayais 1-4 910 12/81, 2/83, 11/83, 10/83

Bugey 2-3 910 3/79, 3/79

Bugey 4-5 880 7/79-1/80

Chinon B 1-4 905 2/84, 8/84, 3/87, 4/88

Cruas 1-4 915 4/84, 4/85, 9/84, 2/85

Dampierre 1-4 890 9/80, 2/81, 5/81, 11/81

Fessenheim 1-2 880 12/77, 3/78

Gravelines B 1-4 910 11/80, 12/80, 6/81, 10/81

Gravelines C 5-6 910 1/85, 10/85

Saint-Laurent B 1-2 915 8/83, 8/83

Tricastin 1-4 915 12/80, 12/80, 5/81, 11/81

1300 MWe Belleville 1 & 2 1310 6/88, 1/89

Cattenom 1-4 1300 4/87, 2/88, 2/91, 1/92

Flamanville 1-2 1330 12/86, 3/87

Golfech 1-2 1310 2/91, 3/94

Nogent s/Seine 1-2 1310 2/88, 5/89

Paluel 1-4 1330 12/85, 12/85, 2/86, 6/86

Penly 1-2 1330 12/90, 11/92

Saint-Alban 1-2 1335 5/86, 3/87

N4 - 1450 MWe Chooz B 1-2 1500 12/96, 1999

Civaux 1-2 1495 1999, 2000#p#分页标题#e#

Total (58)

63,130

Nuclear_Power_in_France

Framatome in conjunction with Siemens in Germany then developed the European Pressurised

Water Reactor (EPR), based on the French N4 and the German Konvoi types, to meet the

European Utility Requirements and also the US EPRI Utility Requirements. This was confirmed in

1995 as the new standard design for France and it received French design approval in 2004.

In mid 2004 the board of EdF decided in principle to build the first demonstration unit of an

expected series of 1650 MWe Areva NP EPRs, and this decision was confirmed in May 2006,

after public debate. The overnight capital cost or construction cost was expected to be €3.3 billion

in 2005 Euros (€3.55 billion in 2008 Euros), and power from it EUR 4.6 c/kWh - about the same as

from new combined cycle gas turbine at 2005 gas prices and with no carbon emission charge.

Series production costs are projected at about 20% less. EDF then submitted a construction

licence application. The Flamanville 3 unit is to be 4500 MWt, 1750 MWe gross (at sea

temperature 14.7°C) and 1630 MWe net.

Site works at Flamanville on the Normandy coast were complete and the first concrete poured in

December 2007, with construction to take 54 months and commercial operation expected in May

2012. In January 2007 EdF ordered the main nuclear part of the reactor from Areva. The turbinegenerator

section was ordered in 2006 from Alstom - a 1750 MWe Arabelle unit. This meant that

85% of the plant's projected cost was largely locked in. The Flamanville construction schedule then

slipped about nine months, with first power expected in 2012 and commercial operation in 2013.

The reactor vessel nozzle support ring was forged by JSW in 2006 and the vessel manufacturing is

at Areva's St Marcel factory. Forging of steam generator shells was at Areva's Le Creusot factory

from 2007.

At the end of 2008 the overnight cost estimate (without financing costs) was updated by 21% to €4

billion in 2008 Euros (€2434/kW), and electricity cost to be 5.4 cents/kWh (compared with 6.8

c/kWh for CCGT and 7.0 c/kWh for coal, "with lowest assumptions" for CO2 cost). These costs

were confirmed in mid 2009, when EdF had spent nearly EUR 2 billion. A second unit would be

more expensive, and would deliver power at 5.5 to 6.0 cents/kWh. In July 2010 EdF revised the

cost to about EUR 5 billion and the grid connection to early 2014 - two years behind schedule.

In August 2005 EdF announced that it plans to replace its 58 present reactors with EPR nuclear

reactors from 2020, at the rate of about one 1650 MWe unit per year. It would require 40 of these

to reach present capacity. This will be confirmed about 2015 on the basis of experience with the

initial EPR unit at Flamanville - use of other designs such as Westinghouse's AP1000 or GE's

ASBWR is possible. EdF's development strategy selected the nuclear replacement option on the

basis of nuclear's "economic performance, for the stability of its costs and out of respect for

environmental constraints."

In January 2009 President Sarkozy confirmed that EdF would build a second 1650 MWe EPR, at

Penly, near Dieppe, in Normandy. Like Flamanville, it has two 1300 MWe units now operating, and

room for two more. GdF-Suez originally planned to hold a 25% stake in it, Total will hold 8.3%, and

ENEL is expected to take up 8% or its full 12.5% entitlement. Germany's E.On. is considering

taking an 8% stake. EdF may sell down its share to 50%. (Areva, GdF-Suez and Total together

bid to build a pair of EPRs in Abu Dhabi.) The French government owns 85% of EdF, 35.7% of

GdF Suez and 88% of Areva, who will build the unit. A public debate on the project concluded in

2010, and construction start is planned for 2012. The reactor is expected on line in 2017.

A third new reactor, with majority GdF Suez ownership and operated by it, is proposed to follow – in

line with the company's announced intentions. A GdF Suez subsidiary, Electrabel, operates seven

reactors in Belgium and has equity in two French nuclear plants. ENEL, Total, Areva and E.On are

other possible partners.

After deciding not to participate in the Penly 2 project, in February 2010 GdF Suez sought approval

to build a 1100 MWe Atmea-1 reactor at Tricastin or Marcoule in the Rhone valley to operate from

about 2020. This sparked union opposition due to the private ownership. This would be a

reference plant for the Areva-Mitsubishi design, providing a base for export sales.

Power reactors under construction and planned

Type MWe gross Construction start Grid connection Commercial operation

Flamanville 3 EPR 1750 12/07 9/12 2/13

EPR 1750 2012 2017

line with the company's announced intentions. A GdF Suez subsidiary, Electrabel, operates seven

reactors in Belgium and has equity in two French nuclear plants. ENEL, Total, Areva and E.On are

other possible partners.

After deciding not to participate in the Penly 2 project, in February 2010 GdF Suez sought approval

to build a 1100 MWe Atmea-1 reactor at Tricastin or Marcoule in the Rhone valley to operate from

about 2020. This sparked union opposition due to the private ownership. This would be a

reference plant for the Areva-Mitsubishi design, providing a base for export sales.

Power reactors under construction and planned

There have been two significant fast breeder reactors in France. Near Marcoule is the 233 MWe

Phenix reactor, which started operation in 1974 and was jointly owned by CEA and EdF. It was shut

down for modification 1998-2003, returned at 140 MWe for six years, and ceased power

generation in March 2009, though it continued in test operation and to maintain research programs

by CEA until October 2009.

A second unit was Super-Phenix of 1200 MWe, which started up in 1996 but was closed down for

political reasons at the end of 1998 and is now being decommissioned. The operation of Phenix is

fundamental to France's research on waste disposal, particularly transmutation of actinides. See

further information in R&D section below.

All but four of EdF's nuclear power plants (14 reactors) are inland, and require fresh water for

cooling. Eleven of the 15 inland plants (32 reactors) have cooling towers, using evaporative

cooling, the others use simply river or lake water directly. With regulatory constraints on the

temperature increase in receiving waters, this means that in very hot summers generation output

may be limited.

Load-following with PWR nuclear plants

Normally base-load generating plants, with high capital cost and low operating cost, are run

continuously, since this is the most economic mode. But also it is technically the simplest way,

since nuclear and coal-fired plants cannot readily alter power output, compared with gas or hydro

plants. The high reliance on nuclear power in France thus poses some technical challenges, since

the reactors collectively need to be used in load-following mode. (Since electricity cannot be

stored, generation output must exactly equal to consumption at all times. Any change in demand or

generation of electricity at a given point on the transmission network has an instant impact on the

entire system. This means the system must constantly adapt to satisfy the balance between supply

and demand.)

RTE, a subsidiary of EdF, is responsible for operating, maintaining and developing the French

electricity transmission network. France has the biggest grid network in Europe, made up of some

100,000 km of high and extra high voltage lines, and 44 cross-border lines, including a DC link to

UK. Electricity is transmitted regionally at 400 and 225 kilovolts. Frequency and voltage are

controlled from the national control centre, but dispatching of capacity is done regionally. Due to its

central geographical position, RTE is a crucial entity in the European electricity market and a

critical operator in maintaining its reliability.

All France's nuclear capacity is from PWR units. There are two ways of varying the power output

from a PWR: control rods, and boron addition to the primary cooling water. Using normal control

rods to reduce power means that there is a portion of the core where neutrons are being absorbed

rather than creating fission, and if this is maintained it creates an imbalance in the fuel, with the

lower part of the fuel assemblies being more reactive that the upper parts. Adding boron to the

water diminishes the reactivity uniformly, but to reverse the effect the water has to be treated to

remove the boron, which is slow and costly, and it creates a radioactive waste.

So to minimise these impacts for the last 25 years EdF has used in each PWR reactor some less

absorptive "grey" control rods which weigh less from a neutronic point of view than ordinary control

Type MWe gross Construction start Grid connection Commercial operation

Flamanville 3 EPR 1750 12/07 9/12 2/13

Penly 3 EPR 1750 2012 2017

Nuclear_Power_in_France

controlled from the national control centre, but dispatching of capacity is done regionally. Due to its

central geographical position, RTE is a crucial entity in the European electricity market and a

critical operator in maintaining its reliability.

All France's nuclear capacity is from PWR units. There are two ways of varying the power output#p#分页标题#e#

from a PWR: control rods, and boron addition to the primary cooling water. Using normal control

rods to reduce power means that there is a portion of the core where neutrons are being absorbed

rather than creating fission, and if this is maintained it creates an imbalance in the fuel, with the

lower part of the fuel assemblies being more reactive that the upper parts. Adding boron to the

water diminishes the reactivity uniformly, but to reverse the effect the water has to be treated to

remove the boron, which is slow and costly, and it creates a radioactive waste.

So to minimise these impacts for the last 25 years EdF has used in each PWR reactor some less

absorptive "grey" control rods which weigh less from a neutronic point of view than ordinary control

rods and they allow sustained variation in power output. This means that RTE can depend on

flexible load following from the nuclear fleet to contribute to regulation in these three respects:

1. Primary power regulation for system stability (when frequency varies, power must be

automatically adjusted by the turbine),

2. Secondary power regulation related to trading contracts,

3. Adjusting power in response to demand (decrease from 100% during the day, down to 50% or

less during the night, etc.)

PWR plants are very flexible at the beginning of their cycle, with fresh fuel and high reserve

reactivity. But when the fuel cycle is around 65% through these reactors are less flexible, and they

take a rapidly diminishing part in the third, load-following, aspect above. When they are 90%

through the fuel cycle, they only take part in frequency regulation, and essentially no power variation

is allowed (unless necessary for safety). So at the very end of the cycle, they are run at steady

power output and do not regulate or load-follow until the next refueling outage. RTE has continuous

oversight of all French plants and determines which plants adjust output in relation to the three

considerations above, and by how much.

RTE's real-time picture of the whole French system operating in response to load and against

predicted demand shows the total of all inputs. This includes the hydro contribution at peak times,

but it is apparent that in a coordinated system the nuclear fleet is capable of a degree of load

following, even though the capability of individual units to follow load may be limited.

Plants being built today, eg according to European Utilities' Requirements (EUR), have loadfollowing

capacity fully built in.

Fuel cycle - front end

France uses some 12,400 tonnes of uranium oxide concentrate (10,500 tonnes of U) per year for

its electricity generation. Much of this comes from Areva in Canada (4500 tU/yr) and Niger (3200

tU/yr) together with other imports, principally from Australia, Kazakhstan and Russia, mostly under

long-term contracts.

Beyond this, it is self-sufficient and has conversion, enrichment, uranium fuel fabrication and MOX

fuel fabrication plants operational (together with reprocessing and a waste management program).

Most fuel cycle activities are carried out by Areva NC.

Conversion: Uranium concentrates are converted to hexafluoride at the 14,000 t/yr Comurhex

Pierrelatte plant in the Rhone Valley, which commenced operation in 1959. Current production is at

13,000 t/yr UF6.

In May 2007 Areva NC announced plans for a new conversion project - Comurhex II - with facilities

at Malvesi and Pierrelatte near Tricastin to strengthen its global position in the front end of the fuel

cycle. The EUR 610 million facility will have a capacity of 15,000 tU/yr from the end of 2013, with

scope for increase to 21,000 tU/yr. Construction has started at both Pierrelatte and Malvesi, and

first production is expected in 2012

In January 2009 EdF awarded a long-term conversion contract to Areva. From 2012 this will be

filled from the Comurhex II plant.

Areva has undertaken deconversion of enrichment tails at Pierrelatte since the 1980s. Its 20,000

Nuclear_Power_in_France

Conversion: Uranium concentrates are converted to hexafluoride at the 14,000 t/yr Comurhex

Pierrelatte plant in the Rhone Valley, which commenced operation in 1959. Current production is at

13,000 t/yr UF6.

In May 2007 Areva NC announced plans for a new conversion project - Comurhex II - with facilities

at Malvesi and Pierrelatte near Tricastin to strengthen its global position in the front end of the fuel

cycle. The EUR 610 million facility will have a capacity of 15,000 tU/yr from the end of 2013, with

scope for increase to 21,000 tU/yr. Construction has started at both Pierrelatte and Malvesi, and

first production is expected in 2012

In January 2009 EdF awarded a long-term conversion contract to Areva. From 2012 this will be

filled from the Comurhex II plant.

Areva has undertaken deconversion of enrichment tails at Pierrelatte since the 1980s. Its 20,000

t/yr W2 plant produces aqueous HF which is recycled, and the depleted uranium is stored long-term

as chemically stable U3O8.

Enrichment then takes place at Eurodif's 1978 Georges Besse I plant at Tricastin nearby, with

10.8 million SWU capacity (enough to supply some 81,000 MWe of generating capacity - about

one third more than France's total). Eurodif has been by far the largest single electricity consumer

in France. It will run at two thirds capacity (using 2000 MWe) until the end of 2012 and then close

down, after replacement capacity is commissioned.

In 2003 Areva agreed to buy a 50% stake in Urenco's Enrichment Technology Company (ETC),

which comprises all its centrifuge R&D, design and manufacturing activities. The deal will enable

Areva to use Urenco/ETC technology to replace its inefficient Eurodif gas diffusion enrichment plant

at Tricastin. The final agreement after approval by the four governments involved was signed in mid

2006.

The new Georges Besse II enrichment plant has been under construction since 2007. The EUR 3

billion two-unit plant, with nominal annual capacity of 7.5 million SWU (with potential for increase to

11 million SWU), is being built and will be operated by Areva NC subsidiary Societe

d'Enrichissement du Tricastin (SET). The first stages of the first unit began operating in December

2009 with commercial operation to start at the end of 2010 and full capacity to be reached in 2014.

Construction of the second unit began in 2009 and it will be fully operational in 2016.

Minority stakes in SET are being offered to customers, and Suez took up 5% in 2008. In March

2009 two Japanese companies, Kansai and Sojitz Corp, jointly took up 2.5%, in June 2009 Korea

Hydro & Nuclear Power took a further 2.5%, and in November 2010 Kyushu Electric Power and

Tohoku Electric Power each took 1%. The 4.5% Japanese holdings are grouped as Japan France

Enrichment Investing Co. (JFEI). EdF as principal customer opted for a long-term contract instead,

and in February 2009 it signed a EUR 5 billion long-term enrichment contract with Areva. It runs

over 17 years to 2025, corresponding with the amortisation of the new plant. Korea Hydro and

Nuclear Power (KHNP) in mid 2007 signed a long-term enrichment supply contract of over EUR 1

billion - described at that time as Areva's largest enrichment contract outside France.

Enrichment will be up to 6% U-235, and reprocessed uranium will only be handled in the second,

north unit. There is potential to expand capacity to 11 million SWU/yr.

When fully operational in 2018 the whole SET plant will free up some 3000 MWe of Tricastin

nuclear power plant's capacity for the French grid - over 20 billion kWh/yr (@ 4 c/kWh this is EUR

800 million/yr). The new enrichment plant investment is equivalent to buying new power capacity @

EUR 1000/kW. The GB II plant will require only about 75 MWe (80 kWh/SWU, compared with

about 2600 kWh/SWU for GB I).

About 7300 tonnes of depleted uranium tails is produced annually, most of which is stored for use in

Generation IV fast reactors. Only 100-150 tonnes per year is used in MOX. By 2040 this resources

is expected to total some 450,000 tonnes of DU.

Enrichment of depleted uranium tails has been undertaken in Russia, at Novouralsk and

Zelenogorsk. Some 33,000 tonnes of French DU from Areva and EdF has been sent to Russia in

128 shipments over 2006-09, and about 3090 t of enriched 'natural' uranium (about 0.7% U-235)

has been returned as of May 2010: 2400 t to Eurodif, 380 t to Areva Pierrelatte, and 310 t to Areva

FBFC Romans. The contracts for this work end in 2010, and the last shipment was in July 2010 with

the returned material to be shipped by year end. Tails from re-enrichment remain in Russia as the

Nuclear_Power_in_France

800 million/yr). The new enrichment plant investment is equivalent to buying new power capacity @

EUR 1000/kW. The GB II plant will require only about 75 MWe (80 kWh/SWU, compared with

about 2600 kWh/SWU for GB I).

About 7300 tonnes of depleted uranium tails is produced annually, most of which is stored for use in

Generation IV fast reactors. Only 100-150 tonnes per year is used in MOX. By 2040 this resources

is expected to total some 450,000 tonnes of DU.

Enrichment of depleted uranium tails has been undertaken in Russia, at Novouralsk and

Zelenogorsk. Some 33,000 tonnes of French DU from Areva and EdF has been sent to Russia in

128 shipments over 2006-09, and about 3090 t of enriched 'natural' uranium (about 0.7% U-235)#p#分页标题#e#

has been returned as of May 2010: 2400 t to Eurodif, 380 t to Areva Pierrelatte, and 310 t to Areva

FBFC Romans. The contracts for this work end in 2010, and the last shipment was in July 2010 with

the returned material to be shipped by year end. Tails from re-enrichment remain in Russia as the

property of the enrichers.

Fuel fabrication is at several Areva plants in France and Belgium. Significant upgrading of these

plants forms part of Areva's strategy for strengthening its front end facilities. MOX fuel fabrication is

described below.

Fuel cycle - back end

France chose the closed fuel cycle at the very beginning of its nuclear program, involving

reprocessing used fuel so as to recover uranium and plutonium for re-use and to reduce the volume

of high-level wastes for disposal. Recycling allows 30% more energy to be extracted from the

original uranium and leads to a great reduction in the amount of wastes to be disposed of. Overall

the closed fuel cycle cost is assessed as comparable with that for direct disposal of used fuel, and

preserves a resource which may become more valuable in the future. Back end services are

carried out by Areva NC.

Used fuel from the French reactors and from otehr countries is sent to Areva NC's La Hague plant

in Normandy for reprocessing. This has the capacity to reprocess up to 1700 tonnes per year of

used fuel in the UP2 and UP3 facilities. The treatment extracts 99.9% of the plutonium and uranium

for recycling, leaving 3% of the used fuel material as high-level wastes which are vitrified and stored

there for later disposal. Typical input today is 3.7% enriched used fuel from PWR and BWR

reactors with burn-up to 45 GWd/t, after cooling for four years. In 2009 Areva reprocessed 929

tonnes, most from EdF but 79 t from SOGIN in Italy. By 2015 it aims for throughput of 1500 t/yr.

EdF has been sending some 850 tonnes for reprocessing out of about 1200 tonnes of used fuel

discharged per year, though from 2010 it will send 1050 t. The rest is preserved for later

reprocessing to provide the plutonium required for the start-up of Generation IV reactors.

Reprocessing is undertaken a few years after discharge, following some cooling. Some 8.5 tonnes

of plutonium and 810 tonnes of reprocessed uranium (RepU) are recovered each year from the 850

tonnes treated each year to 2009. The plutonium is immediately shipped to the 195 t/yr Melox plant

near Marcoule for prompt fabrication into about 100 tonnes of mixed-oxide (MOX) fuel, which is

used in 20 of EdF's 900 MWe reactors. Four more are being licensed to use MOX fuel.

Used MOX fuel and used RepU fuel is stored pending reprocessing and use of the plutonium in

Generation IV fast reactors. These discharges have amounted to about 140 tonnes per year, but

rise to 200 tonnes from 2010.

EdF's recycled uranium (RepU) is converted in Comurhex plants at Pierrelatte, either to U3O8 for

interim storage, or to UF6 for re-enrichment in centrifuge facilities there or at Seversk in Russia*.

About 500 tU per year of French RepU as UF6 is sent to JSC Siberian Chemical Combine at

Seversk for re-enrichment. The enriched RepU UF6 from Seversk is then turned into UO2 fuel in

Areva NP's FBFC Romans plant (capacity 150 t/yr). EdF has used it in the Cruas 900 MWe power

reactors since the mid 1980s. The main RepU inventory constitutes a strategic resource, and EdF

intends to increase its utilization significantly. The enrichment tails remain at Seversk, as the

property of the enricher.

* RepU conversion and enrichment require dedicated facilities due to its specific isotopic composition (presence of even isotopes - notably U-232

and U-236 - the former gives rise to gamma radiation, the latter means higher enrichment is required). It is the reason why the cost of these

operations may be higher than for natural uranium. However, taking into account the credit from recycled materials (natural uranium savings),

commercial grade RepU fuel is competitive and its cost is more predictable than that of fresh uranium fuel, due to uncertainty about future

uranium concentrate prices.

Nuclear_Power_in_France

EdF's recycled uranium (RepU) is converted in Comurhex plants at Pierrelatte, either to U3O8 for

interim storage, or to UF6 for re-enrichment in centrifuge facilities there or at Seversk in Russia*.

About 500 tU per year of French RepU as UF6 is sent to JSC Siberian Chemical Combine at

Seversk for re-enrichment. The enriched RepU UF6 from Seversk is then turned into UO2 fuel in

Areva NP's FBFC Romans plant (capacity 150 t/yr). EdF has used it in the Cruas 900 MWe power

reactors since the mid 1980s. The main RepU inventory constitutes a strategic resource, and EdF

intends to increase its utilization significantly. The enrichment tails remain at Seversk, as the

property of the enricher.

* RepU conversion and enrichment require dedicated facilities due to its specific isotopic composition (presence of even isotopes - notably U-232

and U-236 - the former gives rise to gamma radiation, the latter means higher enrichment is required). It is the reason why the cost of these

operations may be higher than for natural uranium. However, taking into account the credit from recycled materials (natural uranium savings),

commercial grade RepU fuel is competitive and its cost is more predictable than that of fresh uranium fuel, due to uncertainty about future

uranium concentrate prices.

Considering both plutonium and uranium, EdF estimates that about 20% of its electricity is

produced from recycled materials. Areva's estimate is 17%, from both MOX and RepU.

Areva has the capacity to produce and market 150 t/year of MOX fuel at its Melox plant for French

and foreign customers (though it is licensed for 195 t/yr). In Europe 35 reactors have been loaded

with MOX fuel. Contracts for MOX fuel supply were signed in 2006 with Japanese utilities. All

these fuel cycle facilities comprise a significant export industry and have been France’s major

export to Japan. At the end of 2008 Areva was reported to have about 30 t/yr in export contracts for

MOX fuel, with demand very strong. However, EdF has priority.

To the end of 2009 about 27,000 tonnes of LWR fuel from France and other countries had been

reprocessed at La Hague. In addition about 5000 tonnes of gas-cooled reactor natural uranium fuel

was earlier reprocessed there and over 18,000 tonnes at the UP1 plant for such fuel at Marcoule,

which closed in 1997.

At the end of 2008 Areva and EdF announced a renewed agreement to reprocess and recycle

EdF's used fuel to 2040, thereby securing the future of both La Hague and Melox plants. The

agreement supports Areva's aim to have La Hague reprocessing operating at 1500 t/yr by 2015,

instead of two thirds of that in 2008. It also means that EdF increases the amount of its used fuel

sent for reprocessing to 1050 t/yr from 2010, and Melox produces 120 t/yr MOX fuel for EdF then,

up from 100 tonnes in 2009. It also means that EdF will recycle used MOX fuel.

Under current legislation, EdF is required to have made provision for its decommissioning and final

waste management liabilities by 2011, but under a new bill that deadline would be deferred until

2016. At the end of 2009, EdF was reported to have EUR 11.4 billion in its dedicated back-end

fund, compared with an estimated liability of EUR 16.9 billion.

France's back-end strategy and industrial developments are to evolve progressively in line with

future needs and technological developments. The existing plants at La Hague (commissioned

around 1990) have been designed to operate for at least forty years, so with operational and

technical improvements taking place on a continuous basis they are expected to be operating until

around 2040. This will be when Generation IV plants (reactors and advanced treatment facilities)

should come on line. In this respect, three main R&D areas for the next decade include:

l The COEX process based on co-extraction and co-precipitation of uranium and plutonium

together as well as a pure uranium stream (eliminating any separation of plutonium on its own).

This is designed for Generation III recycling plants and is close to near-term industrial deployment.

l Selective separation of long-lived radionuclides (with a focus on Am and Cm separation) from

short-lived fission products based on the optimization of DIAMEX-SANEX processes for their

recycling in Generation IV fast neutron reactors with uranium as blanket fuel. This option can also

be implemented with a combination of COEX and DIAMEX-SANEX processes.

l Group extraction of actinides (GANEX process) as a long term R&D goal for a homogeneous

recycling of actinides (ie U-Pu plus minor actinides together) in Generation IV fast neutron

reactors as driver fuel.

All three processes are to be assessed as they develop, and one or more will be selected for

industrial-scale development with the construction of pilot plants. In the longer term the goal is to

have integral recycling of uranium, plutonium and minor actinides. In practical terms, a technology -

hopefully GANEX or similar - will need to be validated for industrial deployment of Gen IV fast

reactors about 2040, at which stage the present La Hague plant will be due for replacement.

together as well as a pure uranium stream (eliminating any separation of plutonium on its own).

This is designed for Generation III recycling plants and is close to near-term industrial deployment.#p#分页标题#e#

l Selective separation of long-lived radionuclides (with a focus on Am and Cm separation) from

short-lived fission products based on the optimization of DIAMEX-SANEX processes for their

recycling in Generation IV fast neutron reactors with uranium as blanket fuel. This option can also

be implemented with a combination of COEX and DIAMEX-SANEX processes.

l Group extraction of actinides (GANEX process) as a long term R&D goal for a homogeneous

recycling of actinides (ie U-Pu plus minor actinides together) in Generation IV fast neutron

reactors as driver fuel.

All three processes are to be assessed as they develop, and one or more will be selected for

industrial-scale development with the construction of pilot plants. In the longer term the goal is to

have integral recycling of uranium, plutonium and minor actinides. In practical terms, a technology -

hopefully GANEX or similar - will need to be validated for industrial deployment of Gen IV fast

reactors about 2040, at which stage the present La Hague plant will be due for replacement.

See also R&D section below.

Wastes

Waste disposal is being pursued under France's 1991 Waste Management Act (updated 2006)

which established ANDRA as the national radioactive waste management agency and which set

the direction of research - mainly undertaken at the Bure underground rock laboratory in eastern

France, situated in clays. Another laboratory is researching granites. Research is also being

undertaken on partitioning and transmutation, and long-term surface storage of wastes following

conditioning. Wastes disposed of are to be retrievable.

ANDRA reported to government so that parliament could decide on the precise course of action.

After strong support in the National Assembly and Senate the Nuclear Materials and Waste

Management Program Act was passed in June 2006 to apply for 15 years. This formally declares

deep geological disposal as the reference solution for high-level and long-lived radioactive wastes,

and sets 2015 as the target date for licensing a repository and 2025 for opening it. It also affirms

the principle of reprocessing used fuel and using recycled plutonium and uranium "in order to

reduce the quantity and toxicity" of final wastes, and calls for construction of a prototype fourthgeneration

reactor by 2020 to test transmutation of long-lived actinides. The cost of the repository

(in 2002 EUR) is expected to be around EUR 15 billion: 40% construction, 40% operation for 100

years, and 20% ancillary (taxes and insurance). However, with design changes and cost escalation,

this is reported to have doubled. Funds for waste management and decommissioning remain

segregated but with the producers rather than in an external fund.

The Act defines three main principles concerning radioactive waste and substances: reduction of

the quantity and toxicity, interim storage of radioactive substances and ultimate waste, and deep

geological disposal. A central point is the creation of a national management plan defining the

solutions, the goals to be achieved and the research actions to be launched to reach these goals.

This plan is updated every three year and published according to the law on nuclear transparency

and security.

The Act is largely in line with recommendations to government from the Commission Nationale

d'Evaluation (CNE) or National Scientific Assessment Committee following 15 years of research.

Their report identified the clay formation at Bure as the best site, but was sceptical of partitioning

and transmutation for high-level wastes, and said that used MOX fuel should be stored indefinitely

as a plutonium resource for future fast neutron reactors, rather than being recycled now or treated

as waste. In a 2010 report CNE said that transmutation of minor actinides in fast reactors would

add about 10% to power cost, and transmutation of all actinides in an accelerator-driven system

(ADS) would add about 20%. Wastes from transmutation reactors will be interim storage for at

least 70 years.

Earlier, an international review team reported very positively on the plan by ANDRA for a deep

geological repository complex in clay at Bure. In 1999 ANDRA was authorised to build an

underground research laboratory at Bure to prepare for disposal of vitrified high-level wastes (HLW)

and long-lived intermediate-level wastes.

ANDRA is designing its Bure repository - the Industrial Centre for Geological Disposal (CIGEO) - to

operate at up to 90°C, which it expects to be reached about 20 years after emplacement. ANDRA

expects to apply for a construction and operating licence for CIGEO t the end of 2014, preceded

bay public debate. Two further repositories are envisaged by ANDRA and CEA

as a plutonium resource for future fast neutron reactors, rather than being recycled now or treated

as waste. In a 2010 report CNE said that transmutation of minor actinides in fast reactors would

add about 10% to power cost, and transmutation of all actinides in an accelerator-driven system

(ADS) would add about 20%. Wastes from transmutation reactors will be interim storage for at

least 70 years.

Earlier, an international review team reported very positively on the plan by ANDRA for a deep

geological repository complex in clay at Bure. In 1999 ANDRA was authorised to build an

underground research laboratory at Bure to prepare for disposal of vitrified high-level wastes (HLW)

and long-lived intermediate-level wastes.

ANDRA is designing its Bure repository - the Industrial Centre for Geological Disposal (CIGEO) - to

operate at up to 90°C, which it expects to be reached about 20 years after emplacement. ANDRA

expects to apply for a construction and operating licence for CIGEO t the end of 2014, preceded

bay public debate. Two further repositories are envisaged by ANDRA and CEA

ANDRA operates the Soulaines disposal facility for low-level (LLW) and short-lived intermediatelevel

wastes, and the Morvilliers facility (CSTFA) licensed to hold 650,000 cubic metres of very lowlevel

wastes, mostly from plant dismantling, in the Aube district around Troyes east of Paris.

In June 2008, ANDRA officially invited 3,115 communities with favorable geology to consider

hosting a facility for disposal of long-lived LLW (FAVL, containing radionuclides with half lives over

30 years). This is 70,000 m3 (18,000 tonnes) of graphite from early gas-cooled reactors and

47,000 m3 of radium-bearing materials from manufacture of catalytic converters and electronic

components, as well as wastes from mineral and metal processing that cannot be placed in Andra's

low-level waste disposal center in Soulaines. In response, 40 communities put themselves forward

for consideration. Preliminary studies completed late in 2008 by ANDRA revealed that two –

Auxon and Pars-lès-Chavanges in the Aube district – had suitable rock formations and

environments for the disposal of the wastes, but after intense lobbying by anti-nuclear groups both

withdrew. Investigations will proceed into 2010. A repository is likely to be in clay, about 15 metres

below the land surface.

In April 2007 the government appointed 12 new members to the CNE to report on progress in

France's waste management R&D across EdF, CEA, ANDRA and the National Centre for

Scientific Research.

EdF sets aside EUR 0.14 cents/kWh of nuclear electricity for waste management costs, and said

that the 2004 Areva contract was economically justified even in the new competitive environment of

EU electricity supply. Total provisions at end of 2004 amounted to €13.4 billion, €9.6 billion for

reprocessing (including decommissioning of facilities) and €3.8 billion for disposal of high-level and

long-lived wastes.

In August 2010 ANDRA announced that it expected €100 million for two waste projects:

- to establish a commercially viable system to recycle materials recovered during decommissioning

of nuclear facilities. The materials – mainly steel and concrete – would be used exclusively in the

nuclear industry. (French law prohibits using recycled materials from nuclear installations in nonnuclear

applications, which discourages recycling of decommissioning waste and threatens to

quickly fill Andra’s Morvilliers disposal facility – CSTFA).

- to develop techniques to condition chemically-active intermediate-level radwastes for final

disposal. Those "mixed" wastes can be in liquid, gaseous, or organic form. The goal is to condition

them in the most inert physical and chemical forms possible to meet safety requirements of a deep

repository. Most such wastes are from outside the nuclear power industry, but industry generation of

them is expected to increase. Industrial-scale solutions are likely to be costly, and ANDRA is

therefore seeking international partners.

Decommissioning

Thirteen experimental and power reactors are being decommissioned in France, nine of them firstgeneration

gas-cooled, graphite-moderated types, six being very similar to the UK Magnox type.

There are well-developed plans for dismantling these (which have been shut down since 1990 or

before). However, progress awaits the availability of sites for disposing of the intermediate-level

wastes and the alpha-contaminated graphite from the early gas-cooled reactors. At least one of

these, Marcoule G2, has been fully dismantled.#p#分页标题#e#

Nuclear_Power_in_France

repository. Most such wastes are from outside the nuclear power industry, but industry generation of

them is expected to increase. Industrial-scale solutions are likely to be costly, and ANDRA is

therefore seeking international partners.

Decommissioning

Thirteen experimental and power reactors are being decommissioned in France, nine of them firstgeneration

gas-cooled, graphite-moderated types, six being very similar to the UK Magnox type.

There are well-developed plans for dismantling these (which have been shut down since 1990 or

before). However, progress awaits the availability of sites for disposing of the intermediate-level

wastes and the alpha-contaminated graphite from the early gas-cooled reactors. At least one of

these, Marcoule G2, has been fully dismantled.

The other four include the 1200 MWe Super Phenix fast reactor, the veteran 233 MWe Phenix fast

reactor, the 1966 prototype 305 MWe PWR at Chooz, and an experimental 70 MWe GCHWR at

Brennilis. A licence was issued for dismantling Brennilis in 2006, and for Chooz A in 2007.

Decommissioned Power Reactors in France

Materials arising from EdF's decommissioning include: 500 tonnes of long-liver intermediate-level

wastes, 18,000 tonnes of graphite, 41,000 tones of short-lived intermediate-level wastes and

105,000 tonnes of very low level wastes.

The Eurodif gaseous diffusion enrichment plant at Tricastin is expected to generate 110,000 tonnes

of steel and 20,000 tonnes of aluminium that could be recycled for use in ANDRA’s disposal

centres or elsewhere in the industry.

Organisation and financing of final decommissioning of the UP1 reprocessing plant at Marcoule

was settled in 2004, with the Atomic Energy Commission (CEA) taking it over. The total cost is

expected to be some EUR 5.6 billion. The plant was closed in 1997 after 39 years of operation,

primarily for military purposes but also taking the spent fuel from EdF's early gas-cooled power

reactors. It was operated under a partnership - Codem, with 45% share by each of CEA and EdF

and 10% share by Cogema (now Areva NC). EdF and Areva will now pay CEA EUR 1.5 billion and

be clear of further liability.

EdF puts aside EUR 0.14 cents/kWh for decommissioning and at the end of 2004 it carried

provisions of EUR 9.9 billion for this. By 2010 it will have fully funded the eventual decommissioning

of its nuclear power plants (from 2035). Early in 2006 it held EUR 25 billion segregated for this

purpose, and is on track for EUR 35 billion in 2010. Areva has dedicated assets already provided

at the level of its future liabilities.

In April 2008 ASN issued a draft policy on decommissioning which proposes that French nuclear

installation licensees adopt "immediate dismantling strategies" rather than safe storage followed by

much later dismantling. The policy foresees broad public information in connection with the

decommissioning process.

Regulation & Safety

The General Directorate for Nuclear Safety and Radiological Protection (DGSNR) was set up in

Reactor Type MWe operational

Chooz A PWR 300 1967-91

Brennilis GCHWR 70 1967-85

Marcoule G1 GCR 2 1956-68

Marcoule G2 GCR 40 1959-80

Marcoule G3 GCR 40 1960-84

Chinon A1 GCR 70 1963-73

Chinon A2 GCR 200 1965-85

Chinon A3 GCR 480 1966-90

Saint-Laurent A1 GCR 480 1969-90

Saint-Laurent A2 GCR 515 1971-92

Bugey 1 GCR 540 1972-94

Creys-Malville FNR 1240 1986-97

Phenix FNR 233 1973-2009

assignment指导事业部提供文本资料Nuclear_Power_in_France

EdF puts aside EUR 0.14 cents/kWh for decommissioning and at the end of 2004 it carried

provisions of EUR 9.9 billion for this. By 2010 it will have fully funded the eventual decommissioning

of its nuclear power plants (from 2035). Early in 2006 it held EUR 25 billion segregated for this

purpose, and is on track for EUR 35 billion in 2010. Areva has dedicated assets already provided

at the level of its future liabilities.

In April 2008 ASN issued a draft policy on decommissioning which proposes that French nuclear

installation licensees adopt "immediate dismantling strategies" rather than safe storage followed by

much later dismantling. The policy foresees broad public information in connection with the

decommissioning process.

Regulation & Safety

The General Directorate for Nuclear Safety and Radiological Protection (DGSNR) was set up in

2002 by merging the Directorate for Nuclear Installation Safety (DSIN) with the Office for Protection

against Ionising Radiation (OPRI) to integrate the regulatory functions and to "draft and implement

government policy."

In 2006 the new Nuclear Safety Authority (Autorite de Surete Nucleaire - ASN) ) - an independent

body with five commissioners - became the regulatory authority responsible for nuclear safety and

radiological protection, taking over these functions from the DGSNR, and reporting to the Ministers

of Environment, Industry & Health. However, its major licensing decisions will still need government

approval.

Research is undertaken by the ISRN - the Institute for Radiological Protection & Nuclear Safety,

also set up in 2002 from two older bodies. ISRN is the main technical support body for ASN and

also advises DGSNR.

There have been two INES Level 4 accidents at French nuclear plants, both involving the St Laurent

A gas-cooled graphite reactors. In October 1969, soon after commissioning, about 50 kg of fuel

melted in unit 1, and in March 1980 some annealing occurred in the graphite of unit 2, causing a

brief heat excursion. On each occasion the reactor was repaired, and the two were eventually taken

out of service in 1990 and 1992.

Research and Development, International

The Atomic Energy Commission (Commissariat a l'Energie Atomique - CEA) was set up in 1945

and is the public R&D corporation responsible for all aspects of nuclear R&D. In 2009 it was renamed

Commission of Atomic Energy and Alternative Energy (CEA).

The CEA has 14 research reactors of various types and sizes in operation, all started up 1959 to

1980, the largest of these being 70 MWt. About 17 units dating from 1948 to 1982 are shut down or

decommissioning.

In 2004 the US energy secretary signed an agreement with the French Atomic Energy Commission

(CEA) to gain access to the Phenix experimental fast neutron reactor for research on nuclear fuels.

The US Department of Energy acknowledged that this fast neutron "capability no longer exists in

the USA". The US research with Phenix irradiated fuel loaded with various actinides under constant

conditions to help identify what kind of fuel might be best for possible future waste transmutation

systems.

In mid 2006 the CEA signed a four-year EUR 3.8 billion R&D contract with the government,

including development of two types of fast neutron reactors which are essentially Generation IV

designs: an improved version of the sodium-cooled type which already has 45 reactor-years

operational experience in France, and an innovative gas-cooled type. Both would have fuel

recycling, and by mid 2012 a decision is due to be taken on whether and how to transmute minor

actinides. The CEA is seeking support under the EC's European Sustainable Nuclear Industrial

Initiative and partnerships with Japan and China to develop the sodium-cooled model. However, it

notes that China (like India) is aiming for high breeding ratios to produce enough plutonium to crank

up a major push into fast reactors.

The National Scientific Evaluation Committee (CNE) in mid 2009 said that the sodium-cooled

model, Astrid (Advanced Sodium Technological Reactor for Industrial Demonstration), should be a

high priority in R&D on account of its actinide-burning potential. It is envisaged as a 600 MWe

prototype of a commercial series which is likely to be deployed from about 2050. It will have high

Nuclear_Power_in_France

In mid 2006 the CEA signed a four-year EUR 3.8 billion R&D contract with the government,

including development of two types of fast neutron reactors which are essentially Generation IV

designs: an improved version of the sodium-cooled type which already has 45 reactor-years

operational experience in France, and an innovative gas-cooled type. Both would have fuel

recycling, and by mid 2012 a decision is due to be taken on whether and how to transmute minor

actinides. The CEA is seeking support under the EC's European Sustainable Nuclear Industrial

Initiative and partnerships with Japan and China to develop the sodium-cooled model. However, it

notes that China (like India) is aiming for high breeding ratios to produce enough plutonium to crank

up a major push into fast reactors.

The National Scientific Evaluation Committee (CNE) in mid 2009 said that the sodium-cooled

model, Astrid (Advanced Sodium Technological Reactor for Industrial Demonstration), should be a

high priority in R&D on account of its actinide-burning potential. It is envisaged as a 600 MWe

prototype of a commercial series which is likely to be deployed from about 2050. It will have high

fuel burnup, including minor actinides in the fuel elements, and use an intermediate sodium loop,

though whether the tertiary coolant is water/steam or gas is an open question. Four independent

heat exchanger loops are likely, and it will be designed to reduce the probability and consequences#p#分页标题#e#

of severe accidents to an extent that is not now done with FNRs. Astrid is called a "self-generating"

fast reactor rather than a breeder in order to demonstrate low net plutonium production. Astrid is

designed to meet the stringent criteria of the Generation IV International Forum in terms of safety,

economy and proliferation resistance. CEA plans to build it at Marcoule.

In September 2010 the government confirmed its support, and EUR 651.6 million funding to 2017,

for a 600 MWe Astrid prototype with final decision on construction to be made in 2017. The CEA is

responsible for the project and will design the reactor core and fuel, but will collaborate with Areva,

which will design the nuclear steam supply system, the nuclear auxiliaries and the instrumentation

and control system. http://www.ukassignment.org According to a February 2010 study by Deloitte for the EU's Strategic Nuclear

Energy Technology Platform, a 600 MWe sodium-cooled fast reactor would cost EUR 4.286 billion,

with most of the financing coming from European institution loans, EU incentives and grants such as

the EC's European Sustainable Nuclear Industrial Initiative, plus EUR 839 million from private

investors.

The Astrid program includes development of the reactor itself and associated fuel cycle facilities: a

dedicated MOX fuel fabrication line (possibly in Japan) and a pilot reprocessing plant for used

Astrid fuel. The program also includes a workshop for fabricating fuel rods containing actinides for

transmutation, called Alfa, scheduled to operate in 2023, though fuel containing minor actinides

would not be loaded for transmutation in Astrid before 2025. A major tripartite France-US-Japan

accord on developing fast reactors was signed in October 2010.

CNE is a high-level scientists’ panel set up under the 1991 nuclear waste management act and

charged with reviewing the research and development programs of the organizations responsible

for nuclear energy, research and waste. The CNE expressed a clear preference for the concept of

heterogeneous recycling of minor actinides, called CCAM. In that process, minor actinides are

separated out from used fuel in an advanced-technology reprocessing plant and then incorporated

into blanket assemblies which are placed around the core of a future fast reactor. Such blanket

assemblies could contain 20% minor actinides or more, dispersed in a uranium oxide matrix. (In

homogeneous recycling, the actinides are incorporated into the actual fuel.)

The second line of FNR development is the gas-cooled fast reactor. A 50-80 MWt experimental

version – Allegro – is envisaged to be built 2014-2020. This will have either a ceramic core with

850°C outlet temperature, or a MOX core at 560°C. The secondary circuit will be pressurized

water. The CEA has encouraged Czech Republic, Hungary and Slovakia to host the demonstration

project. Further detail in Fast Neutron Reactors paper.

In June 2010 the CEA signed a major framework agreement with Rosatom covering "nuclear

energy development strategy, nuclear fuel cycle, development of next-generation reactors, future

gas coolant reactor systems, radiation safety and nuclear material safety, prevention and

emergency measures." Much of the collaboration will be focused on reprocessing and wastes, also

sodium-cooled fast reactors. Subsequently EdF signed a further cooperation agreement covering

R&D, nuclear fuel, and nuclear power plants - both existing and under construction.

In December 2009, as part of a €35 billion program to improve France's competitiveness, the

government awarded €1 billion to the CEA for Generation IV nuclear reactor and fuel cycle

Nuclear_Power_in_France

version – Allegro – is envisaged to be built 2014-2020. This will have either a ceramic core with

850°C outlet temperature, or a MOX core at 560°C. The secondary circuit will be pressurized

water. The CEA has encouraged Czech Republic, Hungary and Slovakia to host the demonstration

project. Further detail in Fast Neutron Reactors paper.

In June 2010 the CEA signed a major framework agreement with Rosatom covering "nuclear

energy development strategy, nuclear fuel cycle, development of next-generation reactors, future

gas coolant reactor systems, radiation safety and nuclear material safety, prevention and

emergency measures." Much of the collaboration will be focused on reprocessing and wastes, also

sodium-cooled fast reactors. Subsequently EdF signed a further cooperation agreement covering

R&D, nuclear fuel, and nuclear power plants - both existing and under construction.

In December 2009, as part of a €35 billion program to improve France's competitiveness, the

government awarded €1 billion to the CEA for Generation IV nuclear reactor and fuel cycle

development. CEA has two priorities in this area:

- fast neutron reactors with sodium or gas cooling and a closed fuel cycle, and

- in collaboration with industry partners, a very high temperature 600 MWt reactor for electricity

around 2025 and long-term for process heat applications such as hydrogen production. Areva is

developing Antares, the French version of General Atomics' GT-MHR – a high-temperature gascooled

reactor with fuel in prismatic blocks. It says that it "is using the Antares program to make

VHTR a pivotal aspect of its new product development."

In March 2007 the CEA started construction of a 100 MWt materials test reactor at Cadarache.

The Jules Horowitz reactor is the first such unit to be built for several decades, and has been

identified by the EU as a key infrastructure facility to support nuclear power development, as well as

producing radioisotopes and irradiating silicon for high-performance electronic use. The €500

million cost is being financed by a consortium including CEA (50%), EdF (20%), Areva (10%) and

EU research institutes (20%). Since the anticipated planned high-density U-Mo fuel will not be

ready in time for 2013, it will start up on uranium silicide fuel enriched to 27%.

Also at Cadarache, Areva TA is building a test version of its Réacteur d’essais à terre (RES), a

land-based equivalent of its K15 naval reactor of 150 MW, running on low-enriched fuel.

In relation to introduction of Generation IV reactors by 2040, the CEA is investigating several fuel

cycle strategies:

l Optimising uranium and plutonium recycling from present and EPR reactors, then comanagement

of U&Pu and possibly Np in Gen IV fast reactors.

l Recycling these with a low proportion of minor actinides (eg 3% MA) in driver fuels of Gen IV fast

reactors.

l Recycling (in about one third of France's reactors) with up to 30% of minor actinides in MOX

blanket assemblies of Gen IV fast reactors.

CEA is part of a project under the Generation IV International Forum investigating the use of

actinide-laden fuel assemblies in fast reactors - The Global Actinide Cycle International

Demonstration (GACID). See Generation IV Nuclear Reactors paper.

In May 2008 cabinet approved creation of Agency France Nuclear International (AFNI) under

CEA to provide a vehicle for international assistance. Its purpose is to help to set up structures and

systems to enable the establishment of civil nuclear programs in countries wanting to develop them

and will draw on all of the country's expertise in this. It is guided by a steering committee

comprising representatives of all the ministries involved (Energy, Foreign affairs, Industry,

Research, etc) as well as representatives of other major French nuclear institutions including the

CEA itself and probably ASN, though this is yet to be confirmed. Its work will be confined to

countries with which France has signed a nuclear cooperation agreement, and the initial focus is on

UAE. It will function on a fee for service basis.

Non-proliferation

France is a party to the Nuclear Non-Proliferation Treaty (NPT) which it ratified in 1992 as a nuclear

weapons state. Euratom safeguards apply in France and cover all civil nuclear facilities and

materials.

In addition, IAEA applies its safeguards activities in accordance with the trilateral "voluntary offer"

agreement between France, Euratom and the IAEA which entered into force in 1981.

Nuclear_Power_in_France

comprising representatives of all the ministries involved (Energy, Foreign affairs, Industry,

Research, etc) as well as representatives of other major French nuclear institutions including the

CEA itself and probably ASN, though this is yet to be confirmed. Its work will be confined to

countries with which France has signed a nuclear cooperation agreement, and the initial focus is on

UAE. It will function on a fee for service basis.

Non-proliferation

France is a party to the Nuclear Non-Proliferation Treaty (NPT) which it ratified in 1992 as a nuclear

weapons state. Euratom safeguards apply in France and cover all civil nuclear facilities and

materials.

In addition, IAEA applies its safeguards activities in accordance with the trilateral "voluntary offer"

agreement between France, Euratom and the IAEA which entered into force in 1981.

France undertook nuclear weapons tests 1960-95 and ceased production of weapons-grade fissile

It undertook nuclear weapons tests 1960-96 and ceased production of weapons-grade fissile#p#分页标题#e#

materials in 1996. Since then it has ratified the Comprehensive Test Ban Treaty.

Sources:

EdF, Nov 1996, Review of the French Nuclear Power Programme, EdF web site.

IAEA 2003, Country nuclear power profiles.

Nuclear Review, July 2001.

NuclearFuel & Nucleonics Week, August 2005

Areva - major review of paper in July 2007