|

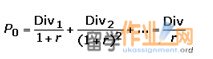

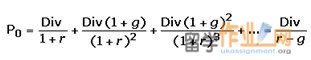

Moving to DDM model, this model use long term interest rate to calculate the firm’s value, because DDM believe that the present value of dividends could be realized by risk free rate, it does not need WACC. Nicholas .H (the vice president at Pareo Inc) pointed that the discount rate for the DDM is the cost of equity or CAPM; whereas the discount rate for DCF is a weighted cost of debt and equity or WACC. Also Aswath Damodaran proved this viewpoint in his book.49 Similar to DCF, DDM was mentioned by John Burr Williams's in his 'The Theory of Investment Value' book in 1938, and differentiated with DCF, DDM only focus on the dividends paid, it relies on one fact, that is, any stock is ultimately worth no more than what it will provide investors in current and future dividends, says that the value of a stock is worth all of the future cash flows expected to be generated by the firm, discounted by an appropriate risk-adjusted rate.50 According to the DDM, it assumes that dividends are the cash flows that are returned to the shareholder. Like DCF, DDM model was set up by the plenty of assumptions, the most important assumption is DDM believe the dividends are steady, or grow at a constant rate indefinitely, and based on the dividends growth rate, DDM derived two sub-model, zero growth

And constant growth As the traditional evaluation method, DDM exist a fatal shortcoming. Merely concentrate on the dividends paid, if a firm does not pay the dividend, DDM model will consider this firm is non-value, because the numerator is zero, but actually, a few of firms will use remain profits to re-invest some projects which have positive NPV, although they did not pay the dividends. Also if one firm has high dividends growth rate, it means g > r, obviously, the denominator is negative, the equation is not exist.

After analyzing DCF and DDM method, researchers realized that these two models cannot assess the firm’s value well. Due to the limitation of DDM, and the small changes lead to unreliable consequence in DCF, investors are eager to find an ideal method to forecast the value of firms. Nowadays, EVA is a popular calculation method in the world and it is a modified version of DCF model. Economic value added (EVA) is a performance measure developed by Joel Stern, and is a registered trademark of Stern Stewart & Co in 1982,53 that attempts to measure the true economic profit produced by a company. It is base on three simple ideas: cash is king, (because Cash flows are more reliable than accruals), some period expenses are - in economic reality - actually long-term investments, and equity capital is expensive (or can say The Company does not create value until a threshold level of return is generated for shareholders.) In his book, David and Stephen pointed that EVA absorbs the advantage of DCF, using cash flow to evaluate the performance of firm, and furthermore, EVA updates the meaning of profits. In EVA model, economic profits reflect the pure residual income (adjustment to GAAP); it means that profits will be accounted when firms deduct all the capital cost which includes equity capital. Because equity capital is a cost, it could be considered as an opportunity cost. Compare two valuation methods below,

Traditional Valuation

Equity Market Capitalization → Invested Capital + Discounted [Economic Profit] = Invested Capital + Market Value Added (MVA)

Summary

|

|

|||

| 网站地图 |