|

Executive Summary执行摘要

中小企业(以下简称“中小企业”)是世界经济增长的重要组成部分。然而,它们的融资困难程度不同,在当今社会引起了广泛的关注。金融行业的专家和专业人士致力于寻找其他方式帮助中小企业获得融资。但是,没有固定的程序。本项目的目的是为中小企业寻找外部融资渠道,主要结构如下:第一部分,世界交易所联合会中小企业代表交易所总指南,明确了中小企业上市在新兴市场和新兴市场的重要性。此外,全球舞台也展示了这项研究的目的。其次,运用实证理论,找出成长型企业上市背后的决定因素,并在韩国、伦敦、印度、中国等国的国际实践中提出上市的建议。第三,由于风险投资目前已成为中小企业最重要的融资渠道,为中小企业交流增值,因此本文从理论和实践两方面对风险投资合同进行了考察。第四,以创业板为样本数据,对上述研究结果进行检验,并对中小企业交易所与风险投资市场的关系进行实证分析,最后对风险投资与中小企业提出结论和建议。在一定程度上,通过有效结合,解决了中小企业融资瓶颈,共同搭建了促进资本市场繁荣的平台。

SME (hereinafter called “Small and Medium Enterprise”) is the most important part of economic growth across the world. However, their financing difficulties of different degree caused a widely-spread concern in the current society. Expert and professionals in the financial industry dedicated to seek out alternative ways to help SMEs access financing. However, there’s no fixed routine. In this project, the purpose is to find out the external financing channel for SMEs.The main structure is laid out as follows: In the first part, a general guide of representative SME Exchanges in World Federation of Exchange,specify the importance of SMEs listings in the emerging market and in the global stage, in addition, presented the purpose of this research. Secondly, applying empirical theories to find out the determinants of listing in Growth Enterprise Market behind the scene; and come up with listing in international practice across Korea, London, India, and China market. Thirdly, as venture capital currently has emerged as the most crucial financing channel for SMEs which adds value to SMEs exchanges, thus venture capital contract in theory and practice is examined. Fourthly, we use Chinext as a sample data to test above findings and empirically analyze the link of SMEs exchange and VC market.Lastly, conclusion and suggestion are put forward to venture capital and SMEs. To some extent, through effectively combined, they solved the financing bottleneck of SMEs and co-establish such a platform to push the prosperity of capital market.

中小企业(中小企业)是全球社会经济的重要组成部分,不仅是发展中国家的重要组成部分,更是美国、美国等发达经济体的重要组成部分。根据2010年的一项不完全统计,以中国市场为例,中小企业占99%的业务,贡献约60%的国内生产总值(2010年世界交易所联合会)。在发达国家,中小企业在创造就业方面也发挥着至关重要的作用。因此,中小企业是世界经济增长的重要机构,也是创新、发展和竞争力的动力站。

然而,中小企业必须面对这种困境,他们愿意扩大业务,但同时也遇到了财务瓶颈。根据作者在当地金融机构的经验,近九分之十的中小企业都有融资需求。然而,事实上,在目前的情况下,银行融资如贷款仍然是中小企业融资的主要来源,或者换句话说,当中小企业有融资需求时,第一个想法是向商业银行借款。然而,社会资源是有限的,就像供求是一对矛盾一样,银行业金融也不能时时满足中小企业的需求。因此,随着资本市场的开放和发展,中小企业和企业家开始关注另类融资。

证券交易所为中小企业融资日益重要,虽然资本市场体系在全球不同的司法管辖区有所不同,但它为中小企业融资提供了一种可行的方式,为潜在投资者提供支持。因此,对这一领域的研究具有重要的现实意义。本文借鉴国内主要成功的、具有代表性的证券交易所的经验,探讨影响中小企业融资和上市的关键因素。

As widely acknowledged at the global stage, SMEs (Small and medium sized enterprises) are important components for social economy, not merely for developing countries but equals to developed economies such as United States and United Kindom. According to an incomplete statistic in 2010, taking the Chinese market as an example, SMEs represent 99 percent business and contribute around 60 percent national GDP (World Federation of Exchanges 2010). In developed countries, SMEs are also playing a crucial role in job creation. Hence, SMEs are functioned as an essential organ for world economic growth, which is the power station for innovation, development and competitiveness as well.

Nonetheless, SMEs have to face this kind of dilemma, they are willing to expand business but at the same time they are meeting financial bottleneck. From author’s experience in a local financial institution, nearly nine out of ten SMEs have financing needs. Nevertheless,the fact is, in the current situation, banking financing such as loans is still the main source for SMEs funding or put in another way, when SMEs have financing requirement, the first idea is borrowing from commercial banks. However, social resources are limited, just like supply and demand are a pair of contradictions, banking finance cannot fully satisfy SMEs from time to time. Thus, with the openness and development of capital market, access to alternative funding has been caught SMEs and entrepreneurs’ attention.

Stock exchanges financing for SMEs is becoming increasingly important although capital market system differs in various jurisdictions globally, it provides a feasible way for SMEs funding supporting from the potential investors. Hence, the research carried out to concentrate on this area is of great importance and practical significance. In this paper, drawing on the experience of main successful and representative stock exchanges to shed light on the key factors to influence SMEs funding and being listed in SMEs exchange.

1.1Main stock SME exchanges across the world

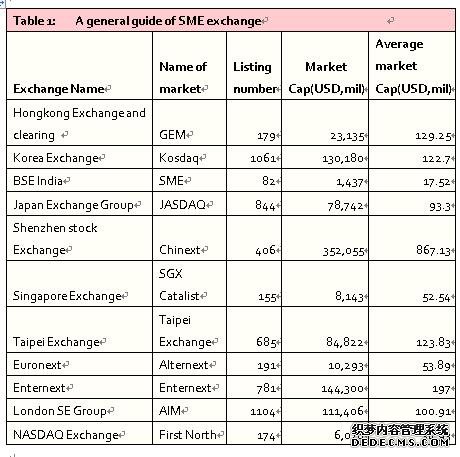

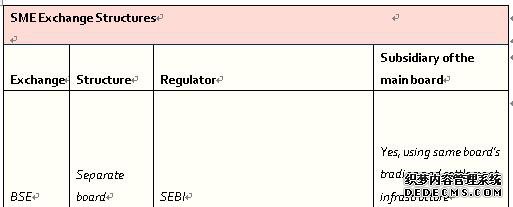

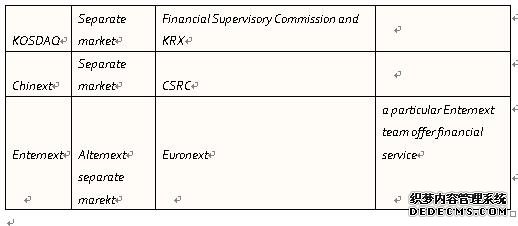

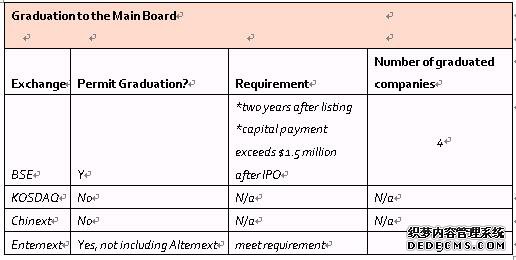

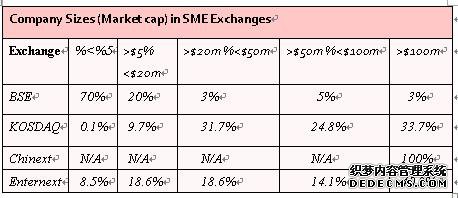

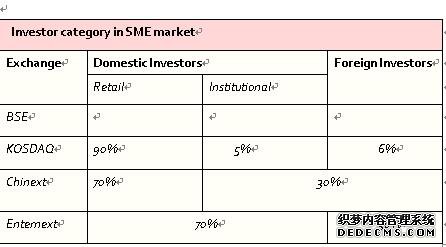

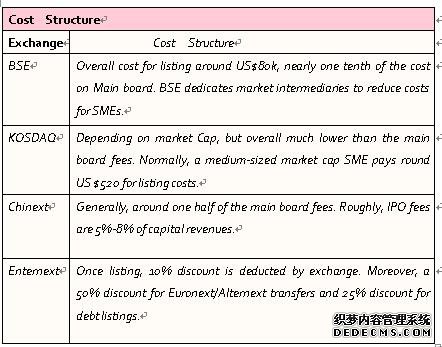

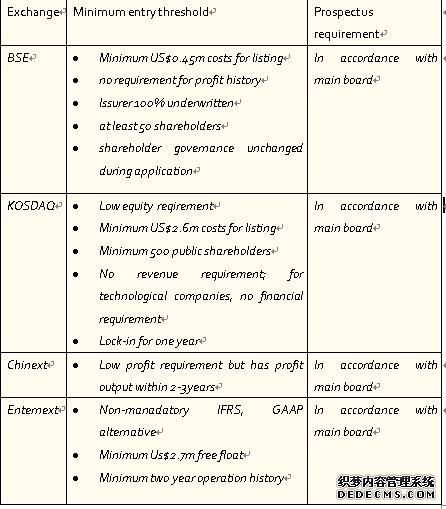

This paper builds upon the work by contrast four main international GEM exchanges which are: theKorea Exchange (KOSDAQ); the Bombay Stock Exchange (BSE SME); the Shenzhen Stock Exchange (Chinext); the Enternext offering of Euronext.Set forth table below outlines a general guide of renowned SME exchanges regarding their listing companies numbers, market capitalization and average market capitalization, thereby we can compare and contrast listed SME in differentiated market.

(Table 1: Adapted from WFE Report on SME exchanges, 2014)

1.1.1 Structure of the main stock exchange

(1) Due to differentiated SME market, some well-developed and some under-developed, national policies differ from one another, accounting rules and standards might differ across the world, there’s no tailored listing requirement for SME;

(2) SME exchanges ought to according to economic system and specific regulation to operate in their countries. If some markets are underdeveloped, they are supposed to play a greater role in cultivating companies, giving an ongoing monitor and supervision on a daily basis;

(3) SME exchanges could rely on investment banking to vet companies and decrease risk. Investment banks play a key role as a bridge between capital acquirers and investors. Their advisory roles enhance valuable decisions and create considerable synergies (Bermpei, 2014) Apart from helping SME borrow equities, they are supposed to manage risks, build-up mutual trust and facilitate cooperation. Their service could contribute the effective functioning of capital market and even the financial system. Hence investment banking should be ensured their activities are carried out in an effective and efficient way (Kushal, 2015)

1.2 The importance of listings

Stock exchanges make contribution to economic prosperity. Through this exchange platform, public investors could invest their money in securities, in this way, listed companies investing their potential projects by publicly offering shares, thus public investors’ money go to industries and promote economic growth.

SMEs do a public offering of shares in SME exchanges could be deemed as a milestone for their operation history. It doesn’t simply mean they could raise money outside bank system and reduce liability, but also symbolize their position of strength and the capability to access capital market. In this waymaybe they could raise a lot of money if public investors are confident and optimistic of their development, at the same time, they could continually issue stocks to expand capital in construction of major projects, original shareholders could cash in some of their profits. In addition, when companies decide to be listed in SME stock exchangessome other issues are out of consideration: increase market attention, visibility and corporate reputation. It will bring a lot of benefits, such as adding negotiating chips with banks,a kind of credit endorsement when dealing with business and customer, providing more options #p#分页标题#e#

if they want to acquire other companies. However, some companies remain private due to avoid diluted shares or scrutiny.

1.3Research Scope

In this paper, we do not specifically introduce legal structure , cost structure and entry requirements acrossmain SME exchanges in the world, but it should be noticed they differ from one market to anther market. Issuers,market participants, investors ought to according to their specific requirements. In addition, capital market changes from time to time, IPO candidates have to follow up national policies even economic system to make right decision and choose suitable market to be listed.

However, by far there seems no particular stereotype to create or replicate a successful model for SME exchange, all models highly depend on financial institutions interact with one another and they need to continually monitor and efficiently supervise those potential SME to the market.Based on contemporary scientific,investment banks play a key role and contribute the efficient functioning of capital market and financial market, they not onlyrun a “book building” process and “due diligence” process through pre-IPO and post IPO, moreover, they ought to consistently improve trading and liquidity in secondary market because they also take the market-making role in financial market infrastructure. However, in this dynamic ecosystem, what’s the key factors to influence SMEs listings and how link all the factors, SME exchange, financial institutions, investment banks, venture capital, and assuch work together to create an efficient IPO, in this project, we bear these questions to explore and find out the relatedattributes. (WFE report, 2014)

2.0 Literature Review

2.1The determinants of listing in GEM

2.1.1Theoretical Review

Growth Enterprise Market(GEM) typically is a stock market set up for growing companies that currently do not meet the requirements of profitability or track record in the main board.(Wikipedia) This SME sector listings to a larger extent enriched the exit channels for Venture capital investing. Coupled with world development, many financial institutions attracted a large wave of funds into VC industry (Anderson) As a result, various theories try to explain the determinants for SME companies listed in GEM exchanges. In fact, as far as investors and SME are concerned, it is necessary to better understand the economic theories before listed on GEM.

2.1.1.1 Life cycle theory

Weston (1981) pointed out the financial structure influencing different stages of companies regarding their life cycle. The four stages can be described as: start-up, growth, mature and recession. Throughout the stages experienced from start-up to recession, companies are attempting to use high-risk financial instrument in the growing cycle. Founder/shareholder direct investment are often appeared in the first stage; When companies grow up, they may use external financing such as commercial banks due to some tangible assets can be claimed as collateral;This proves that at very early stage companies are willing to use their own source to resolve; However at latter stages, when companies grow fast or revenues expand, they have to appeal to risk investment such as VC to pursue growth and at the same time they could bear the corresponding risk. This is also in accordance with pecking order theory which explains entrepreneurs much prefer insider finance to outside finance like equity funding (Myers, 1984)

2.1.1.2 Agency cost theory; IPO underpricing

Agency cost is unavoidable which lead to conflicts among respective stakeholders such as creditors, shareholders, entrepreneurs. However, although stock market fluctuating all the time, it opens an on-ramp especially for SMEs raising fund and approach financial market. For the aim of grandstanding and profit driven under information asymmetry between investors and companies, SMEs have to accept the reality of IPO underpricing (Cao, 2013) Typically, as such variables could impact information asymmetry and IPO underpricing, that ismainly in relation to below attributes (Anderson,2015)

Company scale: generally, large company has more information disclosure resulting in relatively low information asymmetry

Company history: researchers through a series of measurement found out young companies generally have higher operation risk, that lead to great underpricing than mature companies

Time gap: the time between offering and listing, experience proved that longer time gap gives rise to great underpricing

Reputation of Underwriter: underwriters always attempt to function as a bridge in conjunction with market, investors and companies. Historical IPO cases examined that more reputational underwriters conduct lower underpricing IPOs.

Offering price to earning ratio(P/E): based on information asymmetry, the higher P/E ratio, generally speaking, positively related to initial return.

Equity Construction:equity concentration and industries affect IPO underpricing in some market. Research found in manufacture sector, the more concentrated equity, result in bigger IPO underpricing, but cannot be generalized as a whole.

2.1.1.3 Trade-off theory

This theory reflects companies seeking balance between benefits and costs all along the way when using debt and equity ratio. The trade-off also reflects the most optimum capital structure. When expecting for high profits, companies are tempting to increase higher leverage and vice versa.

2.2 Other determinants of listing in GEM

As noted, a normal operation of modern securities market needs the securities transaction, registration, clearance and depository agencies. Additionally, institutional intermediaries such as investment banking operations as a trader or broker to make it run smoothly, which provides financial advisory service etc. Hence, the internal mechanisms of developed countries and developing countries may differ, a favorable market backdrop provide the foundation and ensure participants within this securities market have sound operation.

2.3Listings in International Practice

Different GEM market in the world presumably has differentiated listing motives, various investigations have been applied to find out the real incentives. In this research, we draw upon on some experience to seek out the determinants in GEM markets.Restriction to space and time, this project takes London, India, and China the four representative emerging market as examples. Apparently, the motives and determinants for SME companies listed differ from different market and time span. It is noted no matter companies in which industry or which country, companies ought to implement an all round plan to evaluate all the risk and benefits. Moreover, it is necessary for SME companies to choose a suitable capital market tailored to their characteristics at a right time to be listed.

Korea market–According to Kosdaq official website, they aim to establish a platform to add value through innovation. The SMEs to be listed in this exchange should be in line with their strategic vision, that is: enhancing core business, building potential future growth and attaining globally strategic value

London market–From latest finding in growth enterprise market, there have been nearly 800 companies listed on London Stock Exchange, (Nyakweba,2014) stated that the decision-making on this exchange was mainly positively related to their market capitalization, corporate valuation; negatively to leverage and profitability

India market–(Nyakweba,2014) indicated in emerging market such as India, the main reason for Indian company seeking to be listed was mainly because of following reasons: raise fund to expand; optimize capital structure; evade the supervision of big shareholders; decrease capital cost; increase visibility, etc. Nevertheless information asymmetry and adverse selection are the deterrents to go public

China market--From some dataand from author’s point of view, China as a significant emerging market, currently more SME companies are seeking for listing mainly due to the opportunity to access capital market, raise capital, expand scale and reputation as such. What needed to be explained more, the determinants for Chinese companies cross-list in an overseas growth enterprise market is out of different considerations:

• Obstacles encountered in domestic market. For example, operating history less than three years, business performance not reaching listing requirement

• Lined up with waiting time. Generally, every year there are more than 400 companies lined up waiting to be listed, if they are urgent for financing, they are more inclined to choose listed aboard.

• Market and product in overseas. These companies need to open up market outside domestic market, expand customers resources, build up their international brand

• Pursue “going out” national policy. These companies aim to develop overseas resources and integrate resources such as purchasing companies, establish R&D center, develop in foreign countries and so on

• Pursue the strategy of listed overseas first, then go back for domestic listing. When international board market launch, these companies return to the domestic market

• Relatively larger stock issue scale, companies need to be listed in two or three market in the same time, like large commercial and industrious companies or high-tech growth companies, they can choose to list domestic or overseas simultaneously#p#分页标题#e#

3.0 VC Contracting

3.1 The origination of VC

Venture Capital is kind of private equity, another type of financing that injected to start-up or emerging small and medium size enterprises that are regarded as high potential or with core competition in specific market. Venture capital investing in those companies in exchange for equities or an ownership stake in the hope that in one day they will go on an IPO or do a merger and acquisition sale. In reality, venture capital is also such an institution that help SMEs establish business model, grow business network, offer them with management expertise, funds, marketing methods, as a result, these invested companies are more likely to be successful. However, due to adverse selection and information asymmetry, venture capitalists decision are sometimes somehow biased,after all, it is risk investment. In this project, these arguments will not extend further.

However, taken the whole world in view, economic openness and economic reform together with dynamic capital market, has encouraged more young entrepreneurs to initiate their own business (Wong, 2011) Venture capital is regarded as the most important financing channel for growth SME companies. Besides, VC investments haveappeared as essential driving force for economic growth, technical innovation and employment (Ning, 2014)No matter in western or eastern countries, numerous companies like google, apple,ctrip achieved great success after being financed by venture capital. Taking Chinese market as an example, by far more than 50% VC backed companies have been successfully listed on capital market (Wong,2011) In this literature, from micro-scope perspective, shedding light on VC contract from theoretical and practical relationship between VC and companies has particular meaning.

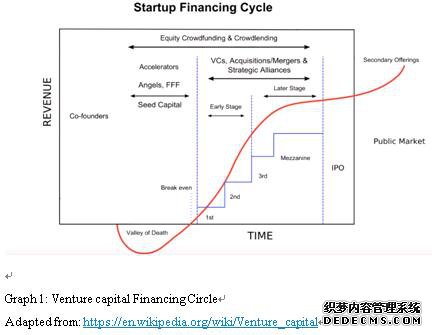

Firstly, let’s roughly understand how venture capital plays a role in start-up or SMEs. The graph 1 below generally demonstrateshow companies are financed, the red curve in this graph is called “valley of death”, if companies could survive through six stages of venture capital financing round, in some sense, that could be corresponding to their growth curve.

Seed capital: It is an initial round for companies’ financing when companies have a business model and this financing are normally offered by angel fund or equity crowdfunding.

Start-up: companies at early stage for the start of product R&D and marketing development.

Growth(Series A Round): At this round is at which Venture capital injected. Following by companies growth, there would be emerging more round regarded as Series B, Series C, Series D, etc.

Second Round: Companies started operation with working capital but has not yet yield profits. This stage can also be thought as Series B.

Mezzanine: can be regarded as expansion stage and at this stage venture capital injecting Mezzanine fund.

Exit: Typically VC exit at the time when new investors come in or through an IPO or secondary offerings

3.2 VC investment model

(Bruno, 1984) pointed out 5 steps for VC investment model which has reference value for venture capital, that is :

(1) Origination of the deal

VC investments are full of opportunities but in the meantime involved in the same risk. All professionals in this industry should bear in mind that the price of average capital can be evaluated investment opportunities, in addition, the law of large numbers might cover risk because not all the investments will take back your anticipated return. So from this point of view this is an interesting and challenging activity.

(2) Screening

Each year there are tens of thousands of SMEs emerge in different countries, western or eastern, this requires VC discerningly explore valuable investments. Especially, under the backdrop of times, for example, currently, energy-saving industry, health-care industry, high-tech is hotspot industry. SMEs have patent invention, managerial expertise, competitive advantage as such are considered to be the potential investments.

(3) Due diligence

Due diligence is thought as the most important work for venture capitalists. Due diligence on target companies including market, management and financial performance pre-investment and post investment. Get sufficient information as much as possible to determine the suitability of this project. Furthermore, ensure the completeness and validity for investigation work. Venture capital is by no means one or two persons’ effort, but a bundle of efforts made by entrepreneurs, VC and investors with shared responsibility.

(4) Deal structuring

Deal structuring contingent on specified investment objective, differ from companies, industry, strategic direction and investment preference, that is needed to reach consensus with entrepreneurs. Apparently, a bundle of contract to protect interest of both sides and finally achieve exit. Contract will change according to national legal, economic and fiscal factors.

(5) Activity post investment

After funding the invested companies, VCs tend to continually seeking financing alternatives, even more importantly, injecting external resource for market entry, patenting, management expertise and even contributing their wisdom and experience such as strategic advice, business model, marketing strategy to their portfolio projects. Exit is generally an IPO, a trade sale, or secondary offering, until new investors taking over the companies then close their deals.

3.3 Main Terms of VC contract:

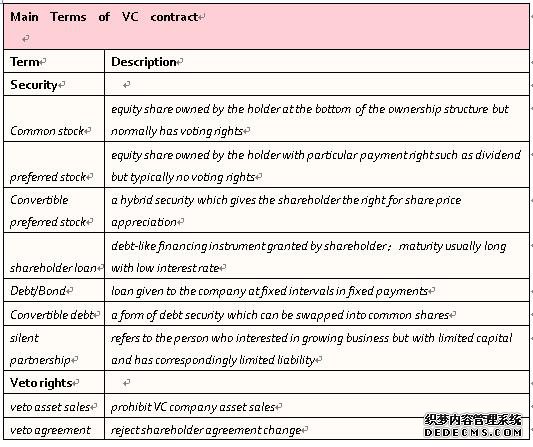

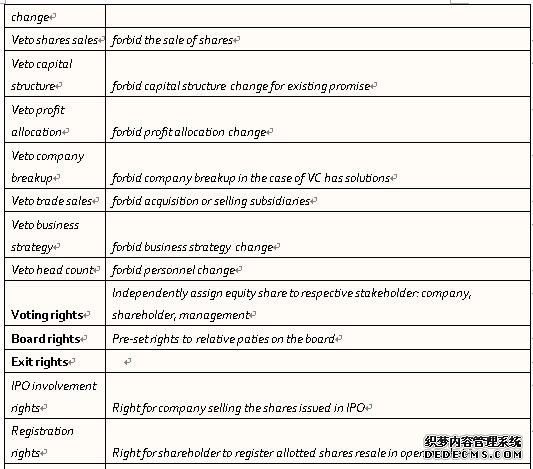

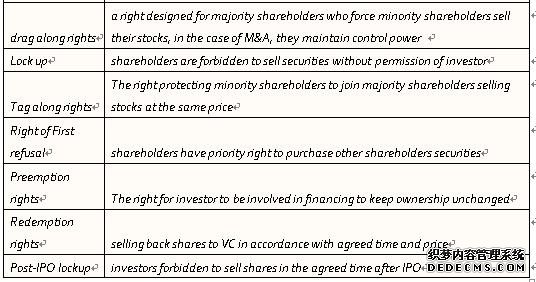

In theoretical and practical use, conflicts emerge from substantial information asymmetries and behavior uncertainties. Numerous studies carried out to give rise to suitable securities choice to evade adverse selection, for the purpose of attracting potential growth companies. In addition, VC contracts within life cycle differ from each stage (Burchardt, 2014) Entrepreneurs and VC capitalists are always looking for the optimum path in the “Grundy’s Game.” The main VC contract terms are presented as table below 2. And in the next section, VC contracting in theory and practical use are further explained.

(Table 2: VC Contract Terms, Adapted from “Venture capital contracting in theory and practice” Burchardt, 2014)

3.4VC contracting in theory and practice

3.4.1 Security Choice

3.4.1.1 Security choice in theory

(Webb,1992) pointed out common shares appeal to companies with low expected returns while (Weiss,1981) stated preferred shares appeal to those companies with high profit variability. Apart from that, (Brennan,1987) noted VC companies with relatively low profit variability are attracted to convertible securities. According to this literature, VC contract can be tailored to companies’ characteristics to decrease agency costs problems.

In the earlier financing literature, researchers more favored convertible preferred securities, which are equity-like or debt-like mixed securities to avoid wrong pricing and intrigue entrepreneurs’ effort. More recently, literatures more focus on staging framework which displayed the superiority of convertible securities over any mix of debt or equity-like securities. Staging not only to some extent avoid adverse selection and moral hazard but also help to convey true information induced by outsider investors and companies themselves and carry out more effective leverage financing (Schmidt, 2003)

3.4.1.2Securities choice in practice

There is nearly no doubt convertible preferred equity is most favorable contract by VC firms in US. Bengtsson (2011) made a sample from 1500 financing rounds in US market and got this conclusion. This reason maybe partly due to favorable tax treatment on these incentive compensation payments to companies thus incentive efficiency as a central purpose for VC contracting. Another reason is information asymmetry particularly in start-up and expansion period, convertible preferred equity could reduce hazard costs in case entrepreneurs’ extracting their private benefit as such.In addition, technological companies are inclined to use convertible securities more than non-technology based companies. There are a couple of reasons: more difficult to assess intangible assets;asset specificity weaken the collateral value of intangible assets; the extraction rents for high-tech companies, etc (Burchardt,2014)

However, other marketsapart from US showed a more diversified trend, the most popular securities are silent partnerships, straight equity and debt-equity mix (Burchardt,2014) More empirically, VC make great use of cash flow rights combined with straight equity; moreover, for a given security, a mixed use of contract clauses such as liquidation preference, cumulative dividends could make the same payoff function for investors.Additionally, some researchers concludes the negotiation power in relation to VC and companies. More mature companies are more willing to finance with common equities rather than convertible-preferred-like equities; on the contrary, more experienced VCs are more likely to use convertible preferred equities rather than common equities(Cumming,2008) Other researchers found more experienced VCs pay less attention to contractual clauses like declined returns, yet more attention on long-term venture development like board rights, etc.#p#分页标题#e#

3.4.2 Cash flow rights: Staging

As mentioned before, staging financing help enhance VC function on the whole and effectively solve the holdup problem. First of all, when companies gradually establish competitive advantage, it makes possible to gain outside investments and at same time, it makes impossible for entrepreneurs to quit business; Secondly, staging adds one more option for VC and companies continue or terminate business,reduce risk and agency costs to a minimum. Thus, as the consequence, both sides VC and entrepreneurs are given continuous effort and benefit to the projects (Burchardt, 2014)

3.4.3 Control rights

It is noted that after sign-up the basic contract of securities and cash flow rights, control rights becomes more important because after all VC is a risky investment adventure. In the process of contributing resources, capital and experience to the portfolio risk companies, they also have the co-decision and veto rights to impact long-term performance. In the case of VC has disagreement with entrepreneurs regarding strategic direction, they implement control rights enforce board decisions. So from this point of view, control rights can be a governance regime which move from full entrepreneur control to contingent control and full VC control based on VC perceiving potential benefits and outcomes (Burchardt,2014)

3.5 Contract Design

Contract design might face these kind of situation. First, important variables might be neglected from very initial stage because it’s difficult to balance which would cause incomplete contract. Secondly, different goal, VCs more focus on return after investment while entrepreneurs focus more on ownership. Thirdly, contractual relationship.Entrepreneurs are seeking for achievements with shared efforts and control rights while VCs are attempting to restrict their rights to prevent private benefits.In most cases, in terms of VC exit clauses, more favored contract might be engaged in an IPO or a trade sale (acquisition), While entrepreneurs might reject acquisition due to lose control. Hence, conflicts might arise from time to time through the investment period,the initial exit goal doesn’t need to be exposed in full till VC fulfill value-add service and companies’ evolution (Burchardt, 2014)

Therefore, this section gives a comprehensive explanation of VC contracts, differences between contract design in theory and practice. Specifically, how securities choice are given different types of companies, how securities in line with cash flow staging and control rights. Further, how contract design give rise to entrepreneurs effort and VC commitment. Rules are changing continuously with changing capital market, these theories and practice provide such avenues for research.In addition, the world abound with investment opportunities though, some underdeveloped market due to weak equity rights, normative regulation, and unreliable accounting information wouldincrease difficulty for VC to conduct due diligence and monitor investments.

4.0 Research Design

As presented the nature of SMEs listings and Venture capital, and numerous findings prove there is a close linkage between venture capitalists and stock market. In previous study we hypothesise VC investments facilitate and help SMEs do an initial public offerings in particular stock market in an easy way.To sump up, this paper represents the first attempt to test whether VCs truly add value in preparing SMEs free ride on the IPO, and how’s VC-backed companies performance in the IPO opportunity? In this paper, we would like to draw upon on publicly available data, empirical methodology, select interviews and particularly take Chinext board (a representative SME board)as a sample to reflect the availability of venture capital financing in terms of VC backed SMEs listings.

4.1 Data

As is known with the development of capital market in China, there are multi-tier capital market facilitating companies listings. Among them, the most representative is Chinext, set up on October, 2009 in SZSE (Shen Zhen Stock Exchange) as the third tier of its Main board and SME board, which is also called “China Next”, as “the Growth Enterprise Board” serving high potential SMEs, especially in technological sector to help them secure finance and seek external funds. From Chinext official website, up to today (June 20 2017), there are totally 651listed companies, industries covering from manufacture, information technology, environmental protection, media and healthcare, etc. Among them, 519 were backed by venture capital. That is to say, nine out of ten SMEs traded on Chinext have the support of venture investment, which is an interesting finding.

Due to limited information, it’s hard to give detailed examples of what kind of VC contract given to these VC-backed listing companies, existing source are applied.

(Lin, 2017) found outcompanies listed in Chinext board are basically combined with private placement of ordinary shares, issuance of preference shares and convertible debt and issuance of privately-raised company bonds. Through these non-public instrumental financing to a larger extent meet these high-growing companies financial bottleneck and fairly match their high-technological nature.

4.2 The measurement of Data

P/E is animportant indicator to value companies, which is the ratio’s of company’s stock price to the company’s earnings pershare.

The formula is: Stock price(Market value per share) / Earnings per share

In essence, high P/E ratio often indicates companies are expected to perform in higher earnings growth contrast to companies’ low P/E ratio. Investors generally see P/E as a benchmark to evaluate whether a company is worth buying or not. If a company with low P/E can be regarded as undervalued compared to other companies in its area or its recent performance is out of picture compared to its operation history. If a company presents as no revenue or at a loss, the P/E will be described as “N/A”. Internationally, P/E ratio could be referred as a standard method to value one dollar’s earning through capital market.(P/E, investopedia)

However, it cannot only use single P/E ratio to measure company’s growth or valuation when not comparing the P/E ratio of other companies in the same market, that’s not comprehensive. In other words, while the entire market has higher P/E ratio, a single company’s high P/E not so caught attention. In addition, debt with a company has to take into account because debt leverage could influence P/E ratio when company take on a lot of debt. As a result, VC-backed SMEs are always situated in IPO underpricing for VC’s risk control angle.

In terms of P/E ratio in business nature, when companies in high P/E ratio are more willing to pay their stocks to merge another company; Companies always attempt to enlarge profits, some companies whitewash their financial report to convey a signal that they are smoothly and steadily growing, for the purpose of increasing P/E ratio; some companies in low P/E ratios on the contrary leverage their debt, which imply they seems cheaper before leveraging, so as to push the stock price and improve P/E ratio; However, this ratio should be evaluated in time span, since their stock price and earnings are fluctuating year by year, it cannot be treated in a single market or in a single year.

4.3 Descriptive Statistics

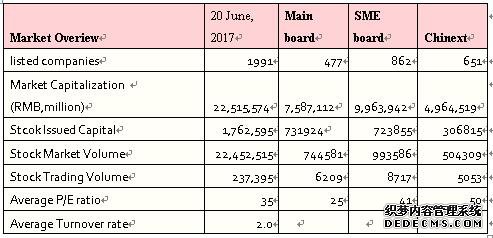

In China, the two main Stock Exchange Shanghai Stock Exchange(SSE) and Shenzhen Stock Exchange(SZSE), their market capitalizations are worth USD 10 trillion. Shenzhen Stock Exchange(SZSE) these years developed very quickly in terms of their size and liquidity. From SZSE public website, extracted data on 20 June, 2017, according to complete statistics, till today, there are totally 1991companies listed on SZSE stock exchange, Main board 477,SME board 862,Chinext 651, amount to USD 514 billion in terms of its market capitalization.

From historical statistics, on the first day of trading when launching the Chinext board, the 10 start-ups’ shares rose by 200%, in almost two weeks, their total stock trading volume was 110 million shares, 2% of the main board, trading turnover was 7% of the main board. However, in recent years, and up to today, their trading volume has nearly already caught up main board. On the first day of launching, the average P/E was above 100, 2.5 times of the main board, 3.6 times of Shanghai Stock Exchange, 3 times of Hong kong GEM; up to today 20 June 2017, average P/E ratio on Chinext tend to be stable, however, nearly 2 times of the main board, 3 times of Shanghai Stock Exchange, 4 times of Hong kong Stock Exchange, 1.1 times of Hong kong GEM.

(Table 2: Adapted from https://www.szse.cn/main/en/chinext)

Nonetheless, behind the buoyant stock market, VC is a long-term strategic investment, enterprise investment is not for the purpose of a certain commercial profits in the short term, but after growth through the equity transfer and get high returns, period normally should be for 3 to 5 years. In the meantime, it is called "patient capital" because it needs to increase better off capital in the process of IPO.

In terms of the main financing difficulties for enterprise development, , if financing is not smooth enough would result in missing the best time for project investment, and slow the development of enterprises, some enterprises due to the capital chain leading bankruptcy, Therefore VC paves the way to solve the enterprise financing difficulties and broaden the financing channels. In a market economy, high risk inevitably corresponds to high returns, while enterprises need to experience a high-risk process to develop and expand their operations. Through VC introducing equity capital, the development of enterprises are reflected by the increase of equity capital prices. The expected return of VC is the price of the stock investors future earnings of the visual display, the future returns are unlimited, so VC can give operators a vast profit opportunities, can effectively solve the problem of asymmetric risk premium.#p#分页标题#e#

On the other hand, venture capital can raise the management level of the enterprise side by side. In investment, investors will consider the cost and return of a project in many ways, especially for high-yielding projects. Outside the enterprise, there will be a new opportunity to explore, which requires advanced management personnel. After investor capital injection, in order to monitor the investment direction of the enterprise, it will be involved in the daily project supervision. VC according to actual situation of enterprise management personnel appointment, internal management system and incentive mechanism provides various effective measures and strategies, thus risk investment institutions regulatory side can improve enterprise management level.

4.4 Result Analysis

(1) Multiples-P/E

Back to the table 2 of Chinext market overview, from the statistics on 20 June 2017, in terms of their performance on stock trading volume, 651 SMEs on Chinext carried 5053 million trading volume;rather 477 companies on the main board dealt 6209 million trading volume. Chinext’ market value not larger than main board, but market liquidity is much more sufficiently large.

The high market liquidity reflects the Chinext is chased by massive public investors, trading on this board is extraordinarily active, today this board is supervised by moderate and normative trading regime, this regime could promote big stockholders ally small stockholders to intervene in the SME’s management, thereby decrease agency costs and increase corporate value.

Up to 20 June 2017, the average P/E ratio of Chinext versus Main board, which is 50 to 25, the high PE ratio in Chinext reflected the investors’ high expectations of SMEs’ growth and profitability, also reflected the high liquidity in the stock market,yet precluding the same stock is different pricing in different market.

Moreover, the price-earnings ratio (P/E) is the ratio for valuing a company that measures its current share price relative to its per-share earnings. As the figure demonstrated in the table that the SME returnwas higher than the main board, therefore the investors such as VC would like to invest more for SMEs in Chinext in the process of the IPO.

What cannot be ignored is the high P/E ratio on Chinext has somewhat uncertain factors, but their contribution to the development of SMEsis beyond doubt. These SMEs got rid of the financing problems, and even go to the capital market and received tremendous returns. Even better, most of them(90% of SMEs on Chinext) are involved in venture capital.

As a result, large amount of venture capital exited from IPOs.

(2) VC performance compared to Public Equity Performance

VC exit could through restructuring, acquisition or IPO, however, before completing the deal they have to face illiquidity. More than this, its risky and unpredictable. To offset these situation, their return in the IPO should be covered and exceeded their total investment. Therefore, the VC backed IPO should outperform public equity performance.

Furthermore, (Stanley, 2011) pointed out the return of the venture capital investments is related to some factors, including the duration of the investment, investment amount, the share proportion owned by the VC, the PE ratios before and after the IPO, and at what stage the venture capital made the investment. In this paper will not specifically introduce further.

(3) The comparison of VC backed and non-VC backed IPOs

Due to limited information, its difficult to probe all the financial indicators in the market, but it without surprise that the comparison of the VC-backed and non VC-backed IPOs indicates that the VC-backed IPOs outperform the non VC-backed ones. However, behind the high valuation, it cannot be ignored the existence of the huge bubbles in the market, when it comes to mass investors, should take it into account in a comprehensive way whether their invested portfolio could experience year-by-year growth compared to their sky-high potential growth.

The survey of Shikhar Ghosh is studied in period 2004 to 2010 VC investment of more than $1 million, more than 2000 start-up companies, obtained "venture-backed startups failure rate is as high as 75%," The rate of failure to get an investment is high, not to mention the self-made entrepreneurs.Besides that, Shikhar Ghosh, points out that even if has the support of venture capital, there are still 75% of start-ups can't give venture back to a penny, and 30% to 40% of the business enterprise bankruptcy liquidation is to let the VC to compensate the lose everything(Michel, 2014).

It is not surprising that companies tend to retain highly reputable underwriters, as this sample is entirely composed of IPO backed by VC. Compared with all VC support IPO over the same period (not shown here), the company and the provided features are actually quite representative.

4.5 Empirical Findings

4.5.1 The role of VC

It is not easy to go public. According to Chinext official website, before listing, SMEs need a series criteria, for example, in terms of net profit, in the past two consecutive years, net profit should be positive; in terms of revenue, in last one year revenue should be no less than RMB 50 million. To approach these ratios, without VC participation its incapable to accomplish. They are a professional team, familiar with listing process, legal issues,etc. For specific investment model could refer to section 3.2.

After VC investment, SMEs will lose part of their equities, but VC financing is also a process for initial shareholders cashing out their equities. As a result, once SMEs go public, VC could realize exit, initial shareholders could liquidate by selling stocks. Naturally, if SMEs could be successfully listed, their stock right could circulate on a larger market.

4.5.2 VC exit option

1)Return maximization

In theory, the timing of VC exit is regarded as the maximization of SMEs value. In reality, any value of product could be pricing through market, and when it comes to stock it is the same thing. When macro economy is on the rise, VC exit could gain rich return; when in macro economic downturn, VC is unable to gain expected return. Therefore, theory doesn’t represent reality. Even at the time of VC exit, SMEs cannot reckon it’s the peak of SMEs value peak, because just like speculation of stocks, no one could ensure when is the bottom, when is the top.

2)Investment lockout period

As presented by the table 2 “VC contract”, VC is restricted by locking up period. Generally it is around one year. After contract expiration, VC could sell all of the shares at once, or sell by installments, and exit completely in the end.

4.5.3 Practical difficulties

The difficulty linksthe relationship between VC and SMEs. Firstly, in terms of issued shares, in organization form, its better for enterprises touse system co., LTD. which has a relatively standard management. Other regulatory measures need to be developed such as registered capital of the enterprise, higher threshold such as profit, etc. These conditions make it difficult for small and medium-sized enterprises to be situated in the top spot in the venture capital market. To better support the development of small and medium-sized enterprises, the regulators have reduced the requirements of the baseline, so as to ensure the smooth financing of SMEs. In this paper we do not go into detail.

Secondly, insufficient funds and limited power are restricted for SMEs. VC is a kind of market behavior, but due to part of the enterprise investment in capital strength is weak, there maybe problem like insufficient power supply in the later stage. For example, if capital investment is small, it is difficult to form an effective capital circulation chain in the increasingly fierce market competition, as a result, it is easily to be wiped out in this competition. Secondly, due to limited strength, enterprises couldn’t form a portfolio, couldn’t realize the transfer and withdrawal of funds when avoiding risk. Thirdly, when there is not enough money to support and design high-risk and high-return projects, it is hard to play a leading role in the development of the enterprise.

5.0Conclusion and suggestion

To sum up, listing has many advantages such as capital inflow, refinancing, increase market value, enhance corporate image, etc; At the same time listing has unavoidable disadvantages, such as diluted shares and losing control rights, taking risk, information disclosure, restricted stock sales, multiple costs etc. Therefore, enterprises have to choose prudently regarding listed or unlisted.

In this paper, Chinext provides such an instructive case study to verify the close linkage between capital market and venture capital, and we are seeking out some insights to constitute a range of offering factors to address the issue of easy access to equity market. Hence, this paper initially introduces the structure of SME exchange, and the importance of listings,subsequently, literature and theories are reviewed regarding determinants of listing in Growth Enterprise Market, we put forward life cycle theory, trade-off theory and agency costs etc to find out what incentives and motives genuinely drive SME to go public. As for professionals in this industry or SMEs themselves, it is necessary to better understand how to cultivate and develop a company, what an appropriate and effective business strategy could be implemented at right time. Consequently, as venture capital is the major force and financing channel for SMEs IPO, a set of related contracting in theory and practice are demonstrated in the latter section, covering VC terms, security choice, cash flow right and control right etc, to seek out how to combine them and how to design contract based on both parties’ interest as such. Lastly, we use Chinext, the second board in SMEs as a sample to exemplify the function of venture capital and how they influence the SMEs financial performance in SMEs exchanges.#p#分页标题#e#

In this connection, some suggestion are given on how to support a successful SME listing:

(1) Increase government support for VC

The market shall open investment channels, and strive to achieve a planned way to foster SMEs innovation funds into equity risk investment main body, and then let the risk investment subject for selectively to the enterprise actual investment. In addition, the government should strengthen the supervision over the investment part and conduct regular spot checks. To establish a reasonable standard of judging system and supervision system for operators who manage investment, thus VC could perform better in their performance.

Due to VC is an important way of solving enterprise financing bottleneck, thus to develop risk investment adhere to “the government-led, private capital and foreign capital as the main body of venture investment development model”. Enterprises need to treat VC correctly and focus on diversification of venture capital. On one hand, enterprises focus on business operation, supervision and management; on the other hand, it should be introduced a fiscal and tax policy on venture capital and the system construction of preventing investment risk. The government should step up VC attraction and carry out relevant laws and regulations, actively guide enterprises. Government should support enterprises in the process of common-built healthy risk investment environment, guide enterprises during the investment period in a scientific and effective way, make efforts in developing high earning performance, so as to win a place in market competition.

(2) The commonality of successful listings

In China, one VC institution investigates around 2000 project within one year, however, the projects they invest are only 1 to 4, others are rejected or eliminated. So there is a word in this area “ put large amount of time into a small amount of items, put small amount of time into large amount of items.” Therefore, what kind of schemes do VCs favor? There’s no cookie-cutter model, but have to say successful SMEs have a number of same characteristics(2015 IPO report, WILMERHALE)

Unique business models:

Unique technology or unique business model. A successful IPO candidate must have a compelling advantage that other counterparts cannot copy or imitate; A brand new business model equals to a new money-making model or operation mode, to a larger extent determines future prospects. Business model innovation is of the same importance of technological innovation. For example, B2B,B2C,etc.

Superior management:

An important doctrine is that investors invest in people. A qualified IPO candidate need a management team with team sprit, composed by talented people, innovative, dedicated, grow with business, grow with company, and at the same time, able to endure IPO hard and lengthy process.

Market differentiation:

An IPO candidate best has a set of excellent product or service or patent in a certain regional market or even beyond geographical scope, has obvious sign or characteristic in this industry. Perfectly, they have the potential to become market leaders.

Substantial Growth:

Generally speaking, 20% growth is the most basic benchmark especially for SMEs. Compelling revenue growth no doubt offers such a platform for market capitalization and create such a surprise for VC and other investors.

Profitability:

A series of profitability ratios such as Net profit margin, Return of asset as such financial ratios are apparently the most important measures to predict and demonstrate SMEs profit abilities.

Market Capitalization:

Appropriate market value so as to generate a liquid trading market.

Other effective measurement might be differed from industry and company size. For instance, high technology companies may have great profitability but due to short history revenues cannot be generated in a very fast speed. Mature companies may have large market capitalization and revenues but relatively lower growth rate. Besides these measurement, IPO candidates have to fulfill corresponding obligations and responsibilities, not limited to corporate governance, auditing preparation, information disclosure, outside investors network and a continuing business administration.

6.0 Next Step

The project mainly address the issue in relation to SME listing and VC participation, the reason to choose this topic is because it is kind of a hot spot in contemporary world and author’s interest in this topic. Apparentlythe expertise in this area is incomplete, even immature due to the absence of adequate practice; This project as a graduation project, however, it’s hard to apply all of the knowledge in class vividlyinto this topic; Nevertheless, in any case it’s just a beginning. In any stage and in any area following on, there are full of opportunity to show business potential within the scope of business administration.

7.0 Appendix 1

Table 3

\ \

Table 4

Table 5

Table 6

Table 7

Table 8

Entry requirements

(TABLE 3-TABLE 8: Adapted from WFE Report on SME exchanges, 2014)

Appendix 2

Data extract and some analysis in this project can be found through the links below:

http://www.PEdaily.cn

https://www.szse.cn/main/en/marketdata

http://www.investopedia.com/terms/p/price-earningsratio.asp

http://www.chinaknowledge.com

https://www.hkex.com.hk/eng/csm/highlight.htm

http://www.cnbc.com/id/43125513

https://tglobal.krx.co.kr

8.0 Reference:

Anderson,H (2015). IPO performance on China’s Newest Stock Market(Chinext). The Chinese Economy,48:87-113,2015

Anderson,H. VC participation and IPO earnings management: Evidence from China

Annual Research reports on venture capital in China, published by Zero2IPO

Burchardt, J., Hommel, U., Kamuriwo, D. S., & Billitteri, C. (2014). Venture capitalcontracting in theory and practice: implications for entrepreneurshipresearch. Entrepreneurship Theory and Practice.

Cao,Q.,Tang,Y.,Yuan,N.(2013) Venture capital certification and IPO underpricing. The Chinese Economy

Chen,H.,Liang,W.(2014) Do venture capitalists improve the operating performance of IPOs

Cumming, D.J. (2008). Contracts and exits in venture capital finance. Review of Financial Studies, 21,1947–1982.

Ellis,K.,Michaely,R.,Ohara,M.(2011). Competition in investment banking. Review of Development Finance 2011,28-46

EY Global IPO Trends, 2015 4Q

Holmen,M.,Wang,P.(2014) Pyramid IPOs on the Chinese Growth Enterprise Market.

Kushal,B(2015) Investment banking: linkages to the real economy and the financial system. Quarterly Bulletin 2015Q1

(Lin, 2017) “Venture capital and the structure of stock market:lesson from China”

Liu,Z.,Chen,Z.(2014) Venture Capital networks and investment performance in China. Flinders Universtity and University of Adelaide and Wiley Publishing Asia Pty Ltd.

Mamatzakis,E&Bermpei,T.(2014) What drives investment bank performance? The role of risk, liquidity and fees prior to and during the crisis

Michel, J.(2014), 'Return on Recent VC Investment and Long-Run IPO Returns', Entrepreneurship: Theory & Practice, 38, 3, pp. 527-549,

Myers,S.,Majluf,N.(1984)Corporate financing and investment decisions where firms have information that investors do not have. Journal of Financial Economics,13,187-221

Ning,Y.,Wang,W.,Yu,B.(2015) The driving forces of venture capital investments. Small bus Econ(2015)44:415-344

Nyakweba,P(2014) The determinants of listing at the growth enterprise market segment in the Niarobi securities exchange

Ravid, S.A., Bengtsson, O. (2011). Geography and style in private equity contracting: Evidence from theU.S. venture capital market. SSRN 1782382 Working Paper.#p#分页标题#e#

“Six important functions of Stock exchange”

(Stanley,2011) “The performance of venture capital funds and VC backed IPOs: An evidence form China”

“Venture capital investment opportunities”

Weston,J.,Brigham,E.(1981) Managerial Finance 7th edition, Dryden Press, Hindsdale

WFE Report on SME Exchanges.World Federation of Exchanges.

“Why does a company decide to go public”

Wong,A (2011) The evolution of the venture capital market in China:Current Trends in Venture capital financing strategies and investment preferences. Journal of Investing ;Winter 2011;20,4;Proquest Central pg.16

Zhang,Z.(2015) Financial ratios and stock returns on China’s Growth Enterprise Market. International Journal of Financial Research.Vol.6,No.3;2015

Zhou,J(2012) Analysis of Influencing Factors of IPO Underpricing in ChiNext . Physics Procedia 33 (2012) 846 – 851

2015IPO Report. WILMER HALE AND DORP ILP

|

|

|||

| 网站地图 |