|

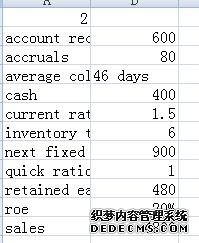

At the end of its just-completed fiscal year Stirling Enterprises, has no preferred stock outstanding and the following financial data (all in 000s)在其刚刚完成的财政年度结束时,斯特林企业没有未偿优先股和以下财务数据(均以千为单位)

1. determine the debt ratio

2. suppose the company were to use 200,000 in cash to buy back common stock at book value. Show as precisely as possible, the impact on stirling’s financial leverage multiplier

3. identify other use of cash that might be more beneficial to Stirling shareholders

1.确定负债率

2.假设公司用20万现金以账面价值回购普通股。尽可能精确地显示对斯特林财务杠杆乘数的影响

3.确定其他可能对斯特林股东更有利的现金用途。

(3)Evan industries is considered two proposed capital investments, p1, p2.Evan Industries被认为是两个拟议的资本投资,p1,p2。

P1的初始成本为5650万美元,10年内每年净现金流量为1000万美元,此后为0。项目2的初始成本为1.342亿美元,10年内每年净现金流量为2000万美元,此后为0万美元。

P1 has an initial cost of 56.5 million and produces annual net cash flows of 10.0 million for 10 years and 0 thereafter. Project 2 has an initial cost of 134.2 million and produces annual net cash flows of 20.0 million for 10 years and 0 thereafte.

The NPV of 2 investments are equal at a cost of capital of 4.87%两项投资的净现值相等,资本成本为4.87%。

Which projects should the company select?公司应该选择哪些项目?

(长回答)

(long answer)

(4) xylicinc has a target capital structure consisting of 50% debt & 50% common equity. The company’s expected net income this year is 15 million. Xylic has an estabilished dividend payout ratio of 20%; the past year’s dividend was $3 per share. The company’s stock sells at a price of 55$ per share, and investors expect earnings and dividends to grow at a constant rate of 10% in the future. The company has a marginal tax rate of 40% and can obtain new capital externally in the following ways:Xylicinc的目标资本结构包括50%的债务和50%的普通股。公司今年的预期净收入是1500万。Xylic的固定股息支付率为20%,去年的股息为每股3美元。该公司的股票以每股55美元的价格出售,投资者预计未来收益和股息将以10%的恒定速度增长。本公司的边际税率为40%,可以通过以下方式从外部获得新资本:

债务:高达600万美元的债务可以以7%的利率出售。

超过600万的额外债务必须有14%的利率。

股权:目前尚未考虑发行新股票。

项目:初始成本内部收益率

项目A:400万18%

项目B:800万16%

项目C:600万14%

项目D:600万12%

Debt: upto $6 million of debt can be sold at an interest rate of 7%

Additional debt over 6.0 million must carry an interest rate of 14%

Equity: issue of new stock is not currently contemplated.

Project : initial cost Internal rate of return

Project A: 4.0 million 18%

Project B: 8.0 million 16%

Project C: 6.0 million 14%

Project D: 6.0 million 12%

A. which of the investment opportunities should the company select?A.公司应选择哪些投资机会?

B. If project D were the only opportunity should we pursue? What if the project is financed exclusively from retailnedearnings.如果项目D是唯一的机会,我们应该追求吗?如果这个项目是完全由零售收入资助的呢?

Warwick Productions(WPI)正在考虑3种可能的资本结构:0%的债务,40%的债务。

(5) Warwick productions (wpi) is considering 3 possible capital structures: 0% debt, 40% debt

, 60% debt. For the foreseeable future, the company’s expected annual sales of 1.6 million, fixed operating cost of 0.6 million, and variable operating costs equal to 50% of sales. WPI will have a total assets of 2 million, (financed with one f the debt –equity capital combination) no preferred stock, commonstock with bookvalue of 20 per share, a marginal tax rate of 40% and a before-tax cost of debt of 10%60%债务。在可预见的未来,公司预计年销售额160万元,固定经营成本60万元,可变经营成本等于销售额的50%。WPI的总资产为200万,(以债务-股权资本组合的一种融资方式)无优先股、每股账面价值为20的普通股、40%的边际税率和10%的税前债务成本。

Which capital structure should the company select?公司应选择哪种资本结构?

(6)Axion manufacturing, inc, has an all-common-equity capital structure with 200,000 shares of common stock outstanding. AMI’s founder, who was also its research director and most successful inventor, has just retired unexpectedly at the end of the fiscal year, and AMI has been left suddenly and permantly with significantly lower growth expectations and relatively few attractive new investment opportunities. AMI found it necessary to retain 80% of its earnings to finance growth, which averaged 12% annually. A future annual growth rate of 5% is now considered realist – in the coming year new investment projects with the minimal 14% rate of return required by AMI’s stockholders would amount to only 0.8 million in comparison to 2.1 million of projected earnings. AXION Manufacturing,Inc.拥有全部普通股资本结构,拥有20万股已发行普通股。AMI的创始人,也是其研究主管和最成功的发明家,刚刚在财政年度结束时意外退休,AMI突然和永久地离开,增长预期显著降低,新的投资机会相对较少。AMI发现有必要保留其80%的收益来为增长提供资金,平均每年增长12%。未来5%的年增长率现在被认为是现实主义的——在未来的一年中,AMI股东要求的最低回报率为14%的新投资项目将仅为80万美元,而预期收益为210万美元。

In light of the change in company’s circumstance. AMI’s management is reviewing its dividend policy.根据公司情况的变化。AMI的管理层正在审查其股息政策。

Ifthecompany adopts a residual dividend policy. Show as precise as possible: how much the market price of common stock would likely decline from its level just prior to the founder’s retirement (use Gordon model with dividends as relevant cashflow)如果公司采用剩余股息政策。尽可能精确地显示:在创始人退休之前,普通股的市场价格可能会从其水平下降多少(使用Gordon模型和分红作为相关现金流)

答案如下:

At the end of its just-completed fiscal year Stirling Enterprises, has no preferred stock outstanding and the following financial data (all in 000s)

1. determine the debt ratio

inventory=4800*(1-10%)/6=720

equity=retained earnings/ROE=2400

Total asset=(600+80+400+720+900)=2700

Debt ratio=(2700-2400)/2700=11.111%

2. suppose the company were to use 200,000 in cash to buy back common stock at book value. Show as precisely as possible, the impact on stirling’s financial leverage multiplier

before buy back, the leverage multiplier=2700/2400=1.125

after buy back, the leverage multiplier=(2700-200)/(2400-200)=1.136

3. identify other use of cash that might be more beneficial to Stirling shareholders

it can use the other cash to buy some government bonds.

(3)Evan industries is considered two proposed capital investments, p1, p2.

P1 has an initial cost of 56.5 million and produces annual net cash flows of 10.0 million for 10 years and 0 thereafter. Project 2 has an initial cost of 134.2 million and produces annual net cash flows of 20.0 million for 10 years and 0 thereafte.

The NPV of 2 investments are equal at a cost of capital of 4.87%

Which projects should the company select?

(long answer)

When calculate the PVIFA:

(5%-4%)/(7.721-8.11)=(5%-4.87%)/(7.721-PVIFA)

PVIFA=7.77027.

For investment 1, the NPV=10*P(4.87%,10)-56.5=10*7.77027-56.5=77.027 -56.5=20.527

Internal rate of return=20.527/56.5=0.3633

For investment2, the NPV=20*P(4.87%,10)-134.2=154.054-134.2=19.854

Internal rate of return=19.854/134.2=0.1479

(4) xylicinc has a target capital structure consisting of 50% debt & 50% common equity. The company’s expected net income this year is 15 million. Xylic has an estabilished dividend payout ratio of 20%; the past year’s dividend was $3 per share. The company’s stock sells at a price of 55$ per share, and investors expect earnings and dividends to grow at a constant rate of 10% in the future. The company has a marginal tax rate of 40% and can obtain new capital externally in the following ways:#p#分页标题#e#

Debt: upto $6 million of debt can be sold at an interest rate of 7%

Additional debt over 6.0 million must carry an interest rate of 14%

Equity: issue of new stock is not currently contemplated.

Project : initial cost Internal rate of return

Project A: 4.0 million 18%

Project B: 8.0 million 16%

Project C: 6.0 million 14%

Project D: 6.0 million 12%

A. which of the investment opportunities should the company select?

Project A

B. If project D were the only opportunity should we pursue? What if the project is financed exclusively from retailnedearnings.

retailned earnings.=15*(1-20%)=12millon

so, it will finance about 6 millon dollars from retailned earnings.

(5) Warwick productions (wpi) is considering 3 possible capital structures: 0% debt, 40% debt

, 60% debt. For the foreseeable future, the company’s expected annual sales of 1.6 million, fixed operating cost of 0.6 million, and variable operating costs equal to 50% of sales. WPI will have a total assets of 2 million, (financed with one f the debt –equity capital combination) no preferred stock, commonstock with bookvalue of 20 per share, a marginal tax rate of 40% and a before-tax cost of debt of 10%

Which capital structure should the company select?(6)Axion manufacturing, inc, has an all-common-equity capital structure with 200,000 shares of common stock outstanding. AMI’s founder, who was also its research director and most successful inventor, has just retired unexpectedly at the end of the fiscal year, and AMI has been left suddenly and permantly with significantly lower growth expectations and relatively few attractive new investment opportunities. AMI found it necessary to retain 80% of its earnings to finance growth, which averaged 12% annually. A future annual growth rate of 5% is now considered realist – in the coming year new investment projects with the minimal 14% rate of return required by AMI’s stockholders would amount to only 0.8 million in comparison to 2.1 million of projected earnings

In light of the change in company’s circumstance. AMI’s management is reviewing its dividend policy.

Ifthecompany adopts a residual dividend policy. Show as precise as possible: how much the market price of common stock would likely decline from its level just prior to the founder’s retirement (use Gordon model with dividends as relevant cashflow)

Before retired,

P=D/(i-g)=2.1/(14%-12%)=105

After retired:

P=D/(i-g)=0.8/(14%-5%)=8.88

The stock price woll decline from 105 to 8.88 per share.

|

|

|||

| 网站地图 |